How to Calculate and Maximize Your Social Security Benefit

The current maximum monthly benefit from social security is $4,555/mo or $54,660/yr. If you purchase this much cash flow as an annuity in the public market, it would be worth $1.3 – $1.5 million. Because of this considerable value, it is worth understanding how to maximize both your monthly benefit/expected lifetime benefit, and how this impacts the overall success of your financial plan.

How Social Security Benefits are Calculated

The Social Security Administration calculates your benefit using Average Indexed Monthly Earnings (AIME) and Primary Insurance Amounts (PIA). AIME is the sum of an individual’s top 35 years of earnings history. If that amount is $2.1 Million, we divide $2.1 million by 420 months (35 years * 12 months) for a $5,000 AIME. Note that this average excludes income above Social Security’s maximum taxable earnings. The maximum taxable earnings for 2023 is $160,200. If you earned $500,000 in 2023, only the first $160,200 would be taxed and counted toward your AIME.

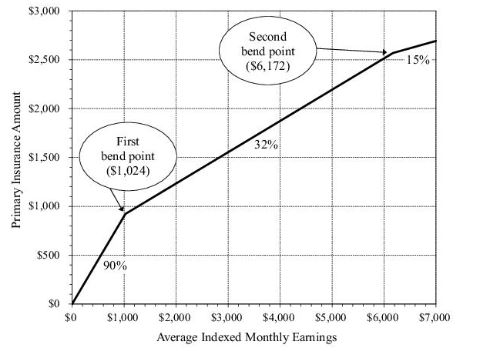

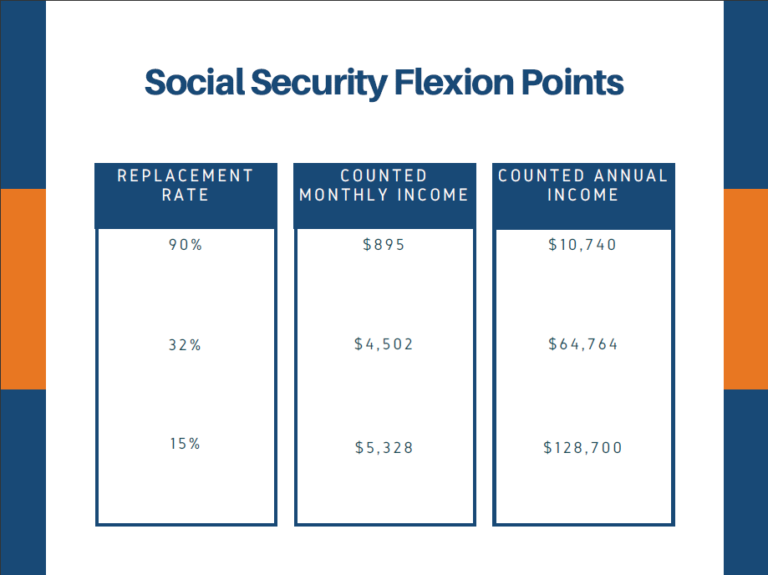

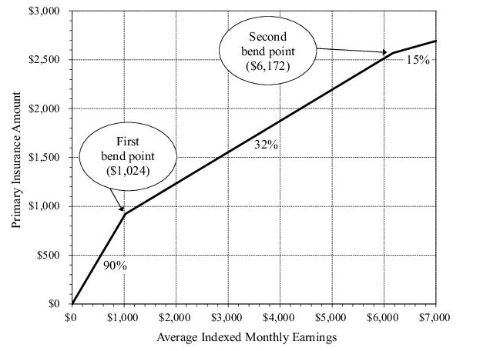

Once we know our Average Indexed Monthly Earnings, we can calculate our Primary Insurance Amount (our social security benefit at Full Retirement Age.) The Social Security Administration utilizes “Bend Points” to provide a proportionally higher benefit for recipients with lower lifetime earnings. This process is similar to how the IRS uses marginal tax rates to collect a higher tax on the last $1,000 that someone earns and essentially zero tax on the first $1,000 earned.

Social Security recipients receive a payment equal to 90% replacement of their first $1,024 of lifetime monthly income but only receive 32% of their eligible AIME from $1,024 to $6,172. The replacement drops off even more for AIME of $6,172 and above. These bend points are adjusted annually for inflation.

Using the PIA chart above, we then use an AIME of $5,000 to calculate the benefit:

$1,024 * 90% = $921.60

$3,976 * 32% = $1,272.32

In this example, the Total Monthly Benefit at Full Retirement Age would be $2,193.92/mo or $26,327.04/yr.

The Impact of Starting Age on Social Security Benefits

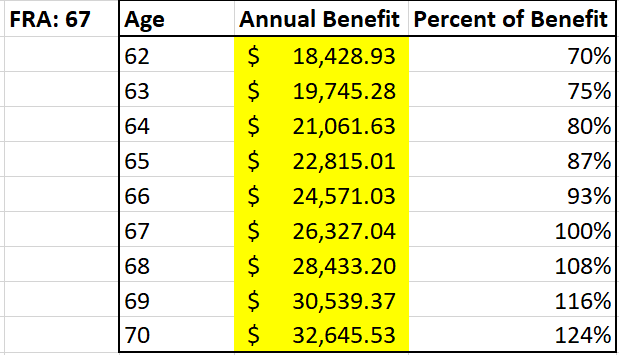

What happens if you start drawing your social security benefits before FRA or after FRA? For illustration purposes, we assume that you were born after 1960 and your FRA is 67 years old, and you have a PIA of $26,327.04/yr.

