Market Commentary Q3 – 2014

Our son, Everett, just turned 18 months old last week. And after having two tutu-wearing daughters (Grayson now 7 and Finley Cate now almost 5) it felt like a real “win” for me, as a dad, to have my son’s favorite word be “truck.” And that doesn’t really even do the word justice, because he usually says it two times in a row, really loudly, and almost always preceded by an audible gasp. So in reality, his favorite word is more like “(GASP) SCHRUCK SCHRUCK!!!”

It started out at a pace of 1 or 2 “schrucks!” a day. And because they were pointed out by Millie or me, they were always actual trucks with a bed and a cab. But then he went on to categorize all SUVs and then, heaven-forbid, most mini-vans as “trucks”. It has now escalated to the point that we were recently reading a “Things That Go” book, and everything from roller coasters to motorboats, from bulldozers to motorcycles were all met with a chubby index finger and a shriek of “(GASP) SCHRUCK SCHRUCK!” In Kaplan’s words, it seems we’ve given a small boy the word “truck” and he has found that everything he encounters now needs to be called a “truck.”

Kaplan’s thought behind pointing out the Law of the Instrument was to encourage scientists to look at things from a different perspective; specifically one outside their trained skill set and comfort zone. Even if we don’t know to label it as such, the Law of the Instrument is present in our everyday lives. It isn’t that we doubt the character or competency of someone; we just wonder if they only know how to solve a problem one way. Like when my long time family doctor prescribes a cholesterol prescription, but I wonder if I should simply change my diet. Or when my mechanic recommends that he rebuild my engine, when maybe I should just try the $50 leak-fix spray. Or when my life insurance agent recommends a product that even I don’t understand and I wonder if I am already really self-insured.

