Dow 20,000 – Irrelevantly Monumental

There are two equally true sides to this story: 1) it’s irrelevant and 2) it’s monumental.

It’s irrelevant

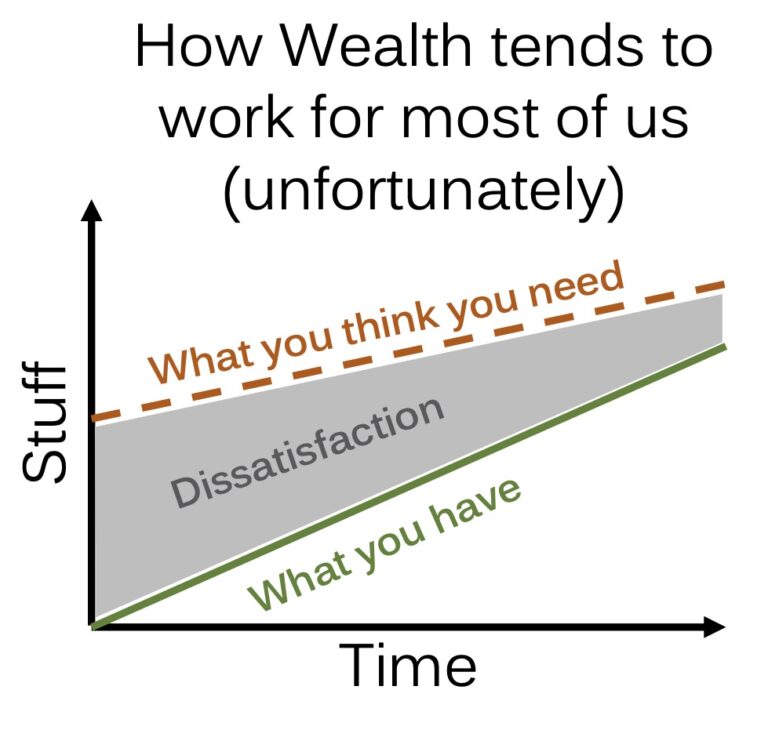

If we had all been born with 7 fingers and 7 toes we would have celebrated when the Dow broke 14,000 (first in 1999, then again in 2006 and, like your friend who has celebrated 3 consecutive 39th birthdays, it broke through again in 2012). Our 7-fingered selves would have to wait another 1,000 points to buy our “Dow 21,000” hats.

In reality, the 10,000 round number doesn’t signal either a direct path to future positive returns nor does it signal an inevitable downturn – it’s just a number. Furthermore if an investor does something different with their portfolio simply because the Dow crossed from 19,999 to 20,000, then they should probably switch to playing the lottery; at least some of those lost dollars go to education.

It’s monumental

I have a vivid memory of two client meetings on March 6th, 2009, the day before the Dow bottomed out at 6,500. As we went through a box of tissues, we heard one client say through tears “I just don’t know how much more of this I can take.” In fact, that phrase made such an impact that we wrote it down on a post-it note and keep it in front of us as a reminder of what is at stake here.

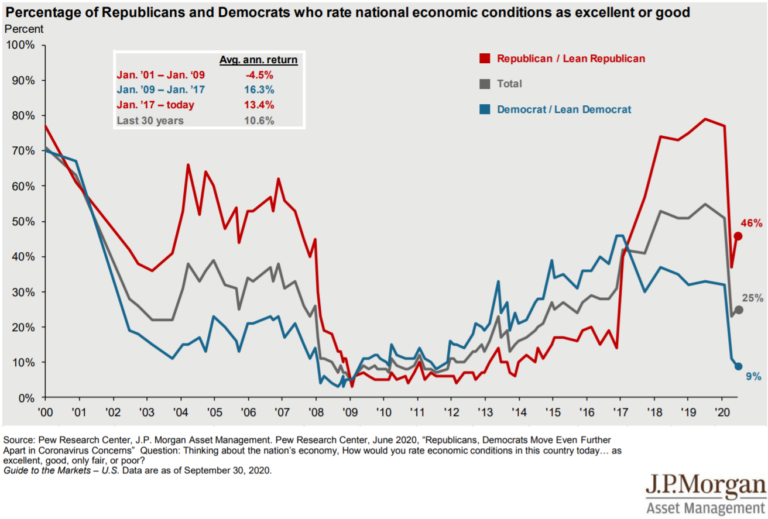

But for the financial markets to rebound the way they have (+200%) has been nothing short of historic. From the depths of Lehman, AIG, Bear Stearns, GM, and Chrysler failures, to the US debt ceiling and credit rating downgrade. More recently the end of the Fed’s QE policy, flash crash, Asian market scare, and Brexit all felt like they were going to go take the whole market down with them. But we have seen some astounding resiliency in the face of doubt, fear and crisis.

Our takeaway is that the market is unpredictable and four zeros on the Dow do not warrant drastic changes. However, if you feel you must do something, our advice follows along the same lines as replacing your smoke alarm batteries when you reset your clocks for daylight savings time (you do that right?) Every 1,000 mark might be a good time to:

- Do a quick check-in on your portfolio and rebalance if your asset allocation no longer fits your long term risk tolerance and goals.

- Consider shoring up your emergency fund. We haven’t met many clients who have regretted having a cash reserve equal to 3, 6, or even 12 months of required expenses.

- It would also be a great time to consider gifting some appreciated stock to something you are passionate about. Or giving them to children or grandchildren to teach them a lesson on the power of compounding.

- If none of those apply or sound appealing, go buy that lottery ticket and limit your losses.