We can see below how the same $26,327 annual benefit would drop to $18,428 at 62 and jump to $32,645 at age 70.

Earned Income While Taking Social Security

Many people believe that if they work while receiving social security, they will forfeit a portion of their benefits. That’s not entirely true. Delays to social security benefits occur if you have earned income while receiving a benefit before FRA (age 67). Every two dollars you make over $19,560, your social security benefit is reduced by one dollar. If it’s the year you turn FRA, but you have yet to hit 67, your benefit decreases by one dollar for every three dollars you earn over $51,960.

However, these reductions are temporary. Your withheld social security benefits are delayed until your income drops or you reach FRA. And once you hit FRA, these reduced benefits will be paid back to you over your lifetime by means of an increased monthly benefit.

However, delayed benefits aren’t the most significant risk when receiving social security while working. If someone can delay social security benefits until they retire but chooses to take them while they are working, they face a potentially unnecessary tax on a portion of their social security benefits and have the possibility of paying high marginal tax rates on those benefits. While each person’s situation is different and should be individually analyzed, this scenario could be avoided by simply delaying social security benefits until income drops off in retirement. You can read more about social security taxation HERE.

How To Increase Your Lifetime Benefit

- Earn More: While much easier said than done, your benefit will increase if you have higher average earnings up to the maximum earnings threshold. Remember that the social security income tax limit is currently capped at $160,200.

- Delay Social Security: As discussed above, your social security benefit will increase every year you delay.

- Consider Life Circumstances: You should account for life expectancy, the age difference between spouses, pension or annuity differences between spouses, life insurance availability, and possible inheritance details. For instance, if I am single and have a shortened life expectancy, I would likely increase my total lifetime benefit by taking social security sooner.

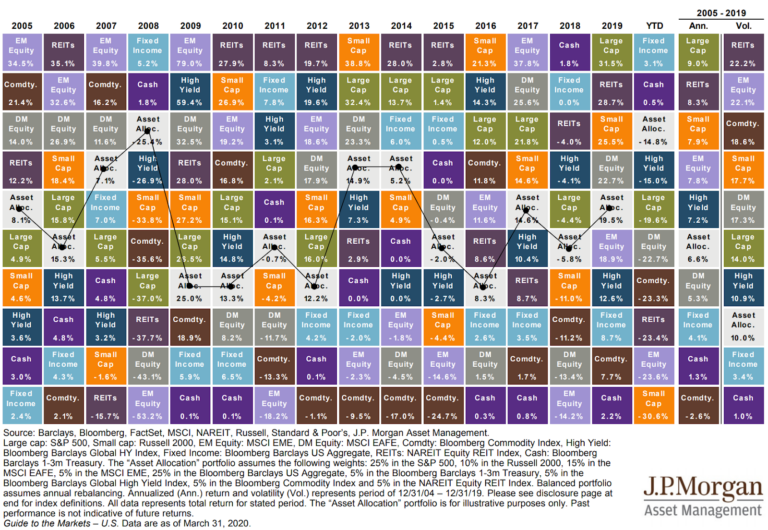

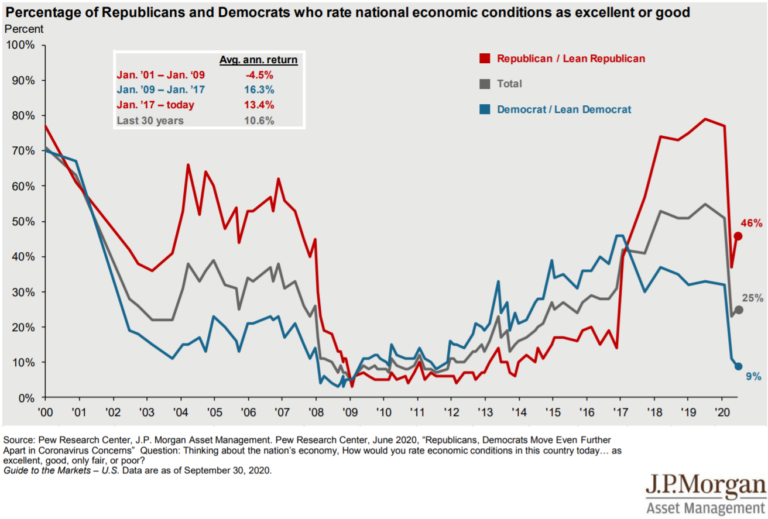

- Account for Opportunity Cost: If you expect future investment returns to be high, it could be advantageous to start withdrawing from your social security so you can invest these funds and grow them. However, if you expect future returns to be low, it could make sense to delay social security so it can continue growing at its guaranteed rate.

What Now?

Social security benefits planning is complex because we will never know (with 100% certainty) how to maximize our lifetime benefits. For example, one client stated their primary goal as “I want to get back as much as possible from what I’ve paid into social security.”

That goal sounds logical, but we’re missing one critical data point: how long would the client live? If he lived to 100, the best way to maximize his lifetime benefit would likely be to delay filing until 70 and collect his maximum amount for 30 years. Take that Social Security Actuaries! However, if he died before age 71, he would want to file as early as possible at age 62.

Rather than asking, “How can I maximize my lifetime social security benefit?” we think the better question is, “How can I utilize my social security benefit to maximize my financial plan’s probability of success?” Sometimes those answers are the same. But often, the answer gets more complicated once we account for current expenses, spousal benefits, pensions, life insurance, spending patterns, market fluctuations, and emotions. If you have questions regarding your plan, please give us a call to discuss the best decision for you.