Market Commentary Q4 – 2016

“Look at me, look at me, I am the Captain Now!”

On Election Eve, pollsters predicted Donald Trump’s probabilities of winning at around 12%. By Election night, the world experienced a low probability, high impact event. As Mr. Trump neared 270 Electoral College votes, investors flew to safety: bond prices soared, the dollar sank, and the Dow Jones futures market skidded 800 points. Justin, who had fallen asleep on his couch watching the results, happened to wake up around 3:00 a.m. just about the time Mr. Trump was delivering his acceptance speech. Seeing the futures market downturn, he set his alarm to get into the office early to see if we could rebalance any cash into asset classes that were “on sale.”

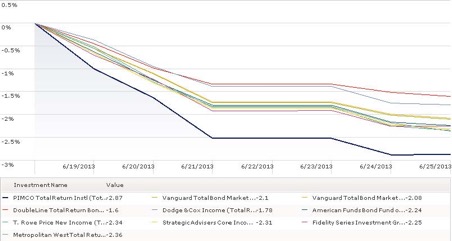

However, by the time the markets opened, we saw a much different picture. Sometime following Mr. Trump’s acceptance speech, huge inflows of capital tipped the scales in the opposite direction.

The then-slumped dollar reversed course and surged to levels not seen in 13 years. The U.S. markets actually opened higher and, by close of trading November 9, the Dow had risen 1,100 points from its eight-hour earlier low. There’s no real way to know what turned the tide or how long it would/will last. Remember, this is the same 2016 in which the U.S. stock market holds the singular distinction of the worst start in recorded history, losing 6% in the first five trading days.

For us, this behavior reinforced two things we believe about financial markets: they are inefficient and at the same time wildly unpredictable. The market is, at its core, a collection of guesses. While complex algorithms and trading systems can wrap those guesses in a warm blanket and call them “predictions” or “estimates,” they are still on par with meteorologists and (now) election forecasters. Inefficiencies like this are what lure investors into thinking they can outsmart the market.

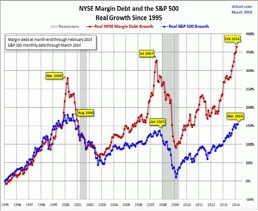

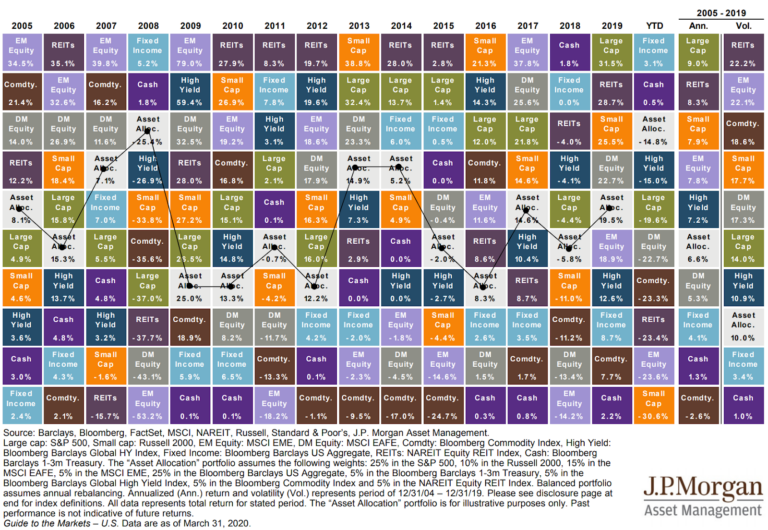

It made me think back to the movie, Captain Phillips. Standing on the bridge of the MV Maersk Alabama, Somali Pirate Abduwali Muse (Barkhad Abdi) takes Captain Phillips (Tom Hanks) hostage at gunpoint and announces an unmistakable and major change, “Look at me, look at me, I am the Captain now!” Over the long term, we believe that stock and bond markets are on a charted course for positive returns. As shown in the chart to the right, they have been for the last 100+ years, and we believe, will continue. It’s like a cargo ship with an autopilot that can’t be dismantled, but can be temporarily overridden by new “captains.” These captains can take a ship off course one way (real estate boom of the mid-2000s) and then the same captains can overcorrect and take the ship wildly in the other directly (financial crisis of the 2008-09.) The point is, if returns have been far above or below their rational, historical return levels, the ship will eventually correct course (revert to the mean). While there are no guaranteed courses, the “waters” from which we start have a big impact on the course we often take.

