Quarter in Charts – Q3 2020

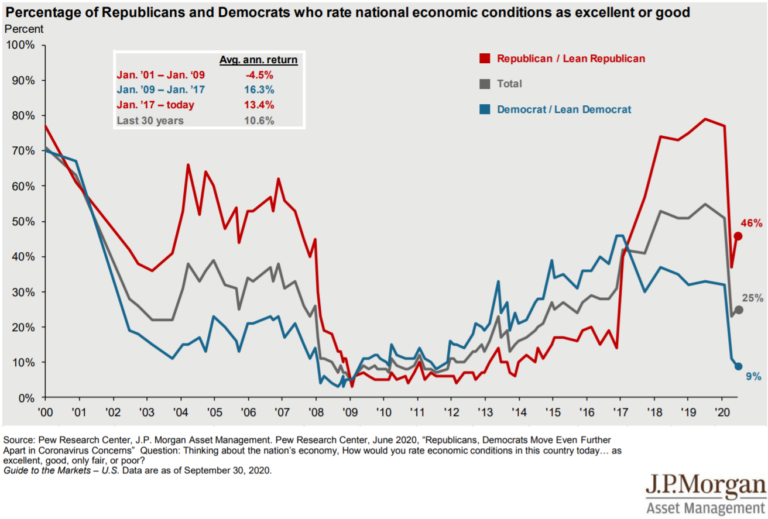

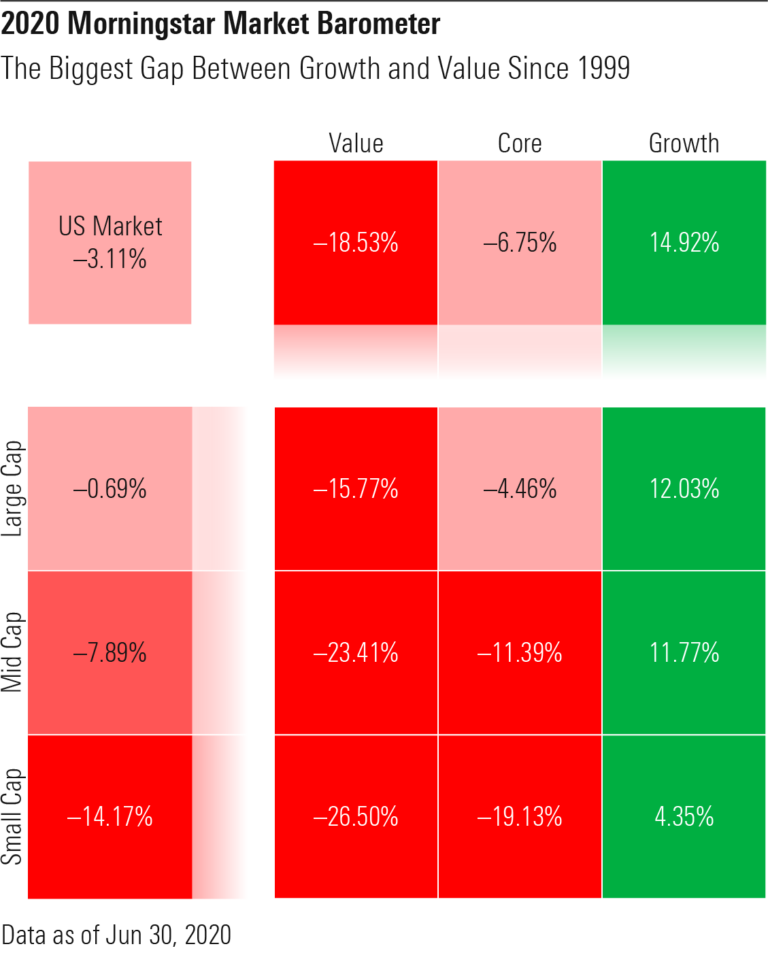

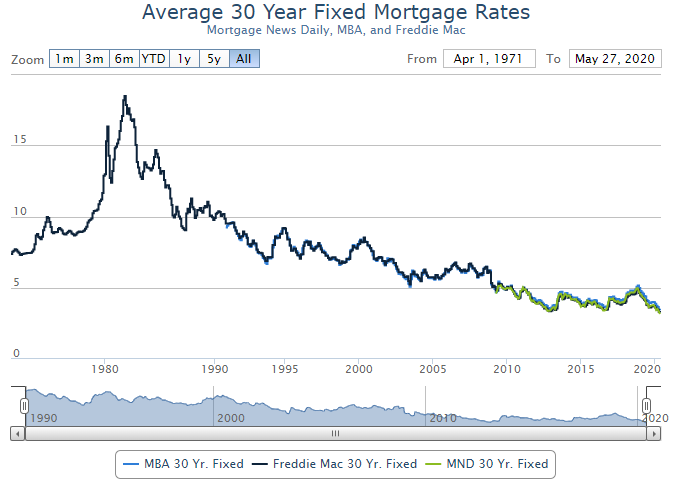

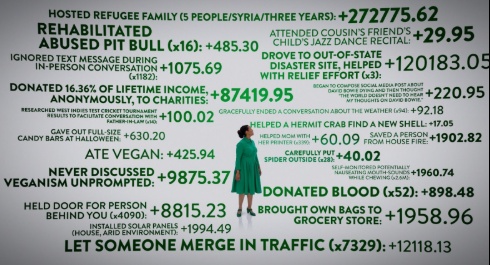

COVID-19 Still Hits Hard “What a year this week has been.” That was the response I got from a friend when I asked him how things were going. And it is probably what most of us have felt as we process COVID-19, the economy, elections, and the market on top of managing work, family, school,…