How to Contribute $67,500 into a Solo 401k in 2022

Solo 401k’s have always had a large annual contribution limit, but the trick is getting to that limit while living within the rules provided by the IRS. There are four rules to follow to contribute the entire $67,500.

Rule #1: Qualifying Business

You must work in a for-profit business with “one” employee: you. However, the IRS will allow a caveat for your spouse, meaning you and your spouse could work for the same company and still qualify. The next question is then, “Can I have Independent Contractors?” You can have contractors if they work less than 1,000 hours in a year. If you have a long-term part-time contractor who has worked for three consecutive years, they will need to keep their hours under 500 per year.

If your independent contract employees go over this limit or you hire a full-time employee who isn’t your spouse, you will disqualify your solo 401k contributions for the year. You will need to remove contributions for the current year and freeze the solo 401k or roll it into another account.

Rule #2: Employee Contribution (Pre-tax or Roth)

As a business owner, you wear two hats: employee and employer. As an employee, you can contribute 100% of earned income from your business up to $20,500 (or $27,000 for individuals over 50 years old.) Employee contributions can be Pre-Tax or Roth, or a mix of both.

Rule #3: Employer Contribution (Pre-tax only)

Employer contributions have two different paths depending on how you are taxed.

Taxed as an S-Corp: In this scenario, you receive W-2 income and then have your K-1 distributions above and beyond your W-2. We will ignore the K-1 distributions as you already received a benefit from those dollars avoiding FICA taxes. Your employer contribution in this scenario is 25% of your W-2 income. So if you earned $120,000 in W-2 income this year then your maximum employer contribution will be $120,000 * 25% = $30,000.

Taxed as a Sole Proprietor/Individual: The employer contribution limit in this scenario is 20% of net income. However, it’s challenging to know net income with back-of-the-envelope math because you need to account for your employee contributions, self-employment tax deduction, and other deductions. Regardless of your comfortability with taxes, I’d recommend speaking with a CPA to calculate your maximum contribution for the year.

S-Corp Example: James is 52 and has a consulting business taxed as an S-Corp: he’s the only employee and earns $200,000 in W-2 income and $500,000 in K-1 Distributions. He makes the following contributions:

Employee contribution: $20,500

Employee over 50 catch-up contribution: $6,500

Employer contribution: 25% * $200,000 = $50,000 is the possible employer contribution, but James is capped at $40,500, because $20,500 + $6,500 + $40,500 = $67,500 (over-50-limit)

Total contribution for 2022 = $67,500

*If James were under 50 his max contribution would be $61,000

Sole Proprietorship Example: Sarah is 52, and has a consulting business taxed as a sole proprietorship. She earns $200,000, but after self-employment tax, 401k deductions, and other business deductions, her Net Income sits at $140,000. This means that she can contribute:

Employee contribution: $20,500

Employee over 50 catch-up contribution: $6,500

Employer contribution: 20% of $140,000 = $28,000

Total Contribution for 2022: $55,000

*If Sarah were under 50, her max contribution would be $48,500

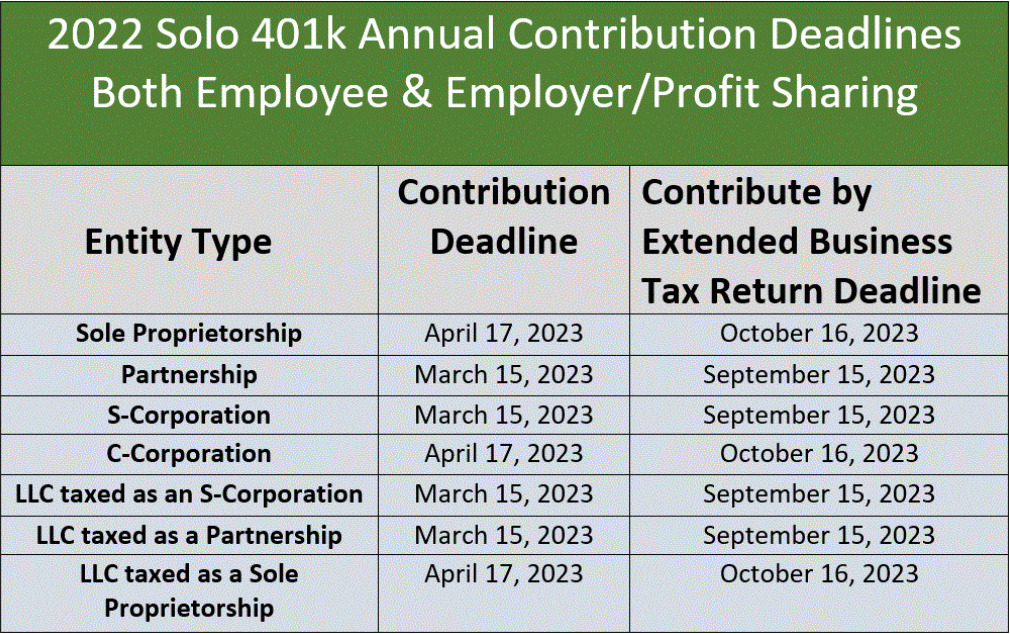

Rule #4: Opening and Funding Dates

Solo 401k’s should be established by 12/31 of the tax year contributions are intended to land. Deadlines for actual employee and employer contributions are below and differ based on the entity type. Yes, employee and employer contributions may be made after year-end.

Solo 401k’s can be great tools to defer taxes, increase Roth exposure, and save large amounts of money. However, everyone’s situation is different, and I recommend talking with a CPA or financial professional to determine which type of accounts and contributions are best for your scenario.