Abigail Disney and Money Conversations

Abigail Disney. Photo: Jemal Countess/Getty Images Source: The Cut

I recently ran across an interview with Abigail Disney, granddaughter of Roy O. Disney, co-founder of The Walt Disney Company (posted here at New York’s The Cut What It’s Like to Grow Up With More Money Than You’ll Ever Spend.)

It is a surprisingly vulnerable and honest insight into the real-life impact (both good and bad) that wealth can wield. Some of my favorite parts were about:

The downside of her dad buying a private jet: “You don’t have to go through an airport terminal, you don’t have to interact, you don’t have to be patient, you don’t have to be uncomfortable. These are the things that remind us we’re human.”

Who you surround yourself with: “And as my father’s drinking problem grew, he was surrounded by people who wouldn’t say, ‘You have a terrible drinking problem. You need to go get some help.'”

Giving away over $70 million: “Luckily, my grandfather gave us money directly, which was great because I never had to go to my parents and ask for anything. I was totally independent at 21. So I started giving money away. Within a couple of years, I was giving away more money than my parents, who had much more money tha I had, which they told me was embarrassing to them.

Money as a measure of success: “They did a study at the Chronicle of Philanthropy years ago where they asked people who inherited money, ‘What amount of money would you need to feel totally secure?’ And every single one of them, no matter what they had, named a number that was roughly twice what they inherited. So that’s what you need to know about money, right? If that is your primary measure of success or value in life, then good luck with that, because it will never feel good.”

It is a fascinating conversation that captures, as Sir Francis Bacon put it, how “money is a great servant and a bad master.”

You can read more of the interview here and listen to the more detailed podcast here.

Our Money Conversations

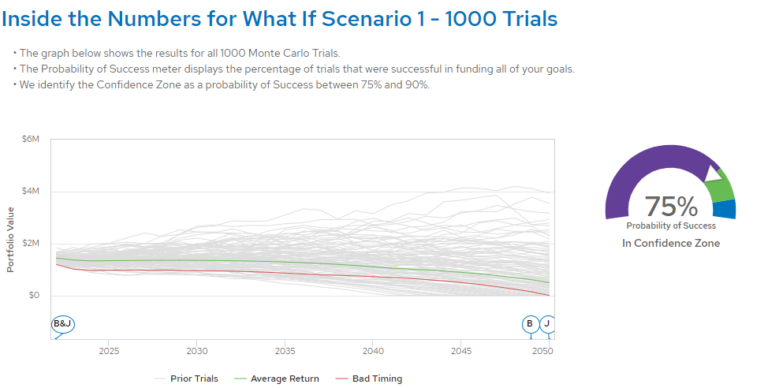

The interview reminds me of money conversations we have with our clients nearly every day. Sometimes the conversations are light-hearted and fun, but plenty

As my good friend and mentor, Sam Hummel, has often reminded me (and dozens of other advisors):

This is a noble profession, and you all have a huge responsibility. As an advisor, your clients are going to tell you things that they won’t tell anyone else. They won’t tell their supper club friends because they’re self-conscious, they won’t tell their insurance person for fear of being sold something, and they sure won’t tell their pastor because he can do amazingly quick math on what 10% looks like. (Sam would finish with a wink and a smile.)

In a sense, we’re the keepers of our clients’ money stories. People come to us with a history of successes and failures and a future full of hopes and dreams. We know this because we ask about them in our first meetings. Over the course of our client relationship, we help guide a client’s big decisions based on what we already know about them. We also get to use what we have learned from one client to help us guide another client. While no two stories are alike; plenty of them rhyme.

Often we’ll have a client apologize for talking about something for what they perceive is ‘too long.’ We typically don’t offer forgiveness. Our feeling is, if it is part of someone’s story and they want to tell us, then we want to hear it. Sure, it might not end up making its way as a data point in a financial plan or Excel spreadsheet. But it will help us provide guidance beyond which account they should use or what amount to save. Like Abigail Disney, we’ve discovered that money is significant, but it’s also more than money.