Kids & Money – Greenlight: A Solution to Help Kids Save, Spend, Give & Invest

A couple of years ago, I wrote a blog post about how my wife and I are teaching our three kids about money. I covered the basic principles we’re trying to instill (Simplicity, Giving, Discipline, Compounding, Enjoyment, Responsibility, and Hard Work) and how those show up practically.

While we have loved teaching these principles, the user error made the system cumbersome (in this case, I’m the user.) Because the kids’ money was commingled with ours but we kept track of it in a separate budget app, I would have to manually update their spending, allowances, babysitting income, and monthly parent-paid investment returns.

You can imagine that when my wife, Millie, would call me from Target to ask how much money each kid had, absolutely nobody liked my “I’ll let you know tonight” answer.

Greenlight to the Rescue

So when I stumbled on a tweet by Aaron Klein (CEO of financial technology company Riskalyze) mentioning Greenlight, I was intrigued. I figured for $5/mo I’d be willing to try it out and signed up immediately:

Just set up our kids on Greenlight! They each get their own debit cards and we automated giving, saving, chores and allowance. Fintech is so cool. ?❤️ https://t.co/U0XTIK3A2q pic.twitter.com/ijBmHnXzKN

— Aaron Klein (@AaronKlein) May 3, 2020

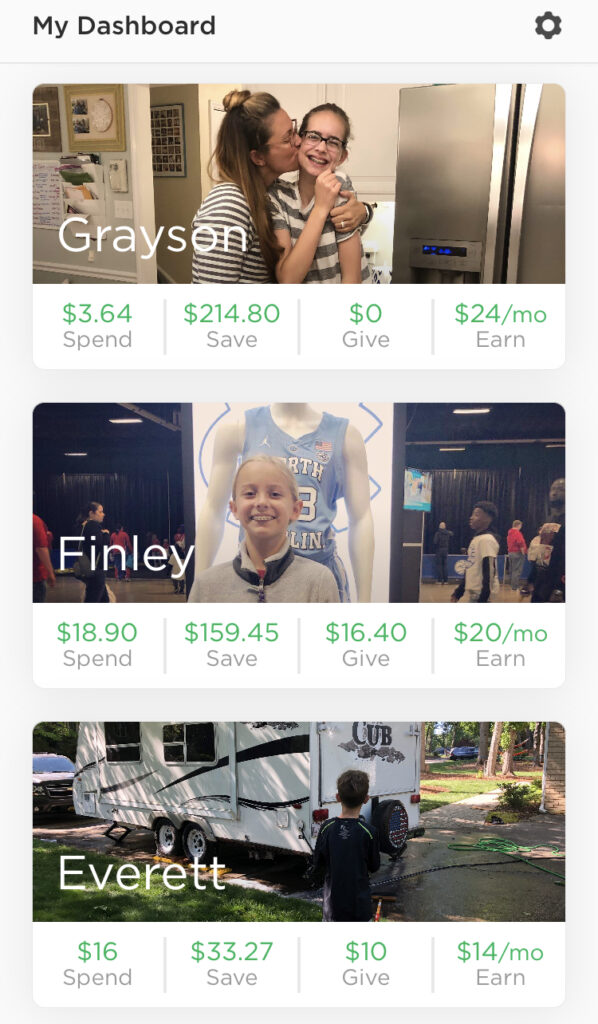

Thankfully, Greenlight fits all of the principles we’re trying to teach into a simple platform. At its core, Greenlight establishes a parent “Wallet” account and then separate bank accounts for each kid with accompanying “smart” debit cards. The app allows for different “buckets” within each kids’ account and additional parental controls.

