Quarter In Charts – Q1 2023

Kids Today Have It Too Easy

As a dad of teenagers, it’s my duty to occasionally put on the “grumpy old man” act and talk about how kids today have it too easy. I say things like, “You know when I was a boy…” followed by a misremembered anecdote of my days working at the local tractor store. (Note: Yes, I actually did work at a tractor store in high school. And no, I did not walk there uphill both ways.)

So, I resonated with the following quote from the Brattleboro Reformer newspaper in Vermont: “A Chicago preacher thinks that ‘the great danger which faces the home life of today is that young people have things too easy because of what their parents do for them.’”

You would probably agree and could add your own “kids today have it too easy” story1. The funny thing is that the above quote is from June 9, 1911. I found it in a thread of “Kids Today Have It To Easy” headlines compiled by Canadian Researcher Paul Fairie. The quotes range from 2022, 1997, 1953, and even back to 1892!

I wonder if my kids will one day tell my grandkids about how they had to ask Alexa multiple times for her to give the day’s weather report.

Investors Back Then Had It Too Easy

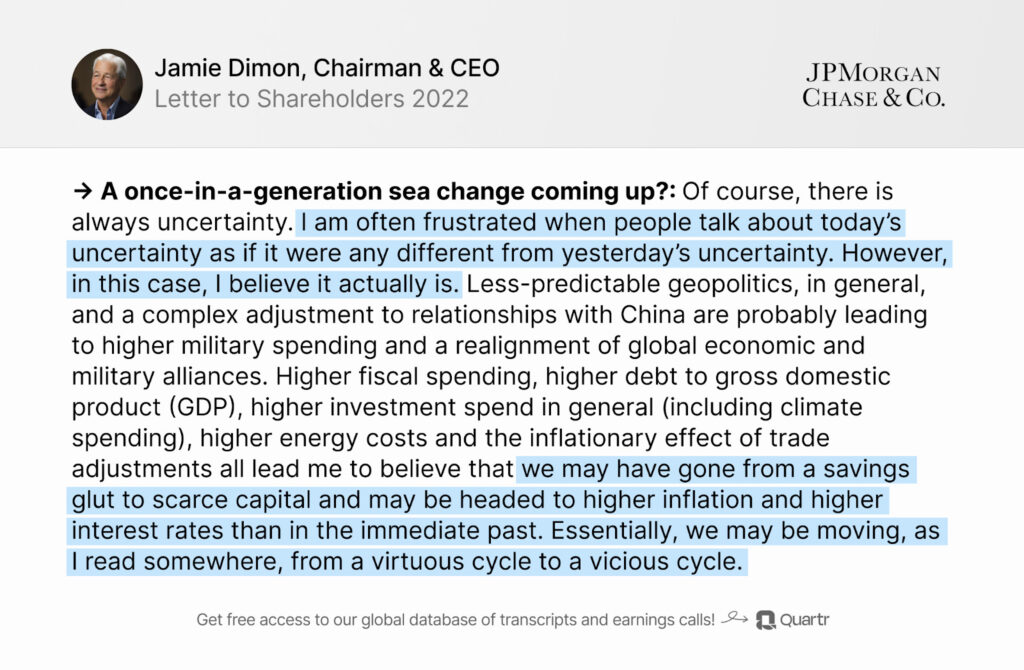

It’s easy to hear a similar sentiment today about investing in an uncertain world. As JP Morgan’s CEO Jamie Dimon laid out in his 16,000-word letter to shareholders (excerpts below thanks to Quartr.com’s recap):