This begs the question: are we off course and, if so, by how much? Reviewing 22 elections from 1928 to 2012, math says we can expect a range of +6.6% to -5.4% 30 days after an election, thus an 8% gain after an election is an outlier. As we mentioned in our prior commentary, we believe that our current coordinates (P/E ratio, earnings growth, dividends, and prevailing interest rate) give us a good picture of where the “autopilot” might take us, but there is no way to predict the timing or impact of the next new “captain.”

Another helpful coordinate is the chart below illustrating the smoothed U.S. Recession Probabilities Index versus the Wilshire 5000 Total Market Full Cap Index. Stocks go down for reasons other than recessions and rarely does it pay to take “should I sell” cues from Wall Street Indexes and the talking heads. Mark Skousen, in The Perseverance of Paul Samuelson’s Economics, wrote, “To prove that Wall Street is an early omen of movements still to come in GNP, commentators quote economic studies alleging that market downturns predicted four out of the last five recessions. That is an understatement. Wall Street indexes predicted nine out of the last five recessions! And its mistakes were beauties.” Conversely, the latest Recession Probability reading from the St. Louis Federal Reserve Bank on October 1, 2016 was ½ of 1%. While you can see this metric spikes upward quickly, we’re safely outside of the chances of a recession for now.

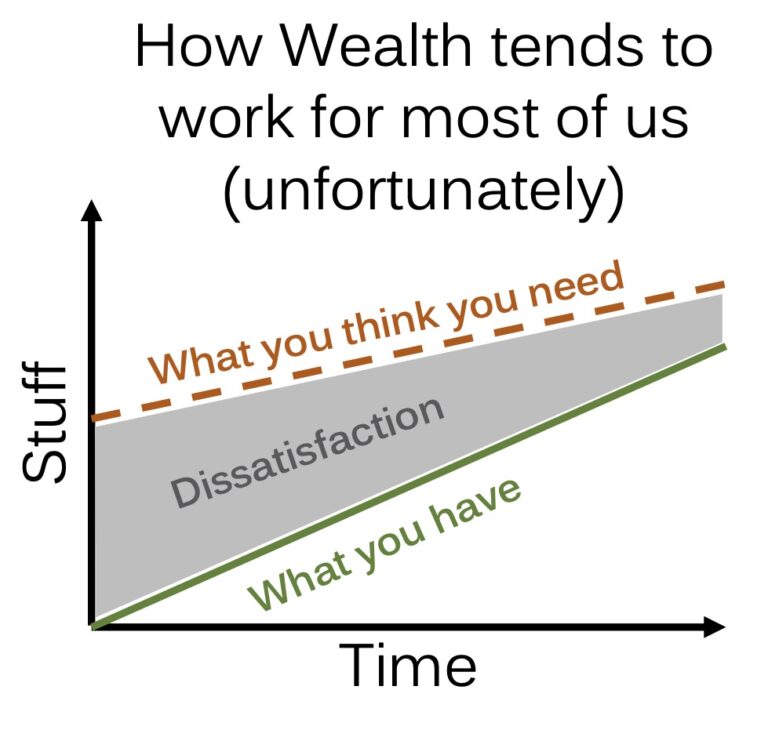

According to Google Trends, “should I sell” appeared in internet search terms more times on January 5, 2017 than any other time in the past 13 years. We believe people are really asking “what are my coordinates and where is this ship going?” In our work, these questions matter greatly. But they matter more so when one faces a life event, such as a retirement, paying off a mortgage, sending a child or grandchild to college or buying a business. They also matter when one’s stomach for risk should be realigned with one’s investment timeline. Those are the most beneficial times to be considering if the current ship (or asset allocation) is the right one. Conversely, the panic-induced “should I sell” after a new captain is already on board and changing course is akin to jumping overboard. Rather, “should I rebalance and catch a slightly different ship?” is typically the more appropriate question.

According to Google Trends, “should I sell” appeared in internet search terms more times on January 5, 2017 than any other time in the past 13 years. We believe people are really asking “what are my coordinates and where is this ship going?” In our work, these questions matter greatly. But they matter more so when one faces a life event, such as a retirement, paying off a mortgage, sending a child or grandchild to college or buying a business. They also matter when one’s stomach for risk should be realigned with one’s investment timeline. Those are the most beneficial times to be considering if the current ship (or asset allocation) is the right one. Conversely, the panic-induced “should I sell” after a new captain is already on board and changing course is akin to jumping overboard. Rather, “should I rebalance and catch a slightly different ship?” is typically the more appropriate question.