How to Save $9 Million on a Legal Secretary’s Salary

Sylvia Bloom started in 1947 as a legal secretary and finished as a legal secretary, 67 years later

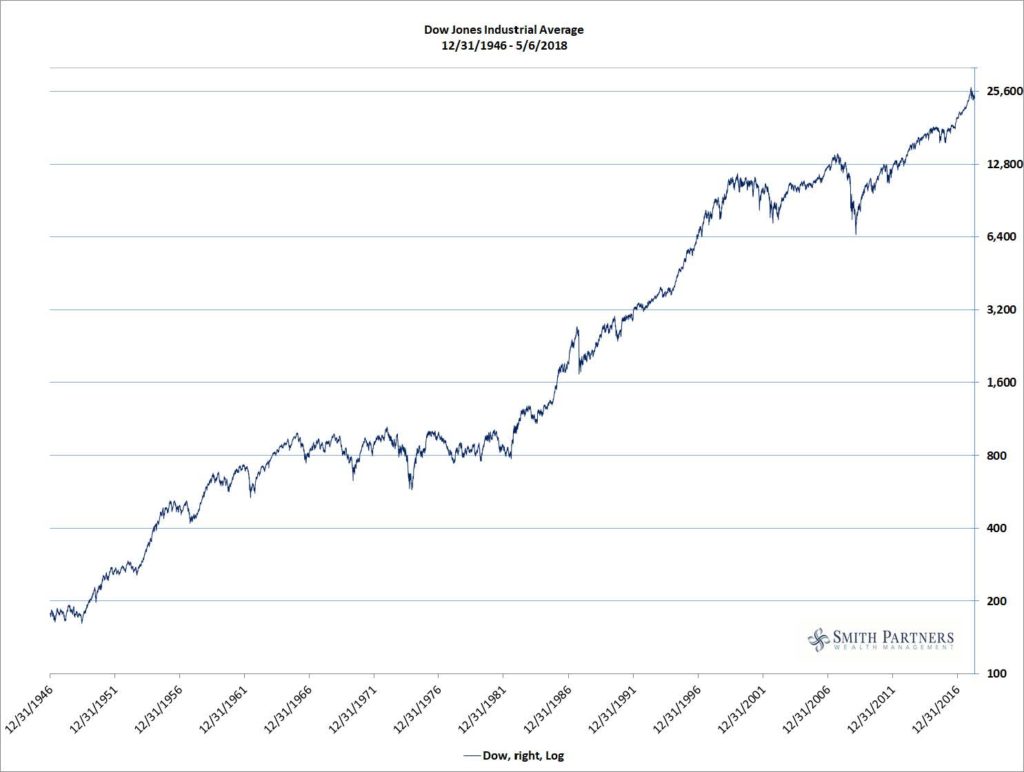

Sylvia Bloom was born in Brooklyn in 1917, the daughter of Eastern European immigrants and a child of the 1929 Depression. She attended New York public schools and graduated from high school. She worked days to attend Hunter College at night and graduated in 1945. In 1947, she went to work as a legal secretary for six law partners at the fledgling law firm of Cleary, Gottlieb, Friendly, & Cox. In those days, gas sold for 23¢ a gallon, the average wage was $3,130 per year and the Dow Jones Industrial Average was 177. For a look at the 1946 Cleary, Gottlieb, click here.

Did you follow me?

![By Gottscho-Schleisner Inc., photographer [Public domain], <a href="https://commons.wikimedia.org/wiki/File:NY_stock_exchange_gsc_5a30622.jpg">via Wikimedia Commons</a>](https://smithpartnerswealth.com/wp-content/uploads/2018/05/NY_stock_exchange_gsc_5a30622-283x300.jpg)

Taking the train to work

Known for thriftiness, Ms. Bloom rode the train to work and walked the distance from the train station to her law office at One Liberty Plaza, across the street from what became, nineteen years later, the World Trade Center. From the pre-construction demolition of thirteen square blocks beginning on March 21, 1966, to the Ribbon Cutting on April 4, 1973, imagine seeing the 1,785 daily construction “instalments” through the eyes of Ms. Sylvia Bloom. Then, at each day’s end, she retraced her path to the same apartment she lived in for 50 years. Along the way, she mt and married a husband, a retired New York City Fireman turned schoolteacher and part-time pharmacist; hard workers, both. On September 11, 2001, she rode the train to work as usual. Before the coffee pot was hot, Ms. Bloom saw one commercial aircraft, followed by a second, dive-bomb the World Trade Center’s Twin Towers. In the horror of that moment, she fled Fleeing North on foot (nothing is South but the confluence of the East River and the Hudson River) and sought shelter. After catching her breath, she walked eight blocks North, turned South West and then walked across the Brooklyn Bridge (about 1.3 miles on foot, in all), before setting foot in Brooklyn. Thrifty Sylvia Bloom, then 84 years old, rode home on a city bus.

Regret redeemed

In Corey Kilgannon‘s fascinating article of 5/6/2018 (@CoreyKilgannon), The New York Times featured Ms. Sylvia Bloom in its, 96-Year-Old Secretary Quietly Amasses Fortune, Then Donates $8.2 Million. The skeptic in me wanted to know two things: 1) how did she do it? and 2) how hard would it be to repeat this, on a secretary’s salary, if one started today. So, I did got out my history books and did the math. In 1947, there were only 22 mutual funds on the New York Stock Exchange with 10-year track records. I chose four stalwart funds, and zeroed in on the one with the smallest 70-year track record; I wondered, would its rate of return do the trick? I plugged the historical numbers in my calculator: 70 year term, save 10% of after tax pay month in and month out, at the 70-year rate of return of the fund with the smallest track record, would that have produced $9 million? Yes. This left me wondering, if a person on a legal secretary’s salary did this, why isn’t everyone? A look at the historical landscape of the last 70 years shows countless reasons investors became overly concerned and sold out; history’s path is literally dotted with wars, panics, assassinations, impeachments, recessions, military coups and even most severe financial meltdown since 1929. The difference is, Ms. Bloom stood firm through every single panic. She never sold out. And Ms. Bloom never, told anyone she was saving and investing. It wasn’t important to her that others know she had money.

Investor behavior beats investment behavior

Ninety-five percent of long-term performance is investor behavior, not investment behavior. Ms. Bloom proved this through good times and bad. Her consistency in living within her means and her persistence in saving and keeping invested were the difference makers. How many scholarships to deserving underprivileged students do you suppose Ms. Bloom seeded with her $9 million?

Addenda

Below is a chart of the Dow Jones Industrial Average from January 1, 1947 through May 6, 2018, the date her bequests were made public. I counted 25 downturns, about one every three years, strong enough to shake investors out. But not Ms. Bloom.