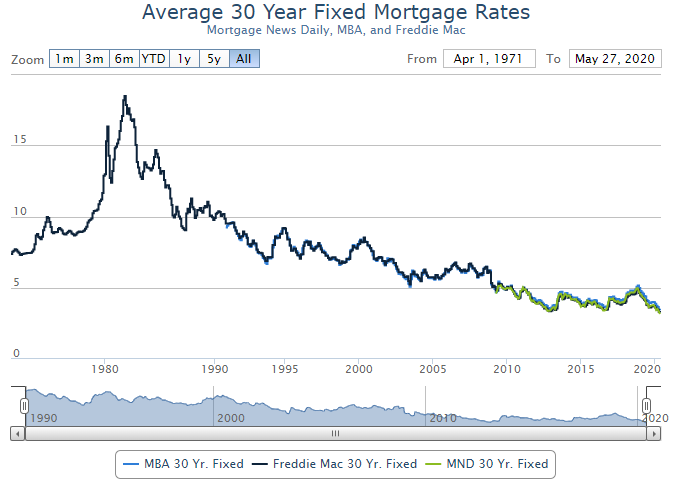

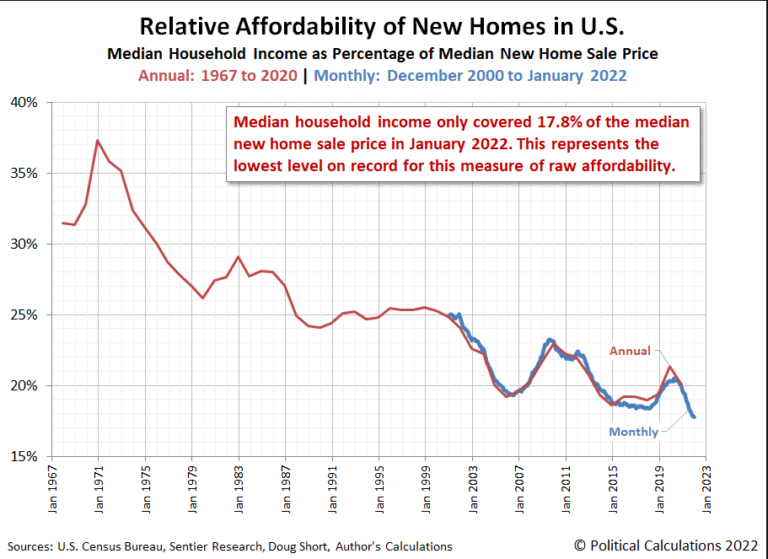

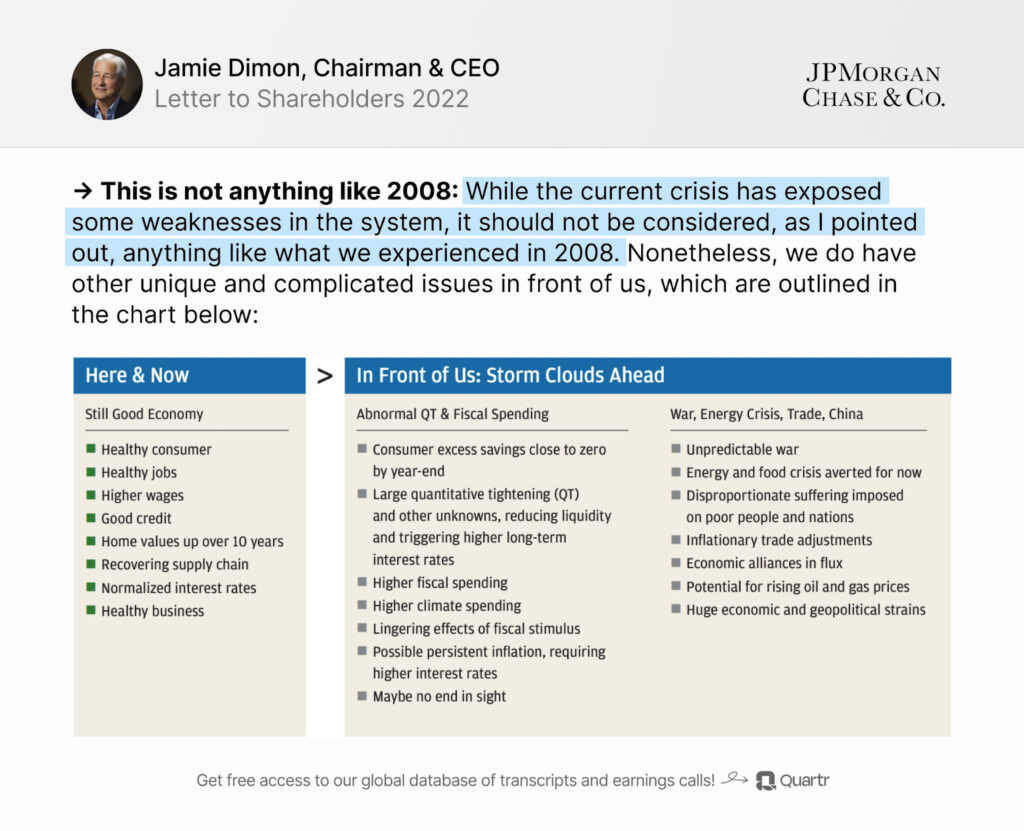

Dimon stops short of saying, “When I was a boy, investors had it easy.” He provides more details of the current “pros” and potential “cons” in the chart below. I don’t discount the uncertainty of today’s geopolitics, fiscal spending, interest rates, and inflation. They are all concerning. But to say they are much different than what we’ve experienced in the past seems short-sighted.

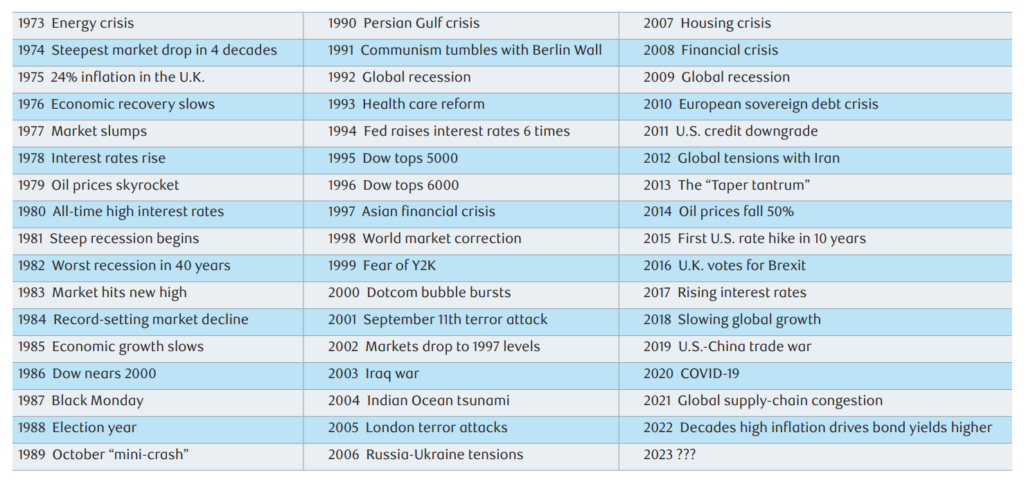

I agree with Dimon regarding the potential storm clouds ahead (though we likely disagree on the certainty and the magnitude of their impact.). But I also know that uncertainty is nothing new. OCCAM Investing produced the following graph in 2018, which lines up roughly with RBC Global Asset Management’s table below it. They both summarize concerning events (or “reasons not to invest”) over the last 50+ years. Take some time to read through the headlines, possibly remembering where you were, what you felt, and how uncertain the times felt. Today’s headlines are different, but hasn’t that always been the case?

