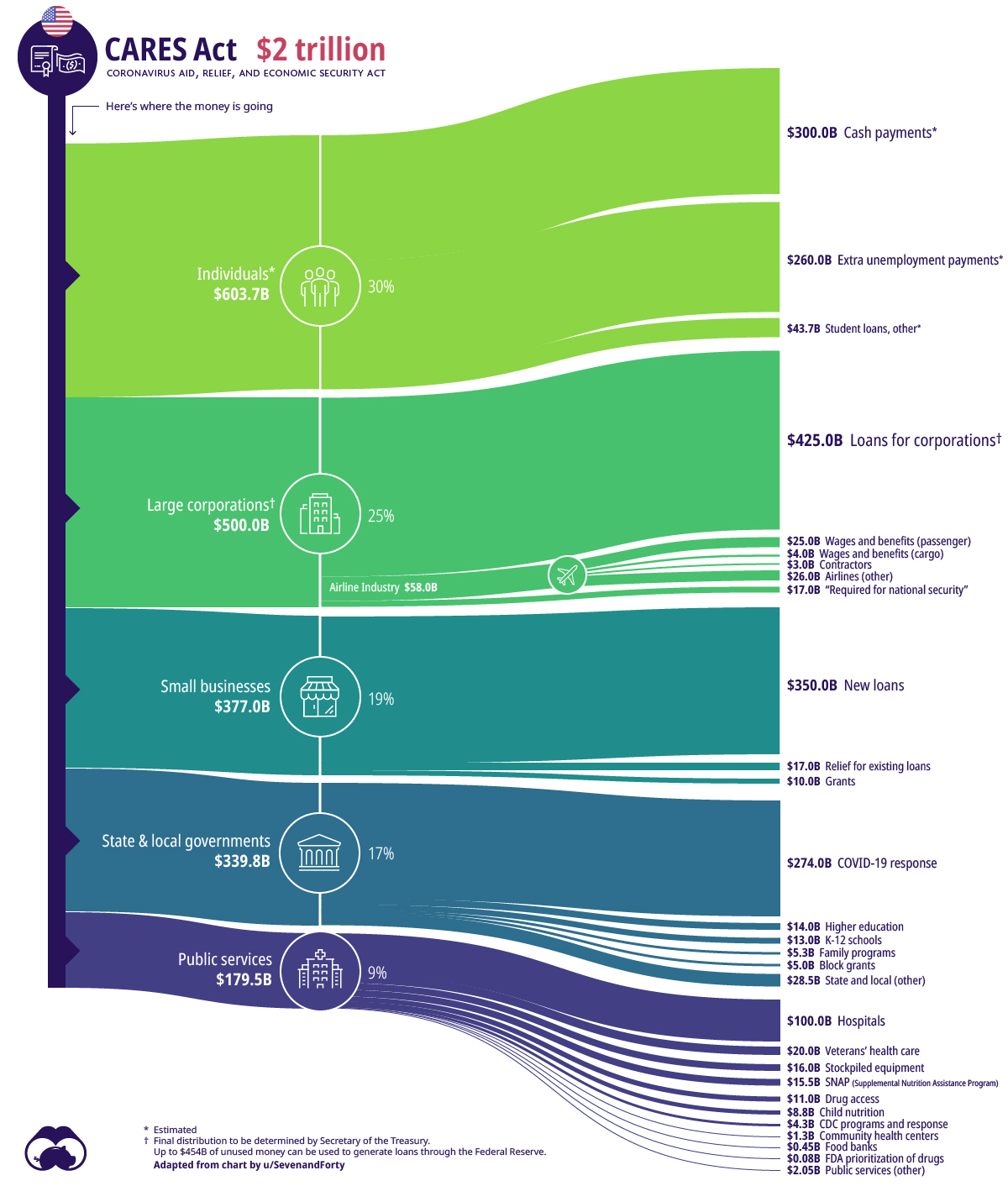

Small Business Focus: Coronavirus Aid, Relief, and Economic Security Act (CARES)

UPDATED: Note the updates to the PPP Section

Disclaimer: We’ve pooled together some resources to give you a comprehensive look at the new developments in tax, lending, and employment law changes since the onset of the Coronavirus. However, do not consider any of this to be tax, legal, or financial advice. We would be happy to talk with you more about your specific situation, but do not pursue anything detailed below without consulting a professional who knows your specific situation.

The following is an overview of how the CARES Act provisions could impact small businesses. We’ll cover retirement plan changes, unemployment compensation expansion, new SBA loans (and the tax credits and grants associated with those), and FMLA/Sick Leave changes. See our Individual Focus blog post for how it could impact you as an individual taxpayer.

- Coronavirus Related Distributions from Retirement Accounts:

- Intended to help individuals immediately impacted by the Coronavirus, but qualifications seem pretty loose.

