Quarter in Charts – Q2 2021

As we close out the first half of the year, significant headlines continue to surround the Pandemic. Concern has shifted to the impact on the labor market, inflation, interest rates, and housing. As we look at those areas in more detail, we’ll see how they impact investment opportunities and the retirement landscape.

Labor Market

You may know about the tight labor market firsthand if you are currently working and especially if you are trying to hire. A friend of ours recently ordered a pizza while on vacation at the beach. Even though Dominoes was offering signing bonuses of $1,000, they were still so short-staffed that the expected delivery time was three hours!

As a recent Conference Board survey shows, participants who say jobs are “plentiful” outnumber those who say jobs are “hard to get” by a large margin, even as the unemployment rate is relatively high (chart below.)

The labor shortage is a result of a confluence of factors: government stimulus (both one-time and ongoing unemployment insurance), business expansion (again, thanks to stimulus through PPP, but also reopening spending), lingering COVID-19 fears, an increase in retirements (more on that later), slow wage growth, and continued demands on working parents where school and childcare have lagged other reopenings.

Inflation

Talk to five people, and you will hear five different stories about their experience with inflation. For the person who refinanced their house, didn’t buy a car recently, and doesn’t travel or dine out often, you’ll discover that their spending might be down from the prior year. But suppose you talked to someone like me. In that case, you’ll hear a different story. I bought a 160k mile used truck in the Fall, we filled it up with inflated gas a dozen extra times last year so we can tow our pop-up camper all over the Southeast, and we’ve kept Walmart in business feeding our three kids.

The two charts below show Core inflation and the impact of “reopening” inflation. If you strip out the impact of reopening the economy (and therefore assume that we’ll see some of those prices return to normal), then inflation shouldn’t be a worry. If you believe that those price increases are here to stay and that they will be a significant factor in your budget or your business, then inflation should undoubtedly be a concern.

Of course, the movement of prices is tough to predict. I told more than one client to hold off on buying a car during the downturn because I was sure that we would see significant job losses, car repossessions, and therefore decreasing car prices throughout the Pandemic. Who would have known that used Honda Civics would have made an excellent investment?

Housing

As interest rates have fallen, workers have spent more time at home, and new home construction has lagged, we’ve experienced an unprecedented increase in home prices. In Harvard’s recent “The State of the Nation’s Housing 2021,” researchers show the historic state of growing prices and shrinking supply.

However, it is worth noting that the actual cost of homeownership isn’t increasing at the same clip due to low mortgage interest rates. Harvard’s study shows that, after adjusting for inflation, the increase in house prices has been offset by low rates, resulting in a cost of ownership on par with much of the last 30 years. How this will impact current and future homeowners remains to be seen.