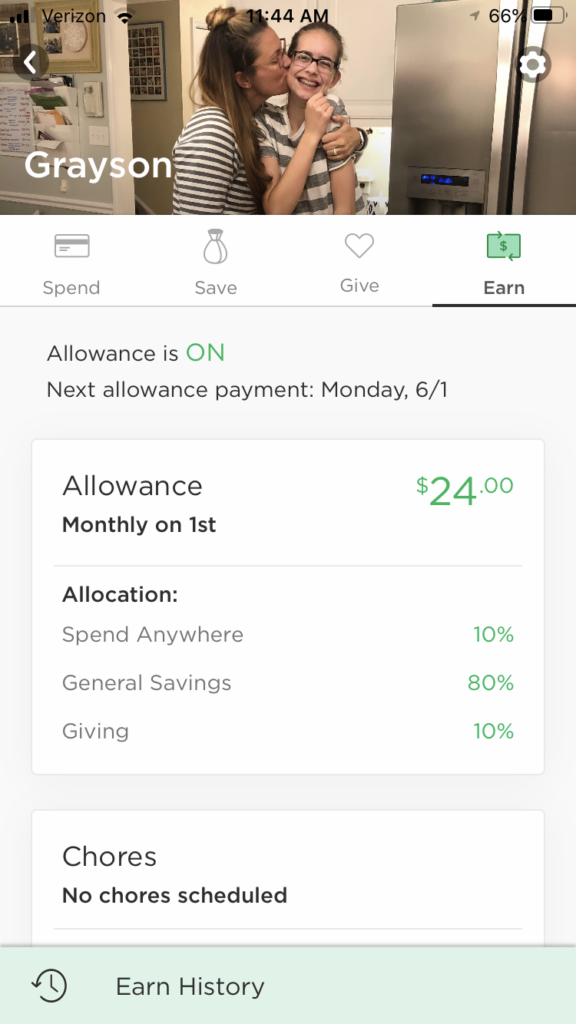

Within each kids’ account, they have the choice to keep money in the Spend, Save, or Give buckets, and to also see their Earnings from chores and allowances. I’ll go into more detail below, but first a short summary video from the kids in question.

Note: While all of this could read a lot like an endorsement, it isn’t. Greenlight lines up well with how our family thinks about money, but it probably isn’t the only (or even the best) tool to use for your family. It should go without saying, but Smith Partners is in no way related or compensated by Greenlight. I won’t even let my 12 year old daughter earn the $10 referral fee for sending it to her friends…and her response to me is 100% 12 year old 😉

Spend

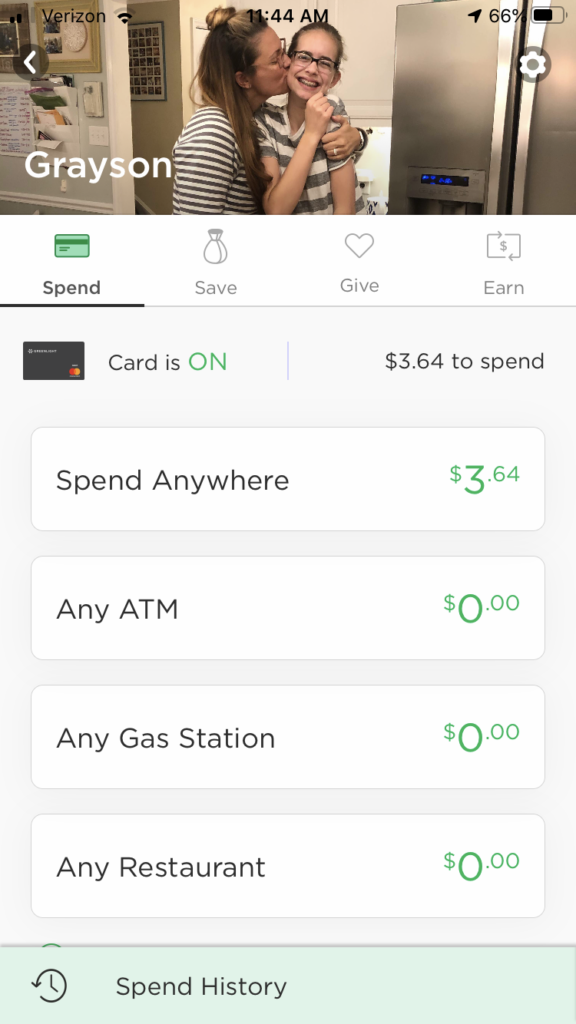

With Greenlight, kids can only spend money that is in their Spend bucket (ie if there isn’t enough money in “Spend”, then a parent can do a simple in-App transfer from “Save” to “Spend”.)

In our family, we have a policy where our kids need to give us a three-week “heads up” if they wish to move money from their “Save” bucket (where they earn 12% parent-paid interest) to their Spend bucket (from which they may freely spend, but on which they earn 0% interest.) This is the “cool down” period I referenced in my prior blog post.

This is why you’ll see that our “spenders” Finley and Everett like to keep a little bit of spending money handy, but our “saver” Grayson likes to run lean so that she earns more on her Save dollars.

