Should I Refinance My Home?

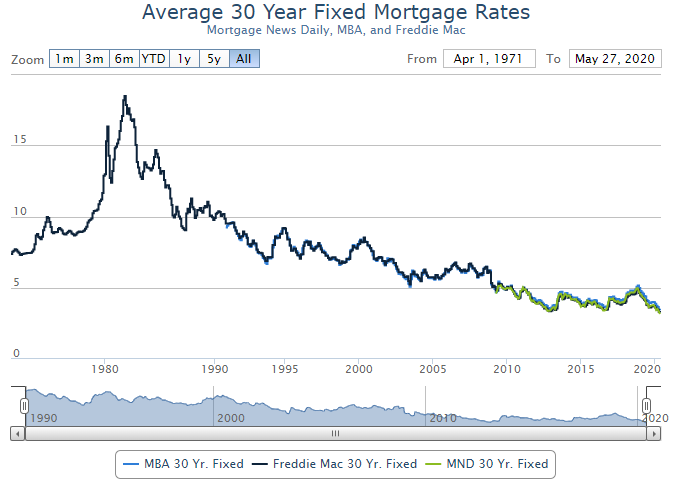

In case you haven’t heard, mortgage rates are the lowest they have ever been. The chart below shows average mortgage rates over the past 49 years, from 1971 to 2020. Currently, the 30-year mortgage has an average rate of 3.17%.

You can view the chart above and edit the timeline yourself in order to see how rates have changed over time.

In our current low rate environment, two questions arise. Should I refinance? And if so, should I choose a 30-year or a 15-year mortgage? Below, I’ll take you through the basic thought process, investment breakeven points you probably didn’t know, and my own home refinance just six months after I bought my home.

Does Refinancing Make Sense?

First, we’ll look at how many months it will take to breakeven on refinancing costs. We must know the closing costs of the mortgage and divide that by how much we can save monthly (closing costs / monthly savings = breakeven months). For example, if closing costs are $2,500 and you can save $150 per month (without changing the term) then you will divide $2,500/$150 to arrive at 16.67 months. If you plan on staying in your home for less than 16 months, then refinancing wouldn’t be beneficial for you. If you plan on staying for longer than the breakeven, then a refinance could be a consideration.

Should I choose a 15-year or 30-year Mortgage?

The first thing to consider is if you can afford a 15-year mortgage. We suggest that a mortgage shouldn’t account for more than 30% of your net monthly income and your total debt payments shouldn’t be greater than 40% of your net monthly income. This means you should account for student loans, credit card debt, and auto loans when calculating your total debt payment percentage.

Assuming you can afford a 15-year mortgage, then what’s the difference between a 15-year and a 30-year? The main difference is that a 15-year commonly has around a .50% lower interest rate, but will carry a higher monthly payment. The 15-year mortgage can be emotionally freeing to know you are paying down your home faster, but it can also account for a large portion of your monthly income. The 30-year mortgage provides greater monthly flexibility in the case of a job loss or income reduction but will take longer to pay down and could cost more in the long run. This is a decision that should be made within the context of a greater financial plan.

Assuming I Want a 15-Year, Should I Instead Get a 30-year & Invest the Difference?

Let’s assume that I’m refinancing at 45 years-old and would like to be done with my mortgage by my age 60 retirement goal. In order to pay off my mortgage by retirement, the 15-year seems best for me, so I lock-in a 3.00% rate on a $400,000 loan, with a $2,762 monthly payment.

But, before I sign the documents and pay closing costs I want to consider if I would be better off with a 30-year mortgage at 3.5% interest, which carries a much lower $1,796 monthly payment. This would allow me to save nearly $1,000 per month ($2,762 – $1,796 = $966) that I could invest in a side-fund and still pay off the mortgage at year 15, with my side fund savings + investment earnings.