Bad News Gets Clicks

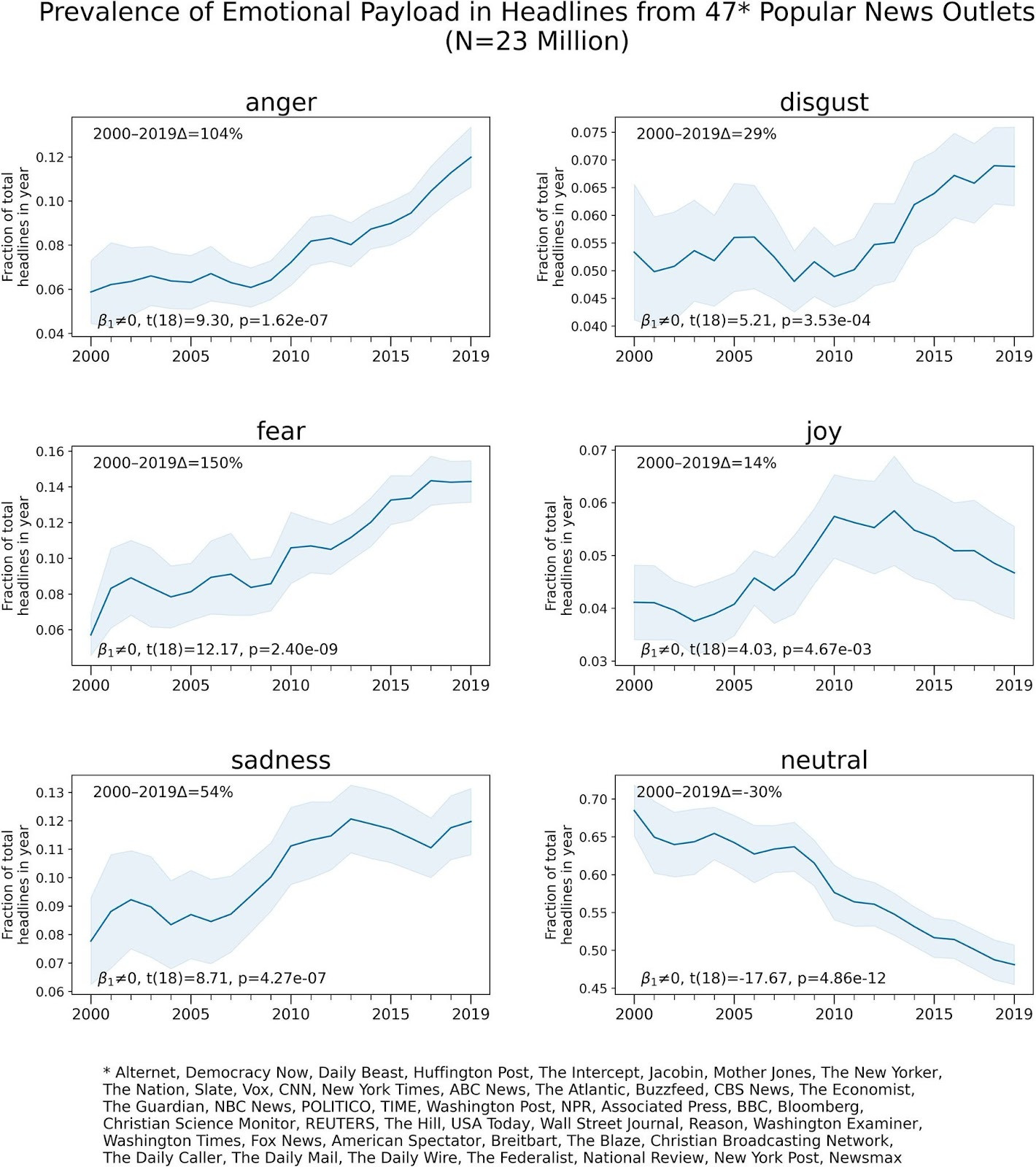

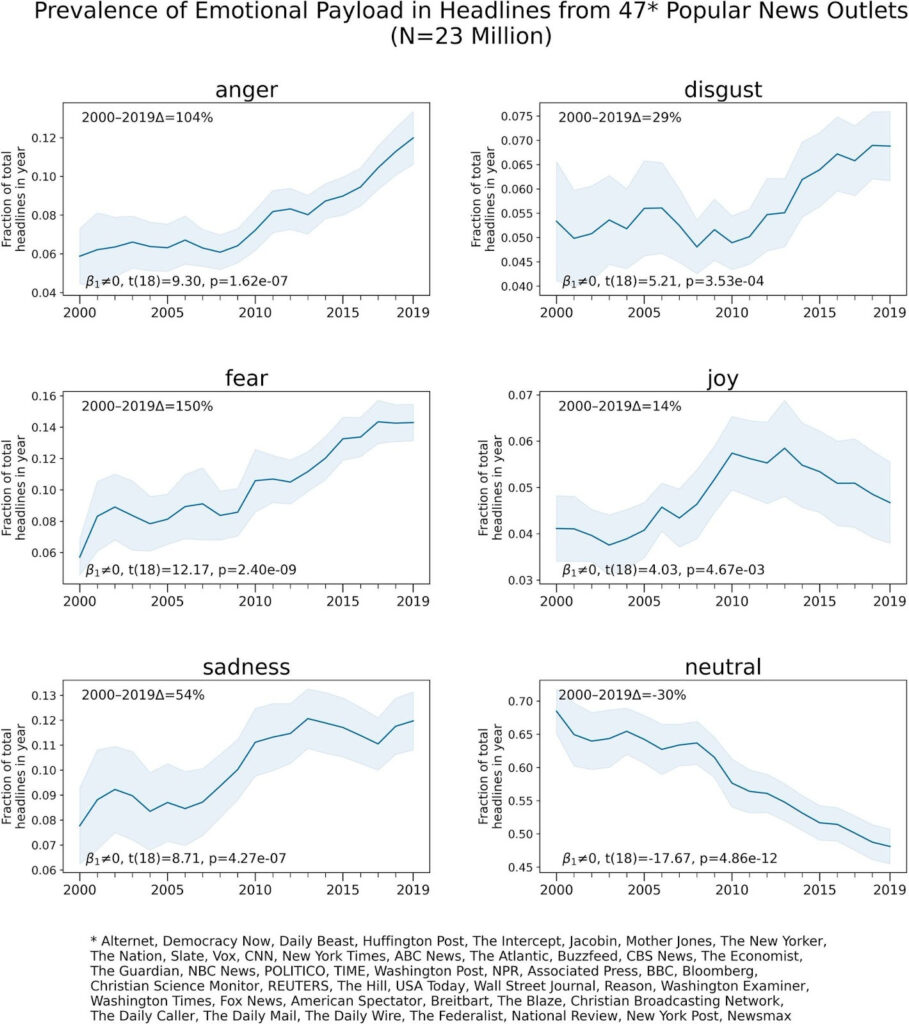

In 2022, researchers Rozado, Hughes, and Halberstadt looked at the changing trends in the “emotional payload” of headlines from a wide range of new outlets (Note: thanks to George Mack highlighting this.) Their findings are disheartening. Headlines that convey Anger, Fear, Sadness, and Disgust are up dramatically since 2000 (104%, 150%, 54%, and 29%, respectively), while Neutral headlines are in decline -30%, and headlines that convey Joy are up just 14% (but are down since 2010.)

One might assume that the world is declining and worthy of all the negative headlines. Even if that is the case, it seems that editors are doing their best to ensure we feel something negative when we read a headline. Why is that? The reason isn’t surprising. Researchers Robertson et al. studied +105,000 stories that generated +5.7 million clicks and discovered that each negative word in a headline increased click rates by 2.3% while each positive word decreased click rates.

