When Does Buying A Home Not Make Sense?

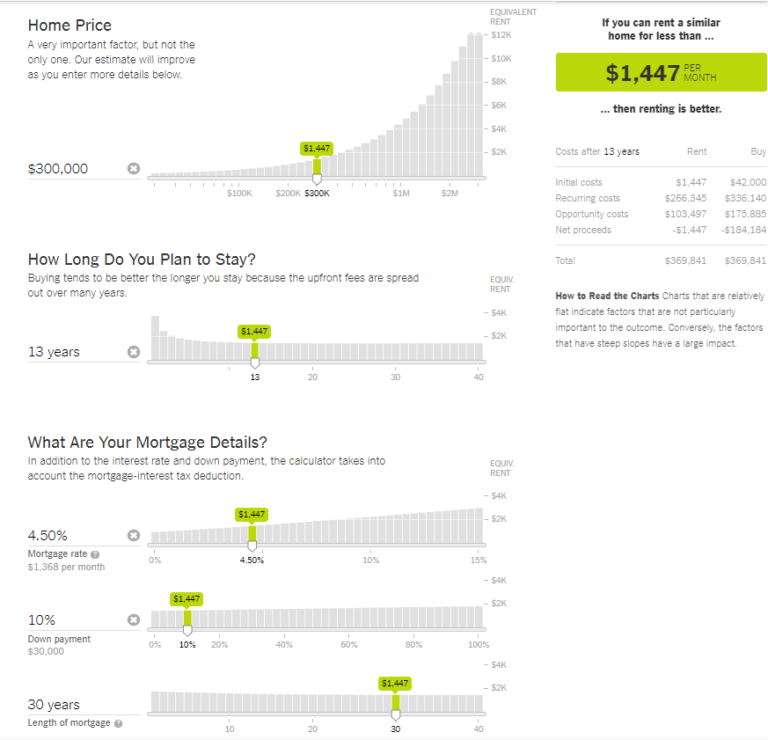

For most, owning a home is one of the next big steps after college. A few years pass and you’re either earning more money or starting a family and you roll your equity into a bigger house. However, after the real estate market took a hit in ’08/’09 people have started questioning this age-old wisdom…