The mistake we typically see is people thinking that if they choose the 30-year and can earn a return greater than the cost of their loan (3.50%) with their $966/month savings, then they’ll be better off than if they locked in the 15-year. However, the answer below may surprise you as to what the break-even investment return actually is.

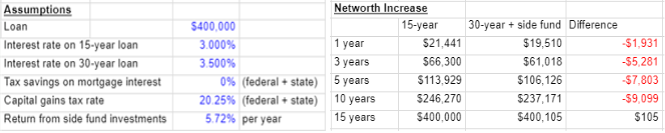

Example:

Option 1: 15-year mortgage / 3.00% interest rate / $2,762 monthly payment

Option 2: 30-year mortgage / 3.50% interest rate / $1,796 monthly payment + $966 monthly side fund deposit

Loan Amount: $400,000

Taxes: We assume a 15% long term capital gain rate + 5.25% state (NC) tax rate = 20.25%. We also assume the taxpayer uses the standard deduction rather than itemizing. After the TCJA (Tax Cuts and Jobs Act) 88% of American Households use the standard deduction.

As you can see from the chart above, not only would you need the discipline to save the extra $966/month, but you would need to earn a guaranteed 5.72% side fund return for your net-worth to be higher with Option 2. If you want to learn more about why you need this 5.72% return, then I highly recommend reading more about the math and thought process in this blog, “Effectiveness of “Borrow 30-Year and Invest The Difference”, there is also a link to an excel spreadsheet that will break down the math, within that blog.

This scenario assumes we are only worried about net-worth at year 15, which shows that a 5.72% return on the side fund would break even in year 15. However, if you want your net-worth to be greater by the 10-year mark you would need a 7.11% guaranteed return and the 5-year mark would require an 11.38% guaranteed return. Those are high hurdles to “invest the difference.”

My Experience

I purchased a home in Greensboro in December of 2018 and was happy with my then-competitive rate of 4.50% on a 30-year loan. But less than a year later, rates had dropped to 3.25% on a 30-year and 2.75% on a 15-year. After running the numbers, I decided to refinance and shorten my loan term to a 15-year mortgage.

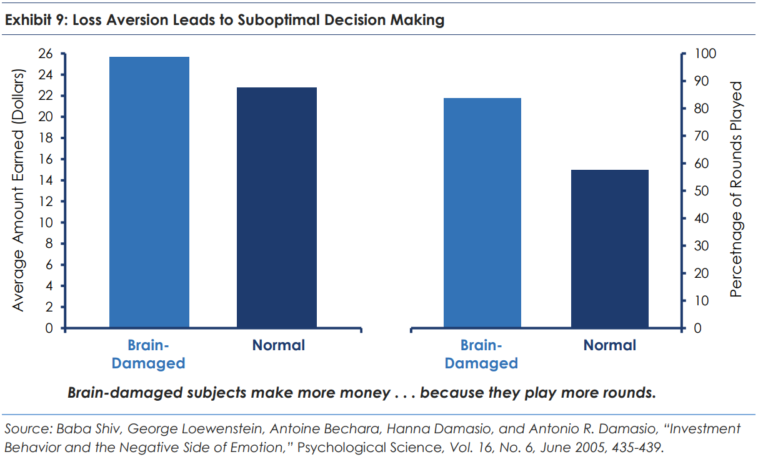

Even after my monthly payment increased by $355 per month, I will save over $135,540 in interest payments. While I could have refinanced to a 30-year and created my own side fund with the monthly savings, I prefer the forced savings of the 15-year. We believe 80% of financial success is behavioral and given the choice of automating a large savings vehicle to remove possible bad behavior, I accepted the less flexible option.

Get The Big Things Right

I like the idea of getting big financial decisions right and having more flexibility with small things. The type and size of mortgage you select is one of the biggest financial decisions in your life. So take your time, compare all the known variables, and ensure you get the best option for your scenario. If you would like to discuss a specific case, then feel free to call or email us.