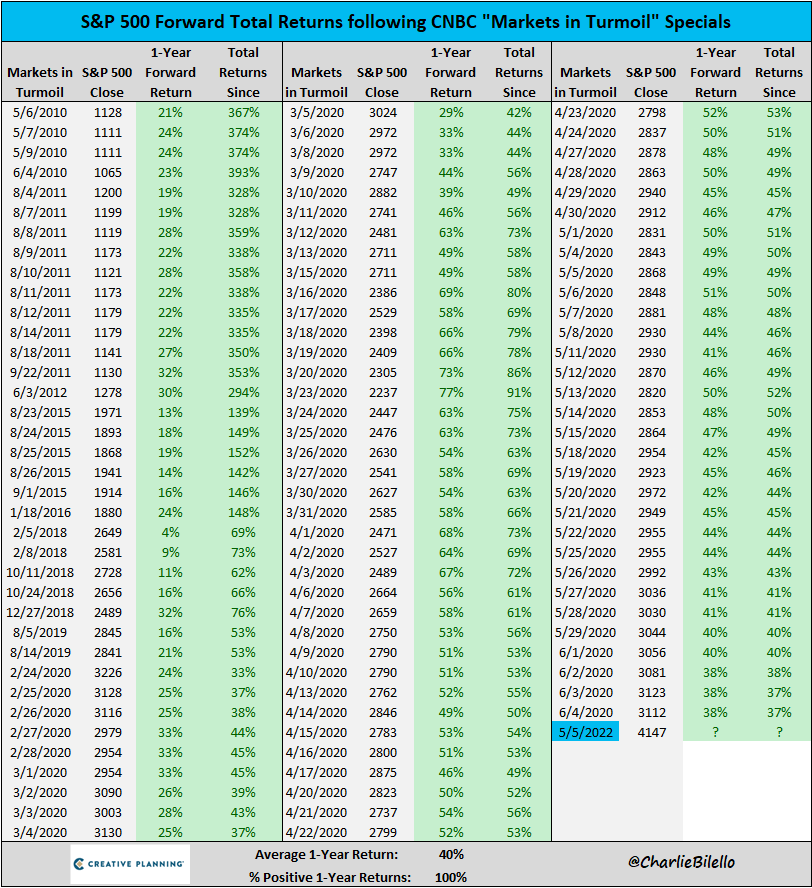

Headline: Markets in Turmoil

One of CNBC’s favorite headlines is “Markets in Turmoil” to highlight a “special” where they recap a particularly depressed time in the stock market. We saw “Markets in Turmoil” specials during the 2010 European debt crisis, 2011 US credit downgrade, 2016 Brexit, 2019 China trade wars, and CNBC nearly wore it out during the COVID-19 downturn. Creative Planning’s Charlie Bilello tracked the 1-year S&P 500 returns following each of these “Market in Turmoil” specials and he (half-jokingly) calls it the “only indicator with a perfect track record.”

