Market Commentary Q3 – 2013

“We the People, In Order to Form a More Perfect Union…”

Last month, we sent our first kid off to kindergarten and I quickly discovered one of the joys of parenthood: learning from your kids. Every morning in September, all the students at her school would recite (well, really sing the “Schoolhouse Rock!” version of) the Preamble to the Constitution. Over the course of a few carpool rides, I convinced her to teach it to me and in return I embarrassed her by belting it out in the style of 1980’s rock power ballads in front of her friends. For some reason, I get the feeling that, with all that is going on in Washington right now, “we the people…” don’t exactly feel like we have a “more perfect union”, we’re falling far short of “domestic tranquility” and don’t even get me started about whether the “general welfare” is being promoted above all else.

Three years ago, I wrote about how investing is similar to owning a hotel (100 rooms=100% of a portfolio). On any given day, investors are free to rent any or all of their 100 rooms (invest) to a variety of tenants (investments). Each tenant has varying levels of job security, payment arrangements and a wide range of inclinations to leave their rooms, at check-out, in the same condition they found them. In this illustration, tenant John Q. Stock’s ability and willingness to pay are tied to his work earnings, whereas tenant James Bond’s pay plan is governed by a contract. When we buy a Stock or Bond, it’s the same transaction as a Hotel Owner handing over the keys to a tenant; the tenant goes to his room and we take our post at the front desk and (usually) collect rent (receive interest from Bonds and dividends from Stocks). However, the bulk of returns come when a tenant moves out. If the tenant has been a good one, some other Hotel Owner will pay me an exit fee so they can move into their Hotel (a capital gain). But if we have to evict a bad tenant, we might have to pay another Hotel Owner just to take the deadbeat off our hands (a capital loss).

America Inc.

This illustration is worth revisiting because the fight in Washington over the annual budget deficit and accumulated national debt has tangible effects on every Hotel Owner’s tenants (investments) in various ways. For the purpose of our story, the US Government can play the role of both the largest employer of tenants and the most prevalent renter itself.

As a company, America Inc. has had an amazing ride. It was started over 230 years ago by a group of guys with wigs and wooden teeth who had a problem with authority (or “taxation without representation”). From the beginning, America Inc. has been in the business of serving the Hotel Owners: it provides infrastructure, security services, social benefits, recreational opportunities and, among other things, a legal system. These America Inc. founding fathers had the foresight to set up one of the greatest (and at times like these, the most frustrating) organizational charts imaginable. They essentially created two Boards of Directors and a CEO/President position. One of the boards, the Supreme Court, is charged with making sure the founding fathers’ wishes are upheld. The other, much larger, board is the 535 person Congress. Its members are put in place by the Hotel Owners and are trusted to manage both the short and long term operations of the company. These members are supposed to decide what services are best to provide to the Hotel Owners, in what proportions, and establish a budget to pay for them.

And oh the bills they will pay. On average, America Inc.’s accounting department (the Treasury) sends out 3-5 million checks every day. Where does all of it go? In 2012, America Inc. spent $3.54 trillion for the overall benefit of Hotel Owners; mainly on medical care (Medicare and Medicaid 23%), retirement and disability benefits (Social Security 22%), security detail (Defense 19%), “other” mandatory and discretionary expenses (13% and 17% respectively) and interest payments (6%). Like any business, America Inc. has two

main sources of cash: revenues and borrowing. The accounts receivable department of the Treasury, formally called the IRS, collects tax revenues at whatever tax rates the Board of Directors and CEO have begrudgingly agreed to. In 2012, they collected $2.45 trillion mainly from individual Hotel Owners (and largely from the owners of the biggest hotels).

Government Shutdown

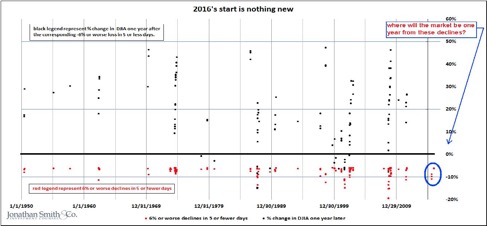

The Board of Directors of America Inc. has had all year to work on and agree to a company budget for 2013. The due date for this budget was October 1st, but it came and went because the Board could not agree on what services to provide to the Hotel Owners. Without a directive of what to pay, America Inc. was forced to prioritize payments and shutdown “non essential” programs such as National Parks, IRS audits, and many civilian defense workers to name a few. This shutdown was not due to being insolvent (no, that came two weeks later), but rather due to not having a legal directive of where to spend. While the shutdown certainly hurt those directly impacted, it is nothing new to our history. America Inc. has seen plenty of shutdowns (since 1977 we’ve had one on average every other year), but they are often short lived and haven’t had much long-lasting ripple effect into the greater economy. In fact, we saw a US Stock Market that mostly disregarded the shutdown and stayed roughly flat throughout it.

Debt Ceiling

So if you’re good at math (and believe me, not all of the Board is) you’ll notice that in 2012 America Inc. spent more than it took in, creating a shortfall of $1.09 trillion. And this isn’t the first time; we’ve done it 81 of the last 113 years. Over time these annual deficits add up and create a National Debt number that has grown to roughly $16.8 trillion. [Aside: ask any student pursuing a graduate degree if annual deficits are inherently bad; they’re not. But it is important to point out that paying for a Masters in Business Administration has a much different return on investment than a Masters in Journalism…and, while we’re at it, going to college for 81 out of 113 years might be a bit excessive].

