Proposed Plan to “Fix Our Broken Tax Code”

For much of the year, we’ve told clients “let’s wait and see” when considering certain tax saving strategies like Roth conversions or a Qualified Charitable Distribution because we wanted to see what tax policies might come from Washington.

On September 27th, the White House released the “Unified Framework for Fixing Our Broken Tax Code” to outline their plans to…well…fix the broken tax code. Below we point to some great resources for learning more about the proposed changes, outline some potential winners and losers, as well as highlight gaps that still need to be addressed.

Winners and Losers

The Wall Street Journal has the clearest explanation of the potential winners and losers. While many individuals would “win”, some will certainly pay more tax and it seems the highest income earners will benefit the most.

I also found it helpful to see a graphical representation of the “winners and losers” by former US Treasury economist Ernie Tedeschi (thanks to MarketWatch). Tedeschi shows the estimated average change in after tax income for different income brackets, and the source of that income. It is easy to see most common benefit is around +1%, except for the +$213,000 income households who would stand to benefit by +3%. Note that the top 10% are lumped together.

The 1% Seem to Benefit Most

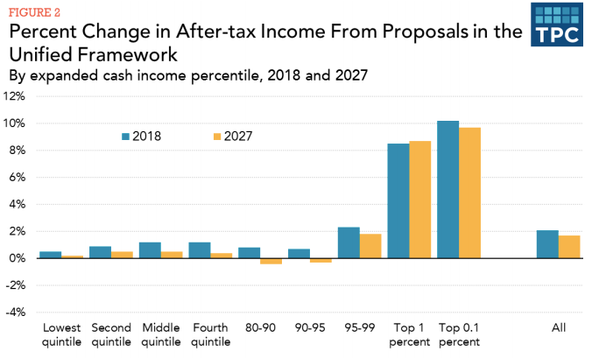

The Tax Policy Center’s “A Preliminary Analysis of the Unified Framework” continues the same analysis of after tax income impact but carries it out to to the top 1% and top 0.10% of income earners. You can see that once the top 10% of earners are broken out to the top 1% and 0.10%, the benefits increase more rapidly to 8-10%.

