How to Calculate and Maximize Your Social Security Benefit

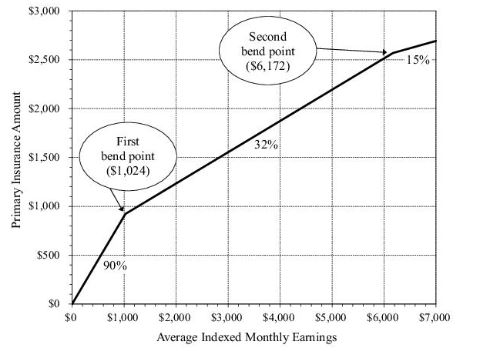

The current maximum monthly benefit from social security is $4,555/mo or $54,660/yr. If you purchase this much cash flow as an annuity in the public market, it would be worth $1.3 – $1.5 million. Because of this considerable value, it is worth understanding how to maximize both your monthly benefit/expected lifetime benefit, and how this…