Investment Markets

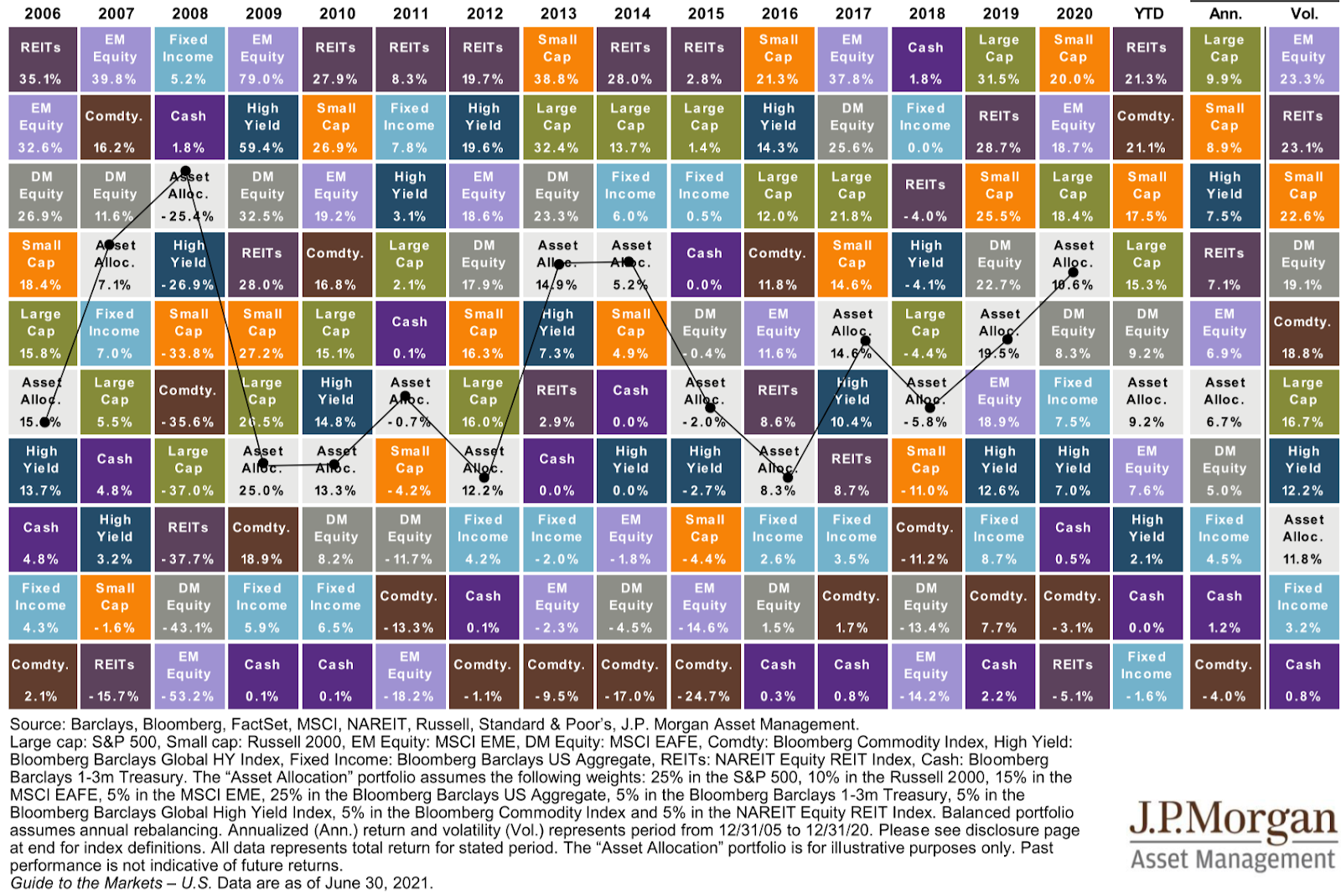

Inflation has also emerged in portfolios as risk assets (commodities, real estate, and small-cap stocks) have led the way, and aggregate fixed income has notched a negative return year to date.

Drilling down deeper, we see some encouraging signs when looking at the source of investment returns for the S&P 500. While company earnings have grown, investors are paying less for every dollar of earnings, bringing valuations back into a more sustainable territory.

As inflation has increased faster than bond yields, real (net after inflation) bond yields drop, and fixed income investors have felt the pressure on bond prices. The only areas of the bond market that experienced a positive nominal (before inflation) return were High Yield, TIPS, Asset-Backed Securities, and Municipals.

Going Forward

I chuckled when I saw the following juxtaposition highlighted on Twitter. The Financial Times noted that “Economists Can’t Predict the Future” then pointed readers to a separate article about…economists’ predictions.

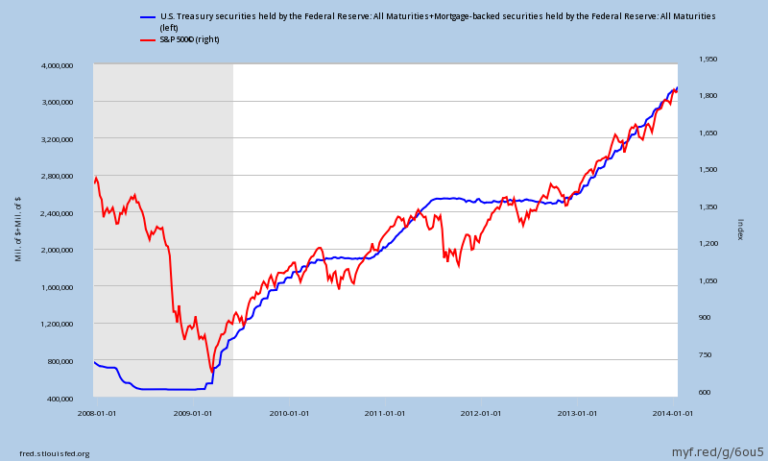

We don’t know what lies ahead for financial markets, but we know what the “future” held for previous investors who have found themselves in similar situations. Sentiment Trader points out that household equities as a percent of total assets are at an all-time high, meaning the average investor is banking on stocks more than ever. We can also see the overlaid future 10-year S&P 500 returns and quickly learn that their future returns are high when investors are least comfortable owning stocks. And when investors are most confident in stocks, future returns have been low. While this should be cautionary, we also know that no prior investor (from 1952 to today) had to deal with the opportunity cost of owning a negative-yielding bond. When fixed income gives little incentive, investors are nearly “required” to own more equities.

