Tax Bill Update and Resources

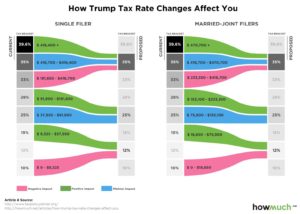

For better or worse, the Tax Cuts and Jobs Act (TCJA) has been signed into law. While it would be fun (is that the right word?) to explore the estimated impacts on our country and economy here, it would be more helpful to take some of our own advice and focus on the more certain impact to individuals and businesses.

Overall Summaries

For a great (and highly detailed) recap of the tax plan, look no further than Michael Kitces. For a more simplified summary, see this great recap by The Balance or the Forbes recap by Kelly Erb.

Highlighted Changes

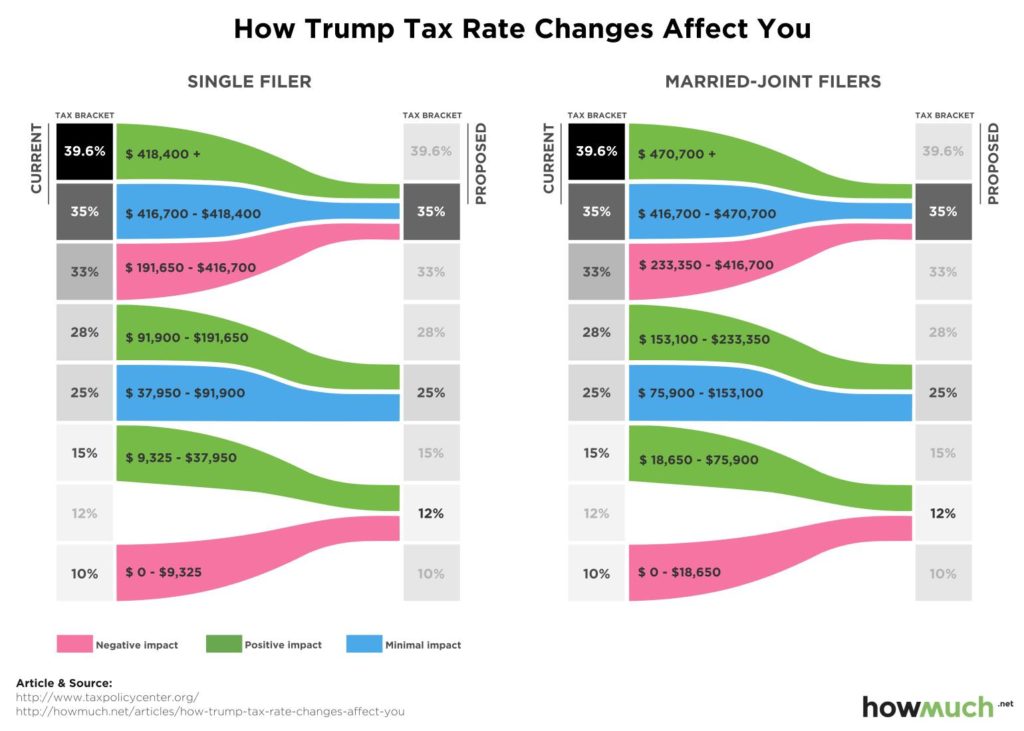

- Most people will have a lower income tax rate, some significantly. Of course, since taxes are far too

complicated to actually put on a postcard, each taxpayer’s situation will be different.

complicated to actually put on a postcard, each taxpayer’s situation will be different. - The TCJA doubles the standard tax deduction meaning that only 1 out of 20 taxpayers will be itemizing. The impact of this is far reaching (and is yet to be determined) for both individuals and impacted organizations.

- The estate tax exemption for couples moves to $22.4 million instead of $10.98 million in 2017.

- The Child tax credit expanded from $1,000 to $2,000 and the income phaseout increased to $200,000 for individuals and $400,000 for couples. Read more.

- 529 accounts can now be used for private K-12 schools (up to $10,000). More here.

- $10,000 State and Local Tax deduction limit combined with deduction changes. This could mean certain individuals should prepay 2018 property taxes (which might not be accepted and/or could be difficult with a mortgage that escrows for taxes.) More here.

- Elimination of the home equity line deduction. More here.

- The standard deduction for individuals will now be $12,000 instead of $6,350 and the standard deduction for couples will be $24,000 instead of $12,700. However Personal Exemptions are taken away which will effect each family differently.

- Qualified Business Income deduction of 20% for pass through entities (S corps, LLCs, sole proprietorship filing Schedule C and partnerships). This is one of the more complicated pieces of the bill and will keep CPAs busy. See the Kitces summary for more detail. The WSJ also has a (somewhat) simplified breakdown of how the tax bill impacts businesses here.

Charitable Giving as a Microcosm

As with any broad tax change, we will see some consequences. Of course, we never fully know if they will fall into the intended or unintended bucket. One change that we most care about is the impact on charities and charitable giving. Alan Cantor wrote a detailed explanation of how the new tax bill will likely impact giving (for instance, only 1 in 20 taxpayers will benefit from the old line “donations are tax deductible”) but also on the charities themselves (a large amount of funding comes from estate bequests trying to stay under the old $11 million dollar cap. What will happen now that it is $22 million?)If charitable giving is important to you (or you just want a picture of how these tax changes can have a butterfly’s wings flapping effect), read Alan’s post.