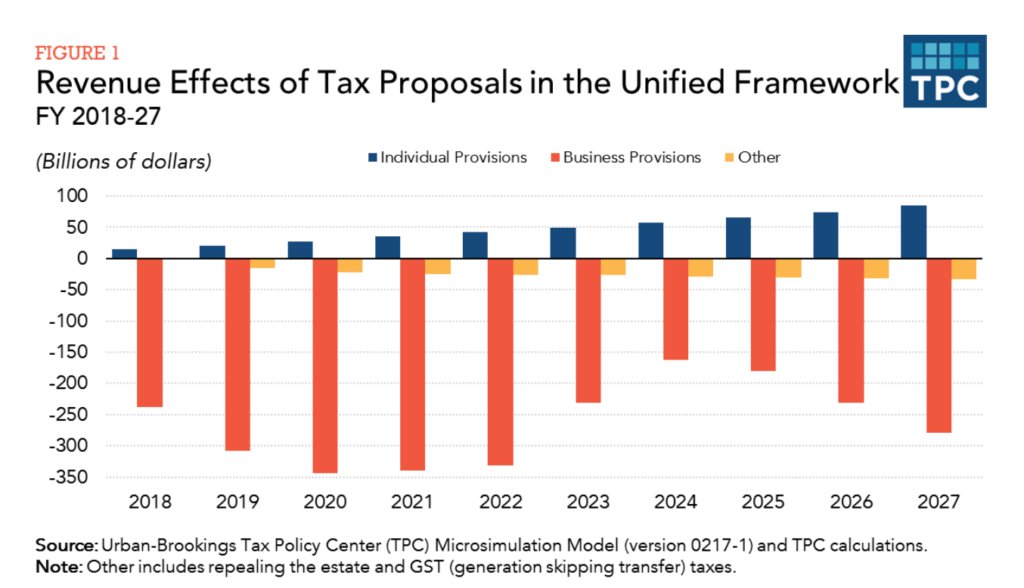

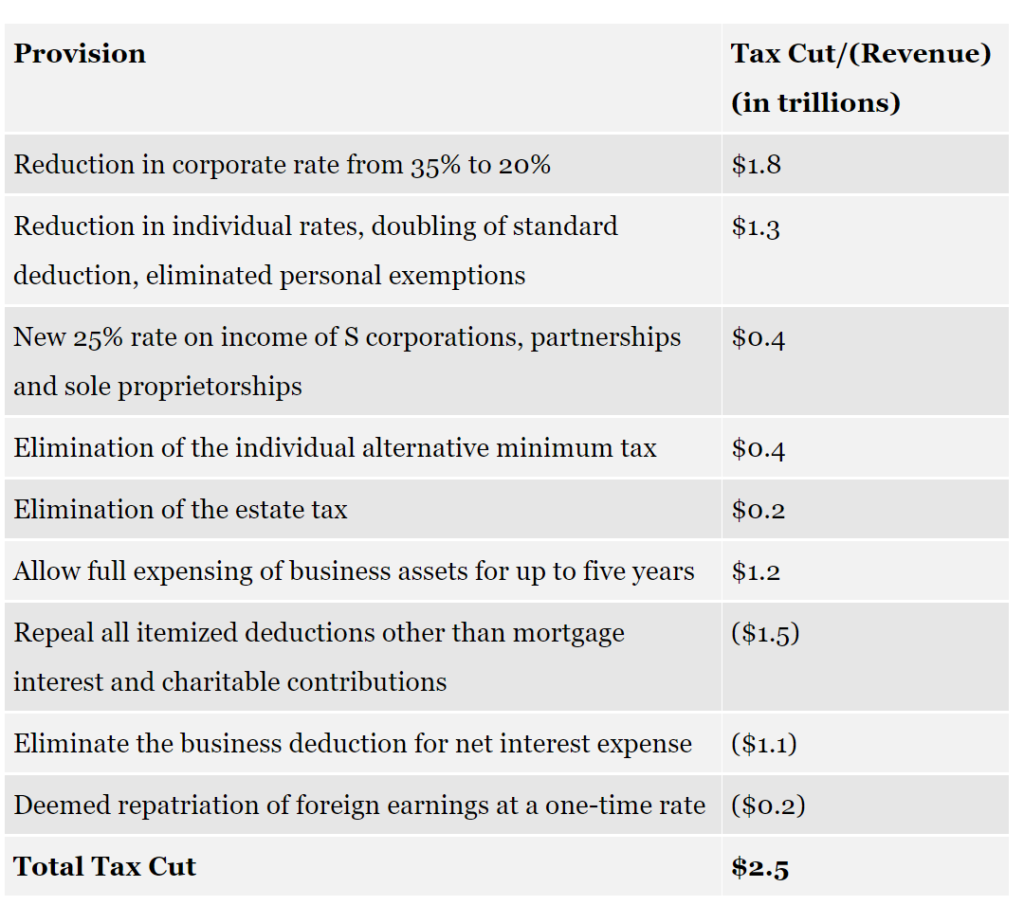

While individuals on the whole seem to benefit, the TPC goes one step beyond to examine the impact on the federal deficit. Their detailed display of net loss in revenue is eye-opening.

Does It Add Up?

In the same vein, Forbes’ Tony Nitti has another great article on the impact of the tax plan on the federal government. In it, he reconciles the revenues losses with revenue gains and doesn’t arrive at a pretty picture.

“Lies” x 10

If he were politically correct, the New York Times’ Paul Krugman would have titled his latest editorial “Misconceptions About the Tax Proposal”…instead, he titled it “Lies, Lies, Lies, Lies, Lies, Lies, Lies, Lies, Lies, Lies”. Regardless of your political leanings, it is worth reading through to see the common thoughts around this plan and at least one side of the discussion (just don’t read the 985 comments).

Wait and See

There are still plenty of details to hash out in this proposal (some as broad as defining what income levels might apply to the new tax brackets) but it will be interesting to see how this plays out. The appeal of fewer tax brackets, repeal of AMT, and elimination of the estate tax sound great on paper. But the impact to those paying high state taxes and/or have multiple children and deduct a mortgage are likely to be worse off. Forgive my pun, but it seems we’ll have to file an extension on our “wait and see” approach.