Logistically, each kid has their own debit card (which stays in Millie’s pocketbook) linked only to their Spend and Give buckets. If they want to buy something online or in a store, they can check out with their own debit card. However, if one of the kids wants to tack on a $10 Lego set onto my existing $200 Lego Land Rover order, I can use my credit card for the whole purchase and then in the Greenlight app, I can move $10 from Everett’s Spend to the Parent Wallet and we’re whole.

Save

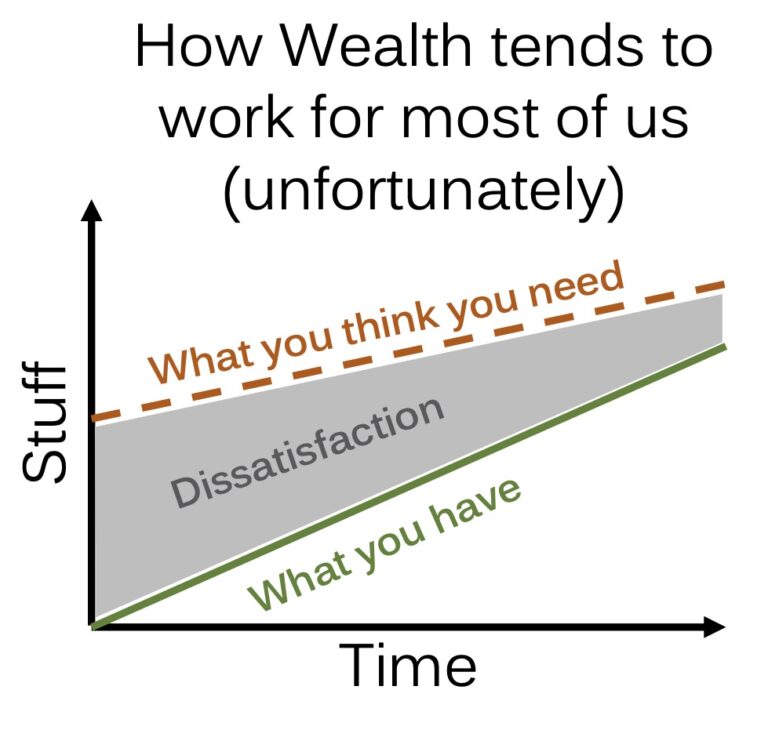

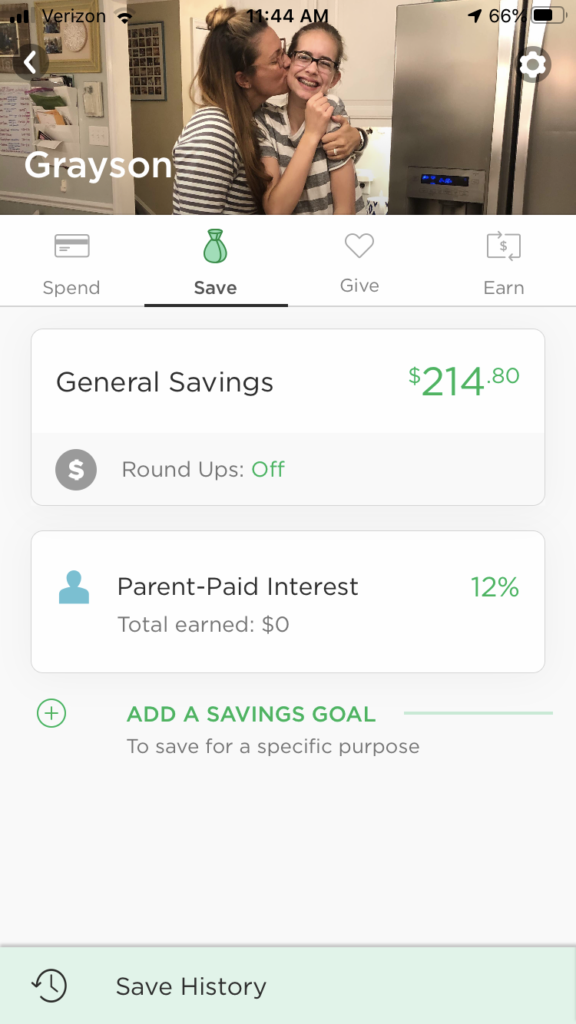

My favorite feature of our prior budgeting attempt was the “Bank of Mom and Dad.” I wanted to teach the kids about the power of compounding, but I wanted to keep the lesson simple…sadly, it wasn’t.