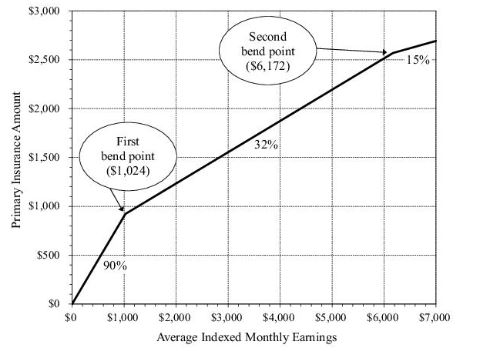

Retirees

As investors plan for their retirement, expectations play an integral part. As Michael Batnick pointed out, a survey of US Investors and Financial Professionals from around the world are (in Batnick’s words) “nothing short of absurd.”

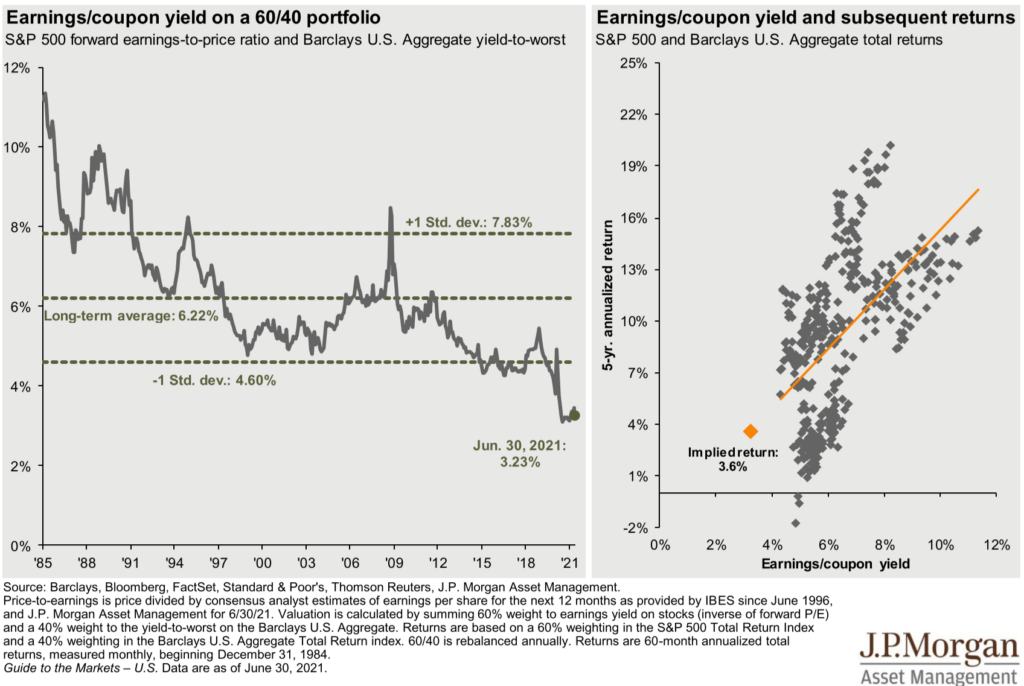

Compare those expectations above with our current “starting point” for bonds (low yielding) and stocks (low earning relative to their price.) The chart below, on the right, plots the historical starting Earnings/Coupon Yield for a 60/40 portfolio and the ensuing 5-year returns (grey dots.) You can see that at a 5% starting earnings/coupon yield, annual returns have ranged from -2% to +12%.

While there is wide variability, it isn’t hard to see the trend that higher starting yields typically lead to higher future returns (highlighted by the orange line.) If today’s 60/40 portfolio followed the historical trend, it would be a “data point island” (orange diamond) projected to earn 3.6% annual returns over the next five years. It would be foolish to see this point and chisel it into stone as a certainty. But it would also be equally foolish to ignore it completely.

The Value of Planning – Money, Time, and Relationships

I know it isn’t a “chart,” but the illustration above from Wait But Why highlights such a clear picture of planning. We don’t know future numbers: investment returns, tax policy, what college our kids will attend, how much we’ll earn, or how long we will live. We also don’t know future intangibles: what will worry us, what will bring us joy, how we will want to spend our time, or what relationships we will enjoy the most. But we can take our knowledge of both of those histories and make a conservative and rational plan for the future, expecting it to adapt and change over time.