Headlines for the Quarter

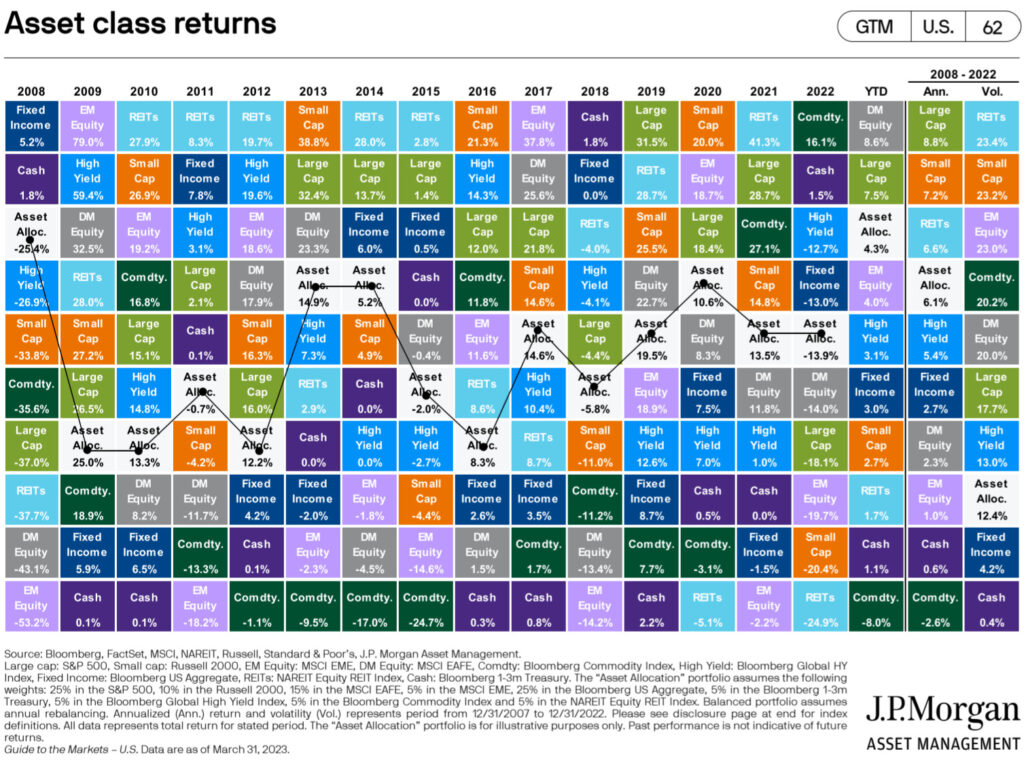

In Q1 2023, all major asset classes (aside from Commodities) added to their Q4 2022 gains, with Developed Foreign Stocks leading the way, followed by Large Cap US Stocks, Emerging Markets Stock, Bonds, and Small Cap US Stocks in order (see YTD in the 3rd columns from the right below.)

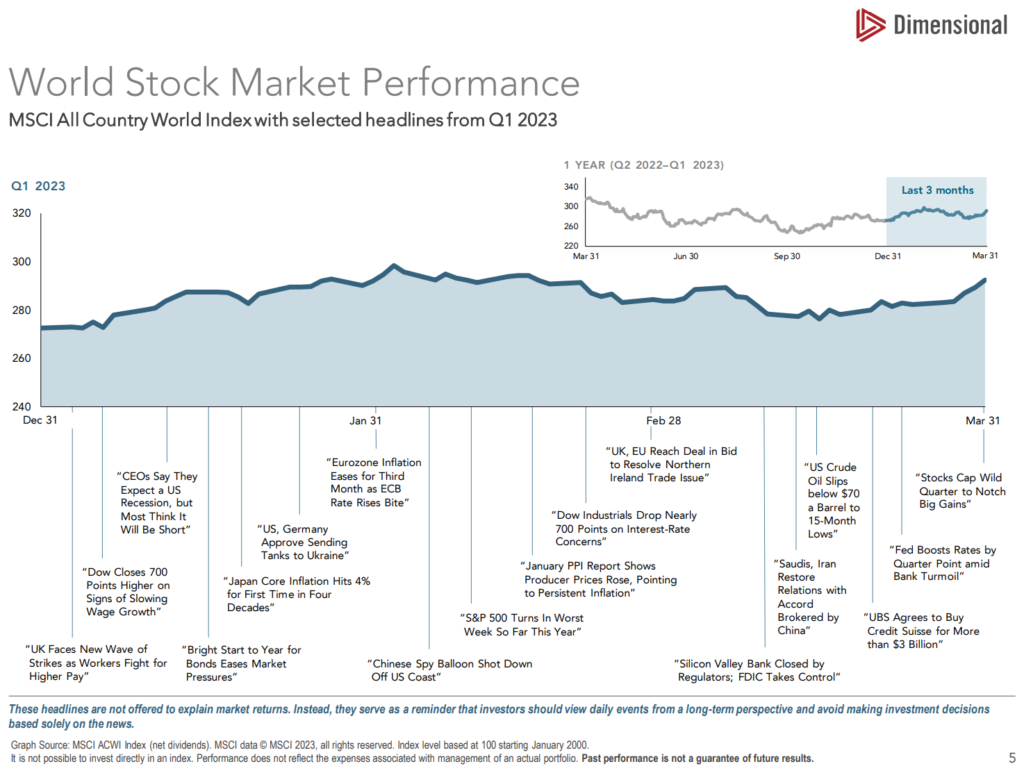

But even those returns have not been without “headline” risk. The chart below from Dimensional provides some context of what went on in the news, while world stocks gained despite the headlines.

So how do we keep our heads amid uncertain times? Step one is knowing your own financial plan rather than assuming that CNBC might know it. Markets can be “in turmoil,” but that doesn’t mean your financial plan is. Step two is understanding when you’ll need dollars and aligning your investment portfolio accordingly.

I stumbled on a great animated chart below from The Measure of a Plan that helps illustrate that point. The first row shows the one-year returns for the US Stock Market since 1872. If an investor had “one-year dollars” (money they needed to spend within one year) invested in the US Stock Market, they would be in for a wild ride with their eyes glued to a TV, newspaper, and investment statement. But if that same investor could delineate which dollars are one-year, five-year, ten-year, and finally twenty-year dollars, then the volatility (and the need to consume the headlines) tends to decrease.

