On Market Volatility and What to Believe

“They were told where they belonged, and they acted accordingly.”

In his book, Predictably Irrational, Dan Ariely highlights how our understanding of our current situation impacts how we will behave in the future.

“One stereotype of Asian Americans, for instance, is that they are especially gifted in mathematics and science. A common stereotype of females is that they are weak in mathematics. This means that Asian American women could be influenced by both notions.

In fact, they are. In a remarkable experiment, Margaret Shin, Todd Pittinsky, and Nalini Ambady asked Asian-American women to take an objective math exam. But first, they divided the women into two groups. The women in one group were asked questions related to their gender. For example, they were asked their opinions and preferences regarding coed dorms, thereby priming their thoughts for gender-related issues. The women in the second group were asked questions related to their race. These questions referred to the languages they knew, the languages they spoke at home, and their family’s history in the United States, thereby priming the women’s thoughts for race-related issues.

The performance of the two groups differed in a way that matched the stereotypes of both women and Asian Americans. Those who had been reminded that they were women performed worse than those who had been reminded that they were Asian-American.”

I read Ariely’s book when it came out in 2010, but was reminded of it while reading Daniel Crosby’s

Where Do I Belong?

One of the problems with the financial media (and even our own blog posts) is that these articles can point out recent market events and provide perspective. However, no article or blog post can highlight what has happened in your specific financial plan. None can help you walk through “where you belong and how you should act accordingly.”

So, if you are a client of Smith Partners Wealth Management, was the recent market drop factored into your financial plan? In a few words: Yes (we expected it) and No (we did not predict it). As Morgan Housel wrote in his evergreen post “When Things Get Wild”:

“There are two ways to prepare for wild times: You can expect them to come, or you can predict when they’ll come. The former is realizing that throughout your career things will occasionally get wild (“Expect about two recessions per decade, on average.”) The latter is predicting that things will get wild at a specific time (“A recession is coming this year.”) The former isn’t hard and helps, latter is extremely difficult and often backfires.”

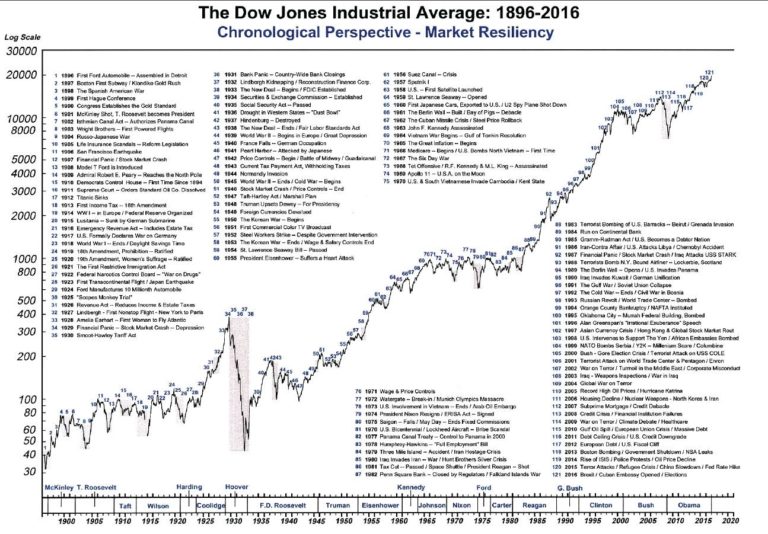

We are not predictors, but rather we are “expectors.” So no, we didn’t predict this specific drop within your investment model or in your financial plan. But yes, we have built your investment model and financial plan expecting this (or another drop like it) to happen. Any advisor or financial plan that is “surprised” by the market movement we are currently experiencing is doing a disservice. Not because the recent market was predictable (no one could, with any amount of certainty, have predicted it), but rather it was “expectable” (to anyone with knowledge of market history and normal distributions.)

We expect to have steep drawdowns every year because they happen often and unpredictably. But we also expect the market to recover, because, for over one hundred years, they always have. Sometimes markets recover quickly, sometimes over several years. Wild swings and long recoveries are built into our plan assumptions. Nothing we’ve seen in this recent drop changes those assumptions or our expectations.

What Do You Believe About The Truth?

What I love about the study of Asian American women is that both groups were keenly aware of two truths when they looked in the mirror that morning: a) they were women AND b) they were Asian American. If the researchers had not prompted them, their scores would have been indistinguishable from each other. However, when the researchers focused the test-takers’ attention on just one of the truths, their test results reflected their beliefs about that aspect of their identity.

In other words, the problem with Group A wasn’t that they suddenly realized that they were women. Instead, it was that they believed a lie about that truth.

The same goes for investing. When we look in the mirror today, we can see the same truth: “We have experienced a significant market drop.” However, we have a choice about what to believe about that truth.

We can believe some lies: “This drop should have been predicted, it cannot be overcome, and I should do something about it! My financial plan is shot!”

Or

We can believe some truths: “This drop is normal, the portion of my portfolio devoted to risky assets will have time to recover, and I know that the market rewards patience far more than action. But if I need reminding, I should review my financial plan.”

To modify Crosby’s summation of the research, the team at Smith Partners recognizes that our primary role in your financial life is to “show you where you belong and then help you act accordingly.” That starts with helping you know the “truths about the truths,” regarding the market in general but, more importantly, about you and your specific financial plan. To that end, we always welcome an opportunity to review your financial and investment plan with you. Those conversations not only help us understand you better, but they also serve to help you navigate your financial life focused on the right truths.