Tariffs and a Declaration of Parental Independence

When our kids were younger, I would sometimes declare an abnormally early bedtime like 6:00pm. It made complete sense to me: I’m tired, they’re tired, win-win. But my declarations were always met with much weeping and gnashing of teeth. Then I would relent, pushing it out to 7:00pm, still getting all the tears, and ending up getting them to bed at 8:00pm with a permanent ding on my negotiation record.

On April 2, 2025, President Trump tried a parenting move directly out of my playbook, announcing extensive tariffs; he called them a “Declaration of Economic Independence.”

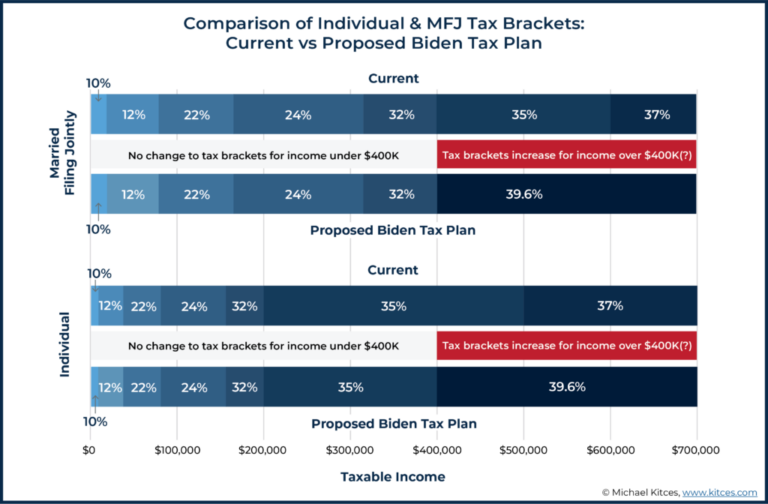

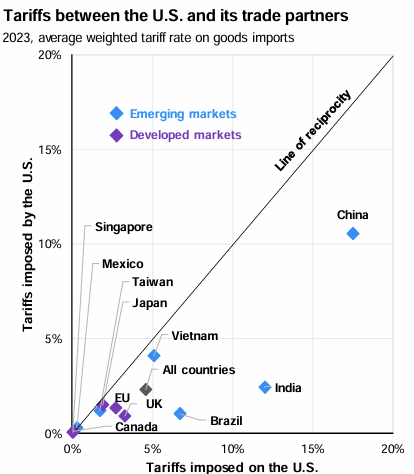

There is no doubt that our exports face higher tariffs than our imports. You can see in the chart below that when our trading partners are below the “Line of Reciprocity”, it means the tariffs on our exports into that country are higher than the tariffs on our imports from that country. I can see the logic in leveling the playing field. In other words, the kids have probably been going to bed too late, so it is perfectly understandable to consider an “earlier bedtime.”

However, these new tariffs were structured to significantly reshape U.S. trade policy, including a baseline tariff of 10% on almost all imports, with targeted higher rates: 20% for European Union imports, 24% for Japan, and 17% for Israel. The President rolled out a substantial package specifically targeting Chinese goods, including tariffs (initially) of up to 50% on select categories. The US equity markets saw this as a 2:00pm bedtime and behaved accordingly. In my world of parenting, this is when I usually pull out the famous, “Let me talk about this with your mother,” card.

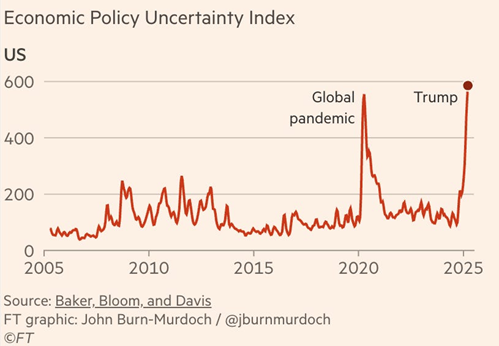

Just a week later, the administration announced something similar with a 90-day delay in the implementation of most of the new tariffs. This pause appears to be an attempt to ease tensions, provide time for additional negotiation, and walk back the effects of equity market disruption. Importantly, the blanket 10% tariff on all imports remains in place, as do the elevated tariffs of (as of publication) 145% on Chinese goods. In response to the announcement, markets rebounded sharply, reflecting investor optimism that cooler heads might prevail-at least temporarily. Still, uncertainty remains high as the broader tariff framework could resume in full later this summer.

Intended Outcomes

The administration aims to revitalize American manufacturing, reduce the trade deficit, and incentivize businesses to shift production back to the United States. Advocates argue that tariffs protect domestic industries from foreign competition, potentially spurring job creation and economic self-sufficiency. In other words, maybe I can get the kids to bed early Friday night, and, as a result, they’ll be well-rested and able to help me with some yard work tomorrow…

Unintended Outcomes

…Or maybe they’ll just wake me up at 5:00am asking me to pour the milk for their cereal. Despite the optimistic intentions, tariffs historically come with significant unintended consequences. The Tax Foundation identifies these latest tariffs as one of the largest tax increases since 1982, potentially costing the average U.S. household approximately $2,100 in additional expenses annually. Similarly, Morningstar analysts highlight the potential for increased consumer prices, which could dampen consumer spending, a critical driver of U.S. economic growth.