Source: National Public Radio – Planet Money

To get the needed funds, America Inc. places their Bond renters in various Hotels near and far. This chart shows exactly which Hotel Owners rent out rooms to America Inc.’s Bonds. So not only are they the most prevalent tenant in the entire market, but they also have the longest and strongest history of repayment of any employer/renter (Government Bond) in history. What gets tricky, is that even though there is a seemingly endless supply of Hotels for America Inc.’s Bonds to live in, the Board of Directors has put a limit on how much debt it can issue; currently set at $16.8 trillion. And even though “debt ceiling” sounds scary and impenetrable, it has actually been raised on average every 8 months since 1962. It is more of a friendly reminder for Congress to argue than a real ceiling.

But as two characters on the TV show West Wing exchanged: “So this debt ceiling thing is routine or the end of the world?” “Both.” The head of the accounting department of America Inc., Treasury Secretary Jack Lew, calculated that as of October 17th, they would no longer be able to pay America Inc’s bills for services the Board of Directors already agreed to fund. We would have hit the debt ceiling and exhausted all

extraordinary measures. The only next step would be to start prioritizing the services they offer the Hotel Owners, like do they pay for the military or social security? Medical care or government agencies?

But beyond the obvious impact of not fulfilling the above obligations, there would be even greater systemic consequences if America Inc. couldn’t pay the rent (Bond interest) to Hotel Owners. By putting those payments in danger, America Inc. would instantly become a much less desirable tenant and wouldn’t pay as much “exit fee” to its Owners when they moved out. But the ripples go even wider than that because these Bonds are in nearly every Hotel; they’ve become the gold standard. With that, all other Bonds would have almost no choice but to adjust their “exit fees” (market prices) downward accordingly. Finally, the possible default crosses over into the Stock tenants also. The Hotel Owners that rent out rooms to Stocks expect to get paid based on what the Stock’s earnings. If things don’t go well for America Inc., they won’t go well for the Stocks’ earnings and the Hotel Owners would have a lot of squatters.

A “Solution”

In an effort to teach our future generations about the value of procrastination, the Board of Directors has finally come up with a compromise in the 11th hour to solve their own crisis. The solution, a Band-Aid really, will allow America Inc. to continue operating and avoid a shutdown…for three months. While this is better than remaining in shutdown, there will be some long lasting effects. For example, I imagine there are some furloughed workers who won’t be rushing out to buy that next house now that they know they might only have a job for the next 90 days.

The Board of Directors also voted to extend the debt ceiling until February 7th. Although, if you take into account the use of “extraordinary measures”, America Inc. will likely have enough borrowing capacity to make it until March. This debt ceiling debate, much more so than the annual budget squabble and shutdown, has the real potential to continue to be a large drag on our economy. As Jonathan reminds me nearly every week, “the market hates uncertainty.” Meaning, investors can work with bad news or good news, but uncertainty can sometimes do more damage than either.

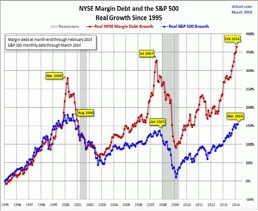

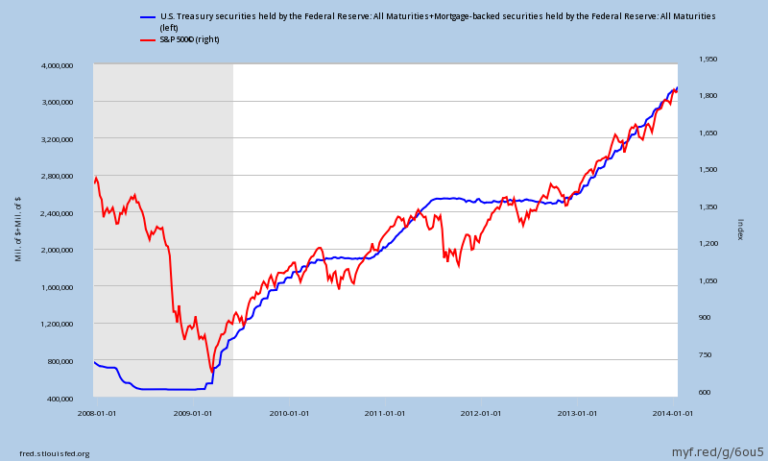

As Financial Advisors, we act as Property Managers for our Clients’ Hotels. We think now is an extremely important time to recognize the risk in renting out a room to just anyone. So who are we particularly inclined to rent to now? The one positive we see is that America’s Inc.’s bank (the Fed) has hinted that it will keep interest rates low as long as America Inc. is recovering. We think uncertainly in DC increases the likelihood of a longer recovery, meaning interest rates could be lower for longer, which is likely good for risk assets like Stocks. Our strategy continues to favor the higher quality, typically larger cap Stock tenants and funds. These are the ones with steady jobs, long histories of paying rent (dividends), and who are more financially independent (more cash rich and less dependent on debt). We still think Small and Mid-Cap Stock tenants are relatively more expensive to get into our rooms, so we’re owning less of them than usual.

While we still like investing within the confines of America Inc., we also realize that at all-time highs, we’re less and less likely to get all-time returns. For that reason, we’re attracted to increasing our Foreign tenants, particularly those in emerging markets. They haven’t been the most dependable tenants year to date, but that means we don’t need to pay their prior Hotel Owners as much to get them into our rooms. We’re still skeptical of the low rents we’ll get from America Inc. Bonds and we underweight the rooms allocated to them. Finally, we continue to keep a slightly greater than average number of rooms empty (hold cash) for those days when other Owners are fed up with their tenants and start handing out eviction notices.