Quarter in Charts – Q4 2020

Either a Science Experiment or a Competition

My wife likes to say that I make everything in our house “either a Science Experiment or a Competition”…and she isn’t wrong. On a cold day, I’ll challenge the kids to see who can stick their hand out the car window the longest. Also, I’ve been known to give spelling quizzes with a nerf gun in hand. And I have a standing offer to pay any of our kids $100 if they can beat me in a mile run (of course, they have to pay a $1 entry fee for each attempt.)

It would be hard to miss the competing stories in today’s headlines and social media posts: investment markets, politics, social justice, economic forecasts, on top of all of the layers of the pandemic (restrictions, business strains, vaccines, hospitalizations, and economic stimulus to name a few.)

It is a lot of information to take in. So much so, that I want to start with just one chart:

What We Can Learn From All-You-Can-Eat Buffets

We’ve had the honor of walking a lot of clients through this tumultuous year. We’ve talked through financial plans, investment models, and tax optimization. But possibly the most important topic we’ve covered is “How We Spend Our Time and Money” also known as “What I’ve Learned from All-You-Can-Eat Buffets.”

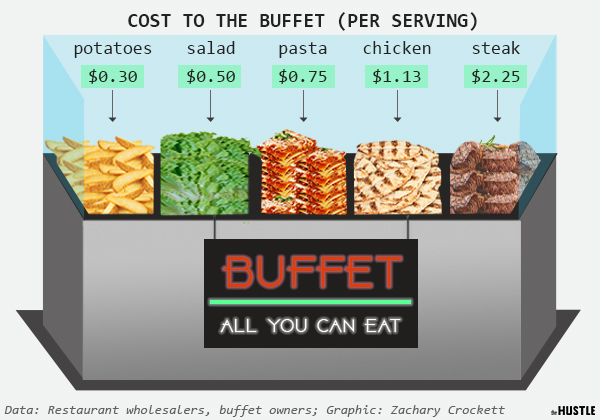

I recently ran across an article on The Hustle on The Economics of All-You-Can-Eat Buffets (via Kent Hendricks’s 52 Things I Learned in 2020.) In it, Zachary Crockett details how buffets make (or lose) money.

I learned that buffets use multiple tactics to minimize the cost of your meal and thus maximize their profit. From the article:

- “They put the cheap, filling stuff at the front of the buffet line: (Study: 75% of buffet customers select whatever food is in the first tray — and 66% of all the food they consume comes from the first 3 trays.)

- They use smaller plates. (Study: Smaller plate sizes reduce the amount of food consumed.)

- They use larger than average serving spoons for things like potatoes, and smaller than average tongs for meats.

- They frequently refill water and use extra-large glasses.”

I couldn’t help but picture our clients saddling up to a figurative buffet line, plates in hand, contemplating how they will spend their time and money. All too often, it feels like our day, month, and year “plates” somehow get filled up without us even realizing it.

Concerning our time, maybe we fill up our plates with a never-ending volunteer board position with an organization we’re no longer passionate about. Or maybe it is a 4 day per week golf habit that never really seems as fun as you thought. Or the hot new TV series I just have to binge-watch.

Our time “plates” can also get filled up with distractions from social media and the news. Our family watched The Social Dilemma recently. It was eye-opening to think about how these social networks work to fill our plates with news articles or interactions that seem mouthwatering at first but ultimately leave us feeling a bit empty.

On the money front, maybe our plate gets filled up with a $400/month car payment on a 4-year-old SUV that has long lost its new-car smell. Or a house that is too big and surprisingly expensive to maintain now that the kids have moved out. Or it could even get filled up with “good” things like a one-time-but-now-ongoing payment to “help” a family member get back on their feet.

Intentionally Filling My Plate

We could all learn a lesson from my 13-year-old. We had a chance to visit an international hotel and ate at the most extensive (and expensive) breakfast buffet I had ever seen. While I started at the front of the line, Grayson’s jaw dropped when she saw her favorite food: sushi…for breakfast! She filled her plate with what she liked, not what was expected or offered to her first.

All too often, we neglect to spend our time and money on what is most important to us until it is too late in life, if ever. A prime example of this is charitable giving and volunteering. A 2015 study by Merrill Lynch found that retirees who gave to and volunteered with charities found greater happiness, a stronger sense of purpose, and felt healthier. But most didn’t discover this love for volunteering and giving until they entered retirement…which seems about 40 years too late.

An Opportunity to Reevaluate Our Plates

One of the silver linings of the coronavirus is that it has highlighted how we’re spending our time and money. For our family, it has caused us to rethink how we’re donating, volunteering, and spending. After missing out on networking events for a year, I’m fairly certain I won’t go back. But after taking five family camping trips this year, we’re already making plans for more in 2021. And after seeing how far our dollars can go to those at a time when people really need it, we’ve expanded our charitable giving both in dollars and in impact.

I would love to encourage all of us to rethink how we’re spending our time and how we’re spending our money. Like those retirees who discovered their charitable passions far too late, I wonder if I could fast forward 5-years to find out:

- What will I wish I had started doing today?

- What will I wish I had stopped?

- What will I say was time and money well-spent?

- What time and money will I wish I could have back?

These are hard questions to ask ourselves, but I don’t think any of us would regret taking the time to thoughtfully consider them. We’d love to hear how you might answer them.

Investment Charts

Much like the buffet lines, the financial media served up a lot of “food” this year, not all of it of substance. In an effort to cut through to what is most important and what we need to pay attention to going forward, we’ll highlight some of the competing headlines:

- COVID-19 vs. The World: It is hard to imagine a section of the political, economic, social, or even religious world that has not felt the impact of COVID-19. And while we know that every person’s and every business’s story is different, I’ve found it helpful to think about the economy as a whole, as presented in the chart below by Vanguard.