But with Greenlight, I have the option to select the parent-paid interest rate which Greenlight automatically pays (transfers) from the Parent Wallet to the Kid Wallet based on the dollars in their Save bucket.

Millie and I settled on a ridiculously high guaranteed 12% return per year (1% per month) because we want to reward saving, even if I’ll have to temper the kids’ expectations on future interest returns. Greenlight also lets the kids create custom savings goals (with the same parent-paid interest along the way) and see their progress toward their goals.

Give

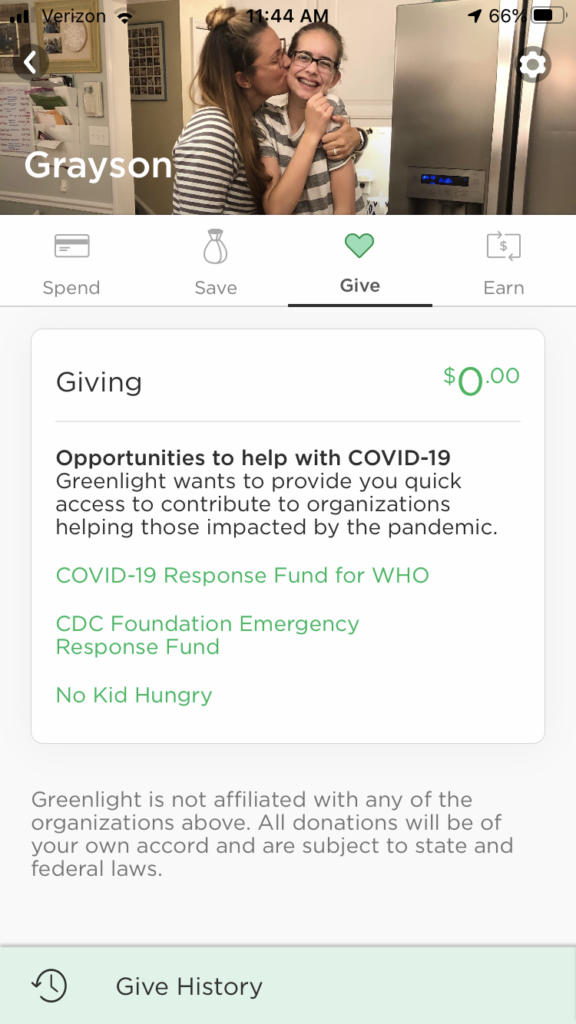

We encourage (but don’t require) our kids to give 10% of their earnings to charities and causes about which they are passionate; whether that is the homeless friend outside the Chick-Fil-A or our church.

Thanks to Greenlight, giving has taken on a new level of meaning. Grayson saw an ad for No Kid Hungry and immediately wanted to make a donation. She went to the site, punched in $25, entered her own Greenlight debit card information, and received the email confirmation (addressed to her own email) in seconds. She’s been giving money away for years, but she said this was the first time that it seemed to really feel like “her” gift.

Earn (Chores/Allowances)

For allowances, Greenlight will automatically move money from our Parent Wallet (money we’ve deposited to Greenlight that hasn’t yet been allocated to a kids’ account) or from our bank account. Each kid can choose how they want their allowance allocated among their Spend, Save, and Give buckets.

Parents can also easily change, pause, or only pay an allowance once a kid has completed a defined list of chores (we’ve had to pause allowances in the past when a kid didn’t finish their expected chores as we asked.)

When Grayson sells a piece of her artwork or babysits, she hands me the cash or I receive the Venmo payment, then I move the money from the Parent Wallet to one of her buckets.

Balancing It All

Greenlight also has a few features and controls that could be helpful, such as rounding up spend transactions (to deposit extra money to save), limits on cashback from stores and ATMs, and limits on buying from certain stores. You can find out more about Greenlights features and protections on their website.

While I love the idea of piggy banks and jars, we found that when our kids held on to paper money, they were much more inclined to spend it. But, when we moved to virtual accounts (Dad’s Excel worksheets), that imposed a healthy distance between them and their money, but it was way too much to keep up with. For our family, the Greenlight app has been a great solution that balances what is important for our family – we can give freedom with controls, easy access with healthy distance, and flexibility while keeping things fun and simple.