The Quarterly Fix

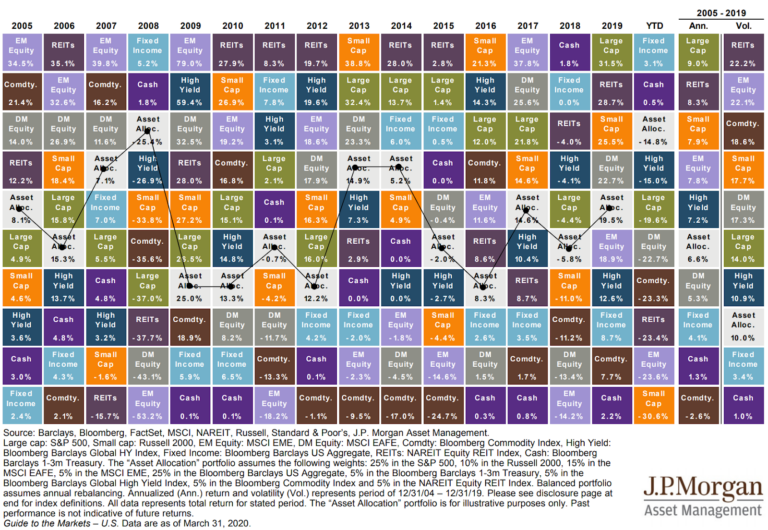

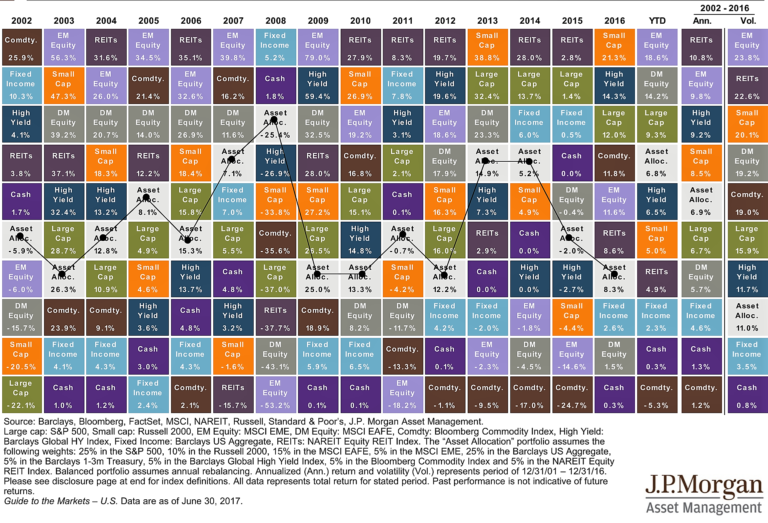

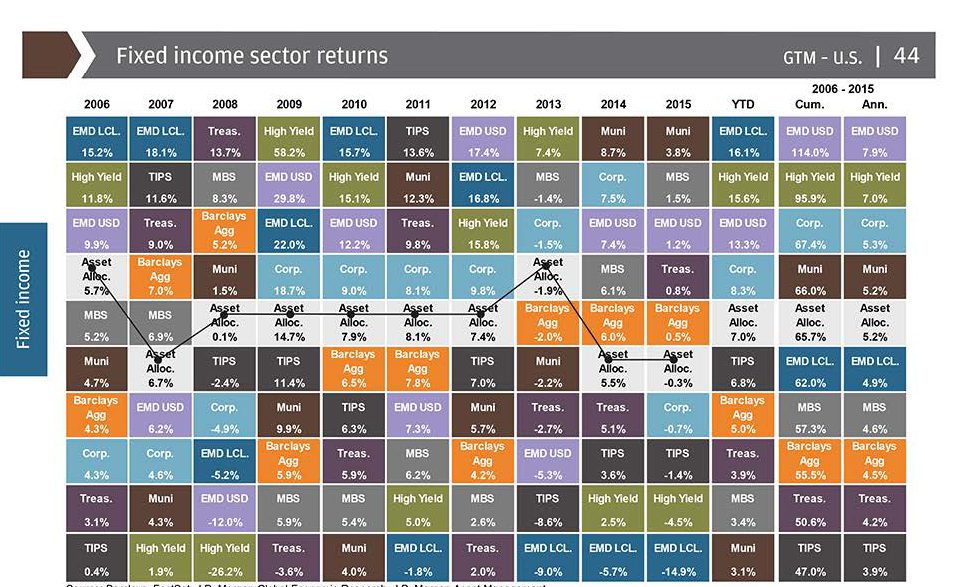

On a nuts and bolts measure, we’ve seen volatility and poor returns come back to a market that, if you read our last commentary, you would know we haven’t seen in a while but we expected at some point. For the 3rd Quarter, the S&P 500 was +1.1%, Barclay’s Aggregate Bond Index was +0.2%, while MCSI Emerging Markets Index was -3.4%. Pulling up the rear were MCSI Developed Markets -5.8%, followed by Russell 2000 US Small Cap at -7.4% and lastly Bloomberg Commodities Index losing -11.8%. Within this, we’ve seen much more growth in the US high quality large cap areas, with Large Cap Blend +1.1%, Mid Cap Blend -1.7%, and Small Cap Blend -7.4%.

And this doesn’t even capture the dip felt in most of these asset classes in the 11 trading days since we closed out the quarter. In fact, over those 11 days, the S&P 500 dropped 105 points (roughly -5.3%)…but has traveled up and down roughly 448 points (or 22.7% cumulative movement) to get there. That’s like traveling from Greensboro, NC to Raleigh, NC but stopping in both Virginia and South Carolina along the way. A trip that would normally take a little over an hour, ends up taking close to eight hours. Not only is that exhausting, it also leaves more opportunity to do something reckless at the wheel.

Even more unsettling than the volatility, are some of stories behind the market moves. On October 8th, the S&P 500 actually jumped +2.28% on news that the Fed didn’t think the economy was strong enough to handle higher interest rates – yes, you read that right. As fellow advisor Josh Brown put it in a mock headline “Stocks Explode Higher on Fears of Renewed Economic Weakness”.