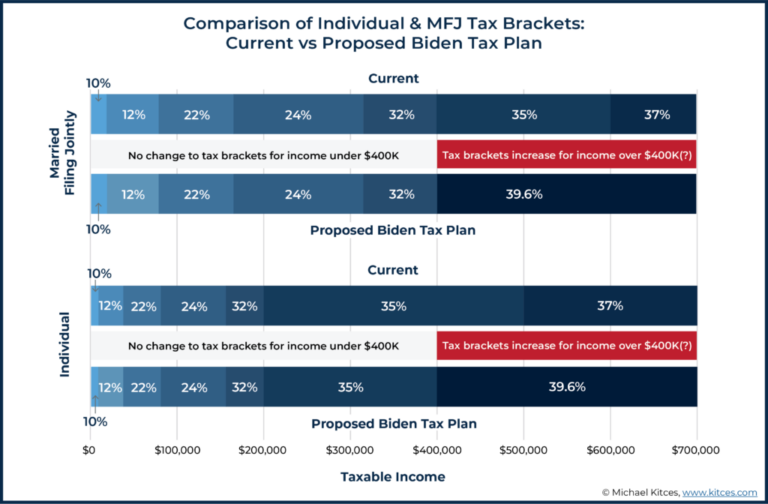

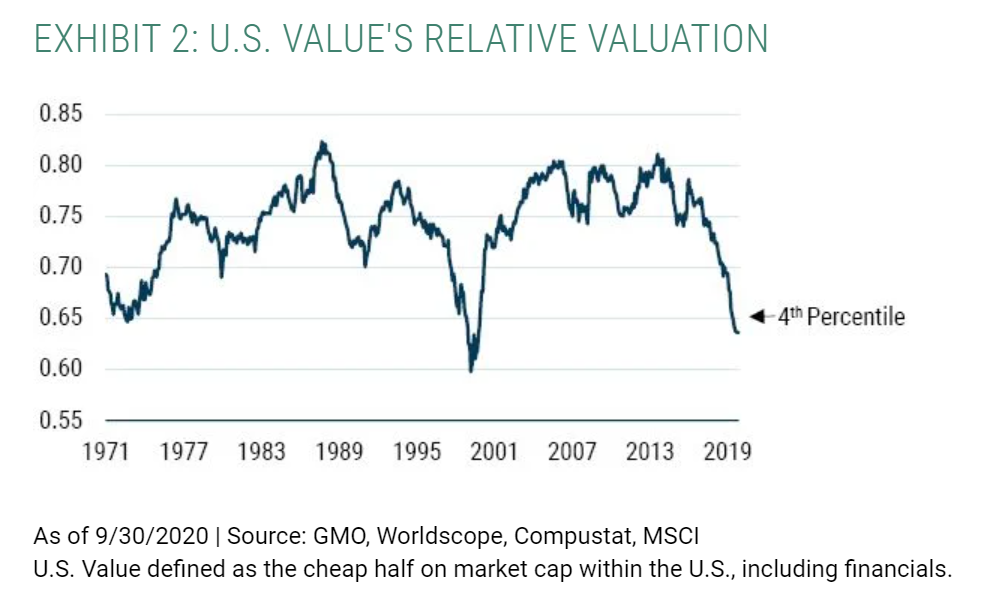

- Growth vs. Value: While Value stocks regained some ground in the last quarter of 2020, Growth still had a (beyond) historic year. According to Morningstar, Large Growth Funds return an average of 34.8% versus 2.68% for Large Value Funds. That is the largest variance ever. In terms of valuation (how much investors are willing to pay for a dollar of company earnings), Value is certainly in rare territory:

- Foreign vs. the US: Over the last year, the US vs. Foreign gap has remained intact, with US stocks selling for far higher than historical valuations while Foreign equities seem to continue to sell for less than they’re used to. It is particularly interesting to see where each of these markets has typically gone from “here” (chart below.) US stocks seem to be poised for perfection, while Foreign looks to have some margin for safety.

- The Fed vs. Inflation: While I know that most investors have a slightly shorter time horizon than 700 years, it is helpful to see our current rate and inflation environment in some perspective. While a 0.50% increase would make headlines (and would be far from expected), it would be well within the long term trend for rates.

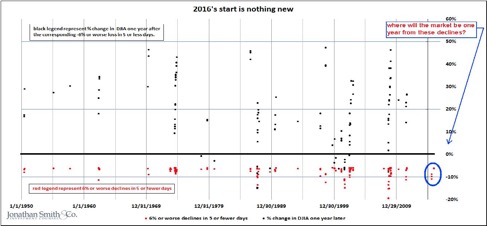

- Bubbles vs. Continued Growth: After going through the shortest US Bear Market ever (one month), both stock and bond markets are at all-time highs in the face of a global pandemic. It is not surprising to hear the proclamation of a bubble. GMO’s Jeremy Grantham outlines their case for why we’re currently in one of the “great bubbles of financial history.” Contrast that with the very real influx of cash into a stock market where the next best alternative is negative real yield bonds and where stocks have generally overcome plenty of worries.

While we can’t control what the financial news media serves us, we can pay attention to what we put on our plate. That goes for how we spend our time and our money, but it also goes for which financial news we watch. The advice from a well-meaning friend, TV anchor, or newsletter to “get heavily into this stock” or “get out of the market completely” is, at best, a gamble served in the first buffet tray. But at worst, it is a decision that begets more similar choices in the future.

To combat this temptation, we encourage investors to know what factors their financial plan depends on and how that lines up with timeless investing principles like diversification, reversion to the mean, and a long-term perspective. In other words, don’t fill up on the first buffet tray.