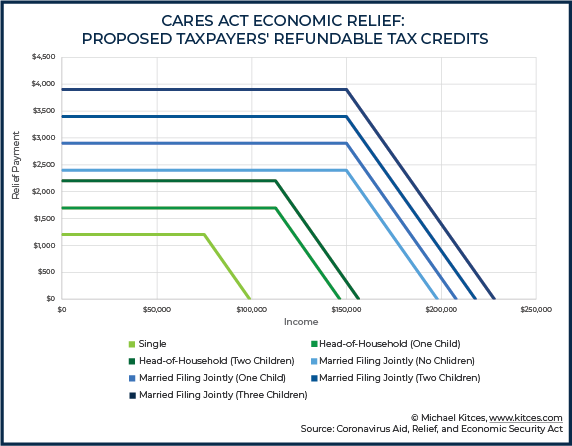

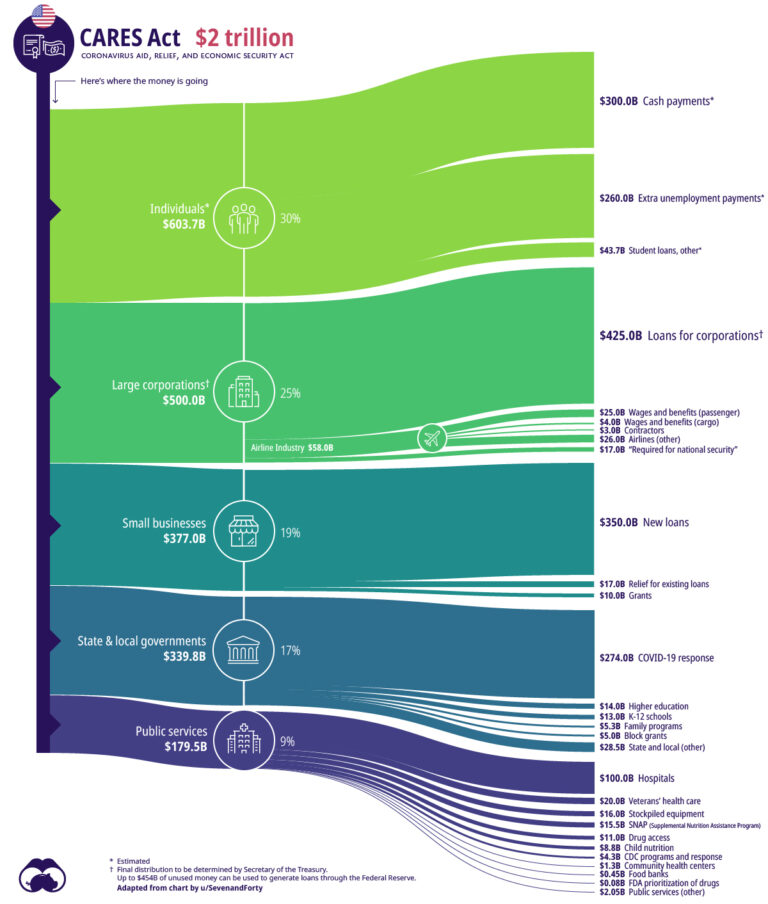

Individual Focus: Coronavirus Aid, Relief, and Economic Security Act (CARES)

Disclaimer: We’ve pooled several resources together to give you a comprehensive look at the new developments in tax and unemployment law changes since the onset of the Coronavirus. However, do not consider any of this to be tax, legal, or financial advice. We would be happy to talk with you more about your specific situation,…