Economist Peter Schiff echoes this sentiment, cautioning that tariffs essentially act as a “tax on middle-class Americans,” risking higher inflation and potentially causing widespread disruption in the retail and manufacturing sectors.

More Context

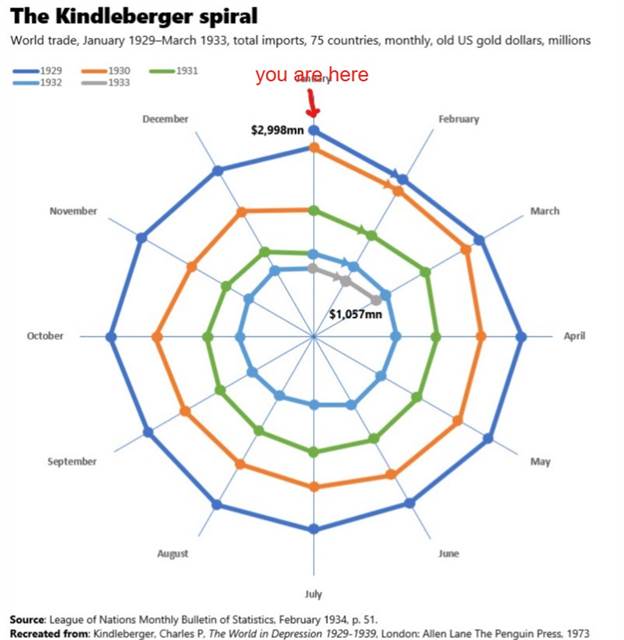

Financial analyst Kyla Scanlon’s post “Tariff Q&A” provides valuable historical context, referencing past tariff policies such as the Smoot-Hawley Tariff Act of 1930. Intended to protect American jobs, Smoot-Hawley ultimately intensified the Great Depression by triggering global retaliation and trade wars. The chart below illustrates the spiral that imports took during the early 1930s.

Scanlon underscores that historically, protectionist measures often lead to economic contraction rather than expansion. She notes, “Without sustained industrial policy (think: training, tech investment, stable regulations), tariffs alone won’t bring a big wave of well-paying manufacturing jobs.”

Sharon McMahon, writing in her The Preamble post “You’re Not Imagining Things: Your Grandparents Had It Easier Than You,” expands on this idea as she details America’s golden age of manufacturing and why replicating that era might not be feasible today. She notes,

“In 1950, the average factory worker made about $1.47 per hour — around $3,000 per year. Today, the average manufacturing job across all roles outside of supervisory positions brings in about $28.92 per hour. At the average hourly wage, a worker would end up making about $58,000 for the year, assuming they took a two-week vacation. It’s easy to look at these numbers and think that people should be able to keep up: they are making nearly 20 times what the average factory worker was in 1950. But the evidence shows otherwise.

The average home in 1950 cost $7,354, about 2.5 times the average yearly income of a factory worker.

A typical home in 2025 costs $357,000 — and that is just an average from around the country. In many large metro areas, one could not purchase an average home for this price. Rather than costing 2.5 times their yearly pay, the average home is now more than six times the average factory worker’s income.

Homebuyers in 30 states and D.C. need a six-figure household income to afford even a typical home. That’s an 80% increase in what someone needed to make to be able to comfortably buy a home in 2020.”

McMahon goes on to give similar examples of how inflation in other areas (cars, education, healthcare, and childcare) has outpaced manufacturing wage growth, resulting in an economy that fundamentally differs from previous decades.

Economic Outlook-Recession or Expansion?

Analysts at Morningstar warn that these tariffs substantially increase recession risks, estimating a 40%-50% probability of recession within the next year. They emphasize that higher input costs and consumer prices could constrain economic growth and reduce corporate profitability.

On the other hand, proponents argue initial disruptions could stabilize over time, potentially revitalizing specific domestic industries and reducing reliance on global trade vulnerabilities.

Market Implications-Stocks and Bonds

- U.S. Stocks: Market volatility has risen sharply following the tariff announcement, reflecting uncertainty about future profitability. Certain domestic sectors like steel or industrial manufacturing might benefit, whereas consumer-driven sectors face potential pressure from rising input costs.

