Annual Financial Checklist: September – December

This last checklist post is during some of my favorite months in the year! Fall and winter are a time for hot chocolate, chopping wood, and plenty of time with the sun down to get your financial ducks in a row. (NOTE: If you are one to procrastinate then I would suggest reading my previous checklist blogs to ensure you are caught up for the year before continuing with this one.) January-April Checklist and May-August Checklist.

September

End of Life Planning: Review your estate plan, beneficiaries, and insurance policies to ensure they are all up to date. You should also make a plan for your passwords and digital assets. Once  everything is in place, store the information in a fireproof safe or safe deposit box.

everything is in place, store the information in a fireproof safe or safe deposit box.

- Communicate with Family: Ensure any relevant family members know where to look for financial data related to account locations, passwords, security questions, etc.

- Retirement Savings: Check your retirement account contributions so that you are maxing out your possible benefits or contributing your expected amount.

- Plan for the Holidays: Plan your Thanksgiving and Christmas spending budget…and stick to it. Sometimes that means being creative with gifts, going in on gifts together, or having a Secret Santa where everyone draws a name for one person.

October

- FAFSA: If you have kids in their Junior or Senior year in high school or college, you need to apply for FAFSA. You can read our blog post about FAFSA details and strategies HERE. And if you have younger kids, you should still read the article because there are some strategies that can take years to implement depending on your situation.

- File Taxes: If you’ve delayed income tax filing then be sure to file before October 15!

- FSA: If you are using a flexible spending account (FSA) be sure to spend the rest before year end. Or if you can’t spend it, familiarize yourself with your specific plan’s extension options.

November

- Required Minimum Distribution (RMD): If you are over age 70.5, be sure to take your RMD before year-end, and plan on how much tax should be withheld for Federal and State taxes.

- Charitable Giving: Plan ahead for your charitable contributions. Examples of this would be stock gifts, QCD’s, and Donor Advised Fund contributions. Self-Employed Retirement: If you are self-employed, consider setting up a Solo 401k, SEP IRA or Simple IRA. Depending on the type of account, you may be able to wait to fund it until you file your taxes, but only if it is established before year-end. See our blog post HERE to understand the differences.

December

- Income Planning: Review expected income for the year and consider the impact of a Roth conversion, capital gains, and changes in the tax law. Depending on your situation it may be worthwhile to know the Medicare thresholds and stay below those limits.

- Expense Planning: Set a budget! We have a few apps we like such as Mint and Mvelopes. But using a pen and paper at the end of the month to write out every expense really puts you in touch with your spending. And if you need a bigger hurdle to jump over, then you can have the physical envelopes full of cash with each spending category written on them. That way you can’t

overspend if you stick to paper money.

overspend if you stick to paper money.

- Stock Options: Make a strategy for stock options. If you have an upcoming expense and don’t have the savings to cover this expense, then it may be worth cashing in your stock options. But if you have time and the company looks strong then holding onto options for over a year to qualify for long-term capital gains may be your best bet. Of course, this depends on the type of stock option.

- Make a plan for any year-end bonus: We often encourage clients to save at least 50% and use the rest on updating some home appliances, investing in their car, or going on a trip.

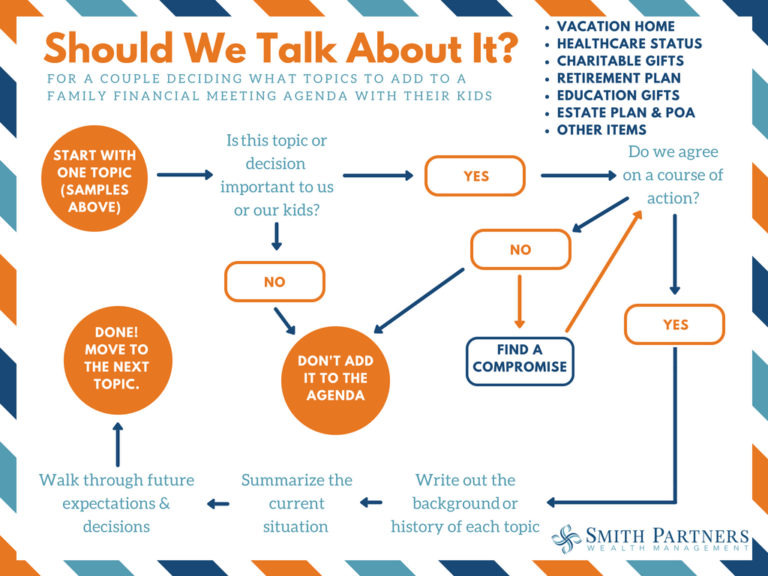

- Have a Family Money Conversation: Now that you have more time with your family make it a point to discuss financial topics. Whether they are 7, 17, or 47, there is always a good reason to have a money conversation. Read our blog post about how to do this HERE.

Best of luck getting your financial house in order. And as always, give us a call if you have any questions or concerns.