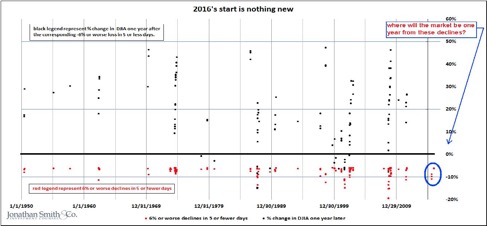

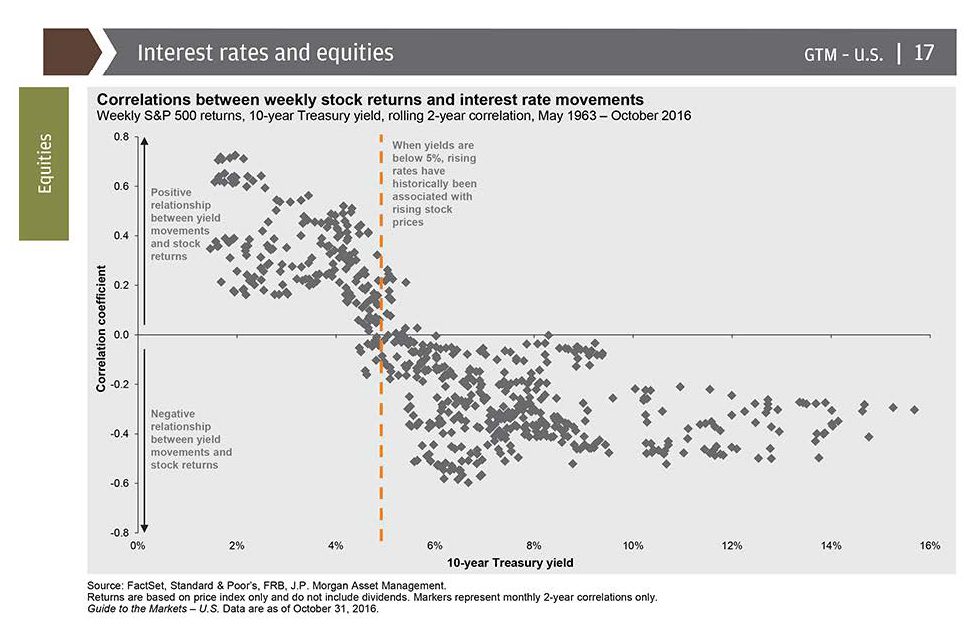

We continue to see reason to stay invested in risk assets such as US and Foreign equities, but not because investing is our only or best tool. We know that over the last 34 years, the average intra-year drop in the S&P from high to low has been -14.2%. But in 26 of those years, the returns have still been positive (and up cumulatively roughly 1600%). Looking back over the last 51 years, we see that whenever interest rates are below 5% (they’re just below 2% today), then rising rates are actually associated with rising rather than falling stock prices (see chart).

What Kind of Instrument Are Your Investments?

It is times like these when we want to make sure that we (and our clients) are viewing our investments as the right instrument. The investor who sees his portfolio as a jackhammer, a way to make a quick and easy buck while picking up a few “attaboys” from the golf pals, will likely find just that…along with plenty of hard losses and a few “how-could-I-haves”. The investor who sees her portfolio like a shop-vac, fearful of messy returns because she has been hurt by past losses will likely find her portfolio avoiding volatility…along with a lot of days sitting completely out of the market and missing a generational rally.

A recent Dalbar study suggests that over the last 20 years, while the S&P has produced an annual return of 9.2% and Bonds 5.7%, the average investor has produced a 2.5% annualized return; that’s just 0.01% above inflation. While I believe this study over inflates this gap a bit, this massive difference still exists and is due to investor behavior. Or in other words, investors oscillating between treating their portfolios like a fearful vacuum on one end of the spectrum and a fearless jackhammer on the other (and even worse, getting the timing of when to use which tool horribly wrong).

We’ve seen this in real life with a client couple who came to us a few years ago after already retiring. Their whole working lives, they had almost blindly put money away in well-known, low cost mutual funds in up markets and in down, and then treated their accounts with investor’s amnesia. Sure, they would have benefitted from systematic rebalancing and yes, their contributions were a little more when the market was expensive and less when it was cheap. But because they focused on low-cost, well-run funds, contributed in a large and systematic way and didn’t get swept up in the market, they came to us with a very heathy nest-egg. As an aside, a good hallmark of investing process would probably be one that wouldn’t sell a single ad on CNBC (“Yes, this is Jim Cramer, I just wanted to report that the Joneses failed to log onto their investment account for the 100th day in a row…we’re not even sure if they will open their statement this month! This is exciting stuff!”).

How Are You Using Your Instrument?

But saving and investing properly is only equivalent to finding the correct instrument…using it correctly is another matter. In the words of Francis Bacon, written over 300 years ago, “Money is a good servant, but a bad master.” We’ve had the great privilege to walk through retirement with so many clients over the last 26 years. We’ve determined that “success” certainly has some (but less than you’d think) to do with how many absolute dollars someone has when they retire. Rather, we’ve found it comes down to two simple things: living within your means and spending resources (time and money) on things you are passionate about. The problem is, while these are simple, “simple” does not mean “easy”.

With this in mind, with this same client couple, we asked the hard questions: What keeps you up at night? What might you regret if you don’t do it? What do you want your legacy to be? And a whole host of other questions. We also talked at length about travel, how they wish they had done more and that now was probably the time to do it, but they didn’t feel like they could.

So we crunched the numbers. Once we were able to show them our models and multiple scenarios (mostly focusing on worst case probabilities), we decided on a path. Focusing less on price appreciation and more on dividend income production, they felt freedom to enjoy what they had saved and invested wisely. And with us watching the assets and managing the plan, they didn’t need to shoulder the what-ifs. On the planning side, we suggested a family foundation which they funded with appreciated stock. Suddenly this couple was funding projects in their community and that was some of their favorite money to spend. We also suggested traveling abroad more frequently while they were still able. And now we get a monthly “wish you were here” postcard telling us of their travels near and far – each one, essentially thanking us for helping them use their investment instrument properly.

This isn’t the case with every client. In some cases, we have to have the opposite conversation, encouraging someone to give up some travel and maybe help the kids a little less. The process for us is the same: ask the hard questions, listen for what is important, crunch the numbers, make investment and planning recommendations that are always in the best interest of our clients. Many times that means investing in the stock and bond markets, but often it means paying off a mortgage, loaning money to a kid, reinvesting in their business or even giving the assets away. It is the same process used to fix a broken door knob: look at what the problem is, how you would want to fix it, then pick out the tool. When we pick the tool first (saying something like “I just want to beat the S&P” or “I can’t lose any money”) before we answer the “what” and “why” that need fixing, we release the young boy to start pounding away.