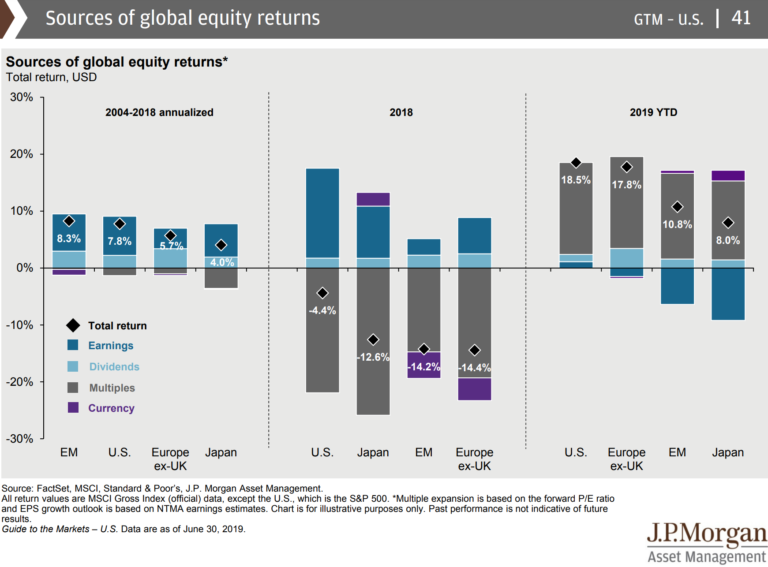

- Foreign Stocks: International markets may experience volatility as countries respond with retaliatory tariffs. Export-heavy foreign economies could see declines, while non-U.S. markets less dependent on American imports might outperform.

- Bond Markets: Bonds typically act as safe havens during uncertainty, and heightened recession fears could increase demand for U.S. Treasuries. We’ve already seen movement higher in bond prices as yields decrease.

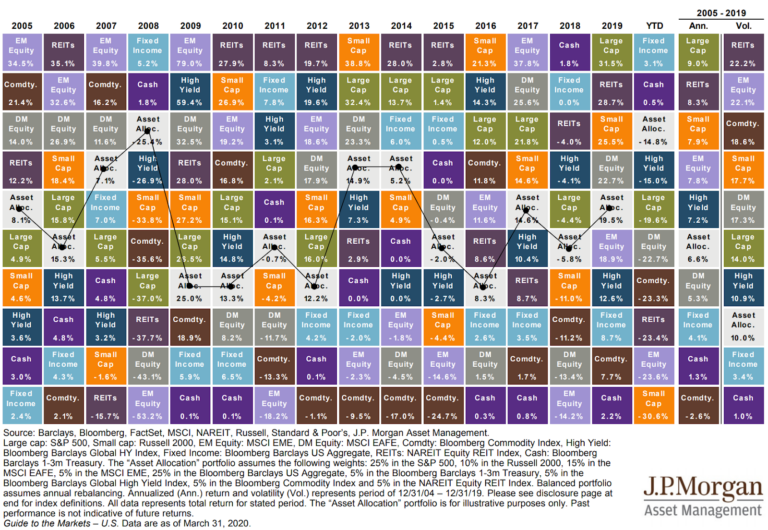

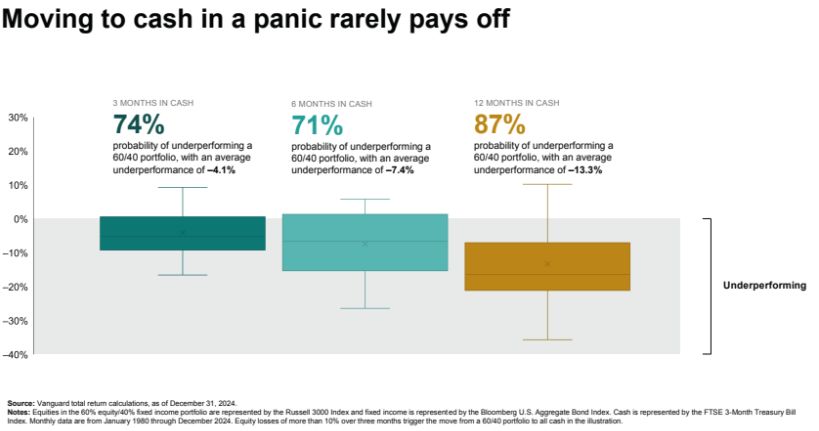

- Overall Allocation: While it can be beneficial to alter an asset allocation based on life circumstances due to tariffs (i.e. income changes from an income loss or gain) it is not typically helpful to make drastic asset allocation toward safety after a downturn. Vanguard demonstrates this in the chart below, where they looked at a rebalance from a 60% stock/40% bond portfolio to a 100% cash portfolio after a 10% stock decline from 1980 through 2024. Even a short-term (3-month) move to cash underperformed the 60/40 portfolio 74% of the time, with an average underperformance of 4.1%. If the hiatus into cash lasted more like 12 months, investors underperformed 87% of the time with an average underperformance of 13.3%.

While tariffs may have noble goals of protecting domestic industry and improving economic sovereignty, the broader historical and economic context suggests caution. Investors and consumers alike should remain informed and prepared for potential market volatility, higher consumer prices, and increased recession risks in the months ahead.