1No matter what us old folks say, I believe that kids today have it plenty hard…just a different “hard” than previous generations. Yes, they can search the Internet instead of getting papercuts from Encyclopedia Britannica or trudging down to the library. And that is pretty easy. But on the downside, they can search the Internet…anytime…from nearly anywhere! And as we’ve seen above, that’s probably not great. Social Media and unsocial relationships have created a string of issues, from mental health and consumerism to distraction and dissatisfaction.

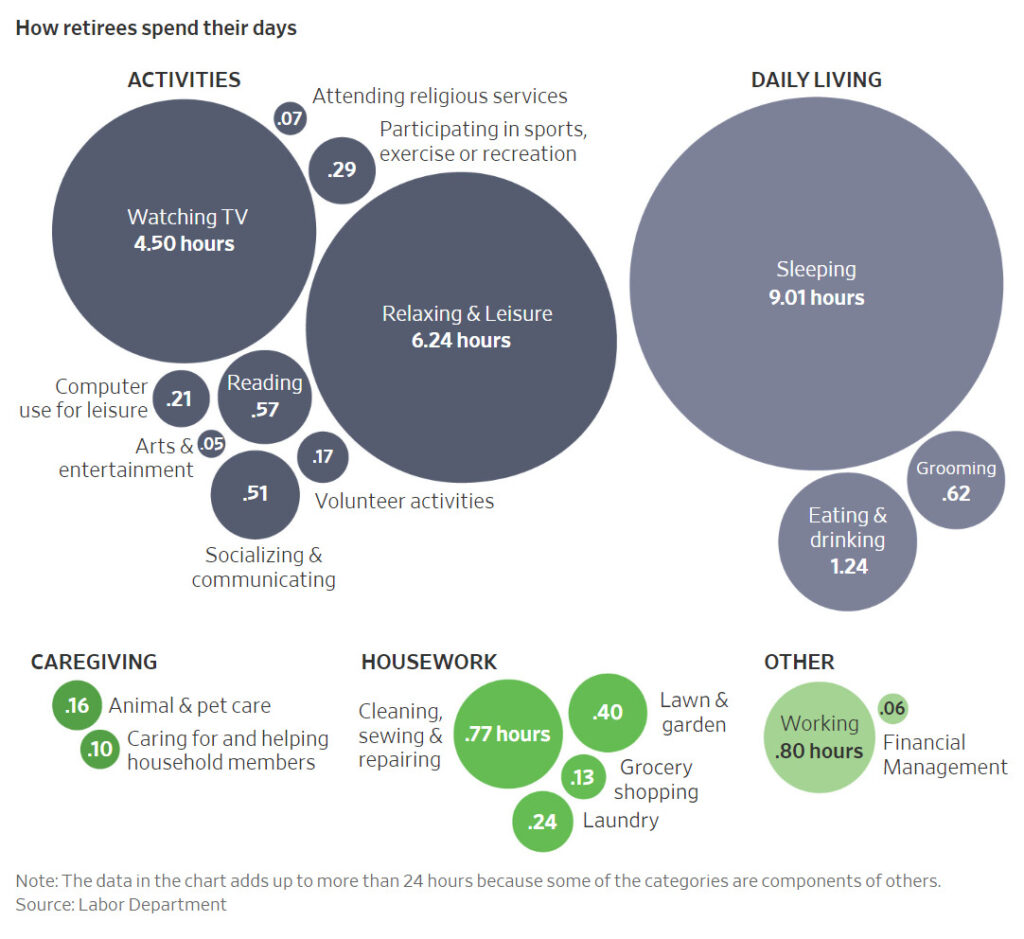

But it isn’t just kids who are subject to the pitfalls of consuming information and entertainment. A recent Wall Street Journal article details how retirees spend their days and the startling disparity between watching TV versus socializing, exercising, and reading. It is a good reminder for all of us to be mindful of how we spend our time.