- Have been diagnosed with COVID-19;

- Have a spouse or dependent who has been diagnosed with COVID-19;

- Experienced adverse financial consequences as a result of being quarantined, furloughed, being laid off, or having work hours reduced because of the disease;

- Unable to work because they lack childcare as a result of the disease;

- Own a business that has closed or operate under reduced hours because of the disease; or

- Meet some other reason that the IRS decides to say is OK.

- You can go back in time for any distribution made in 2020, even before the Coronavirus.

- Features:

- No 10% penalty (for those under age 59.5)

- Individuals still owe income tax, but it can be taxed over 3 years or all in 2020 (whichever is preferred).

- Flexibility to repay the withdrawn amounts over 3 years in order to “restore” the account’s tax deferred benefits. One would want to file an amended return to get a refund of the taxes paid when distributed.

- Self-certification (i.e. the onus is not on the 401k plan administrator or custodian to prove qualifications.

- Intended to help individuals immediately impacted by the Coronavirus, but qualifications seem pretty loose.

- Retirement Plan Loans

- Similar to the relaxed IRA qualifications and elimination of 10% early withdrawal penalty.

- Max loan amount increased from $50k to $100k

- Max from % of vested balance available increased from 50% to 100% available.

- Loan repayments must be made (to avoid taxes and penalties), but can be delayed for up to one year.

- As with any 401k loan, if you lose your job while the loan is outstanding, you could owe taxes and penalties if it is not repaid.

- As always though, the real cost of a 401k loan or withdrawal from an IRA is that those funds will not be invested. If the market goes down, that would be a good thing, but since the market typically goes up, more often than not, it is a potential “cost” to consider.

- Unemployment Compensation

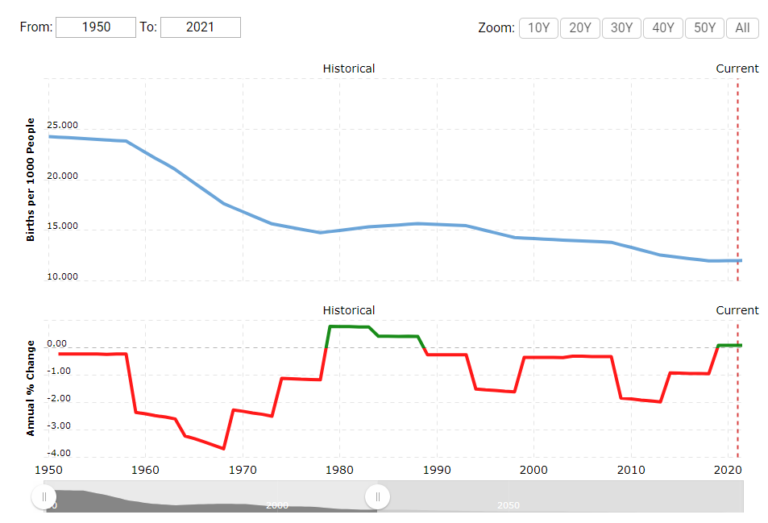

- The Federal Government is taking each state’s unemployment programs and giving them a boost (they will be paid quicker, for longer, and the average benefit will increase +150%).

- Since Unemployment Insurance is governed by the state, each state has its own set of rules and procedures. Here is a list of each state with a link to their website: https://www.savingtoinvest.com/maximum-weekly-unemployment-benefits-by-state/

- Note that while typically I could not just quit my job and apply to unemployment, there seems to be some consensus that the rules will be relaxed. For instance, in a world where we are being encouraged to stay home, I’m not sure if the UI office wants me to go out looking for work or not. Here’s a great Q&A on the specifics from Markowitz: https://www.markowitzaccounting.com/coronavirus-unemployment-benefits (Parts of this are Florida specific, but it is the best explainer of how UI works and its downfalls and benefits).

- If I am given the option to work from home or take sick or other paid leave, then I am not eligible. More information from the tax foundation can be found here: https://taxfoundation.org/unemployment-compensation-changes-cares-act/

- Details of Unemployment Insurance(UI) changes:

- Pandemic UI: Those who are typically not eligible for UI such as the self-employed are now insured.

- Furloughed or Hours Cut: Possible expansion of UI if your hours have been cut but you are not officially unemployed.

- No Waiting Period: Typically there are no benefits paid for the first week of unemployment, but now the Federal Government will cover the first week and the States will cover after that.

- All states will provide UI for 13 additional weeks.

- Bonus Check: This is the provision that stalled the bill when it was at the goal line…and for good reason. There are many scenarios where employees will be paid more to not work.

- Standard Unemployment Benefit + $600/week

- Typical Unemployment is $380/week so it is a huge increase.

- The $600 bonus is for up to 4 months only

- This seems like an area ripe for planning by a proactive business owner who wants to help out both their business and their employees. But it could also be an area of frustration for employers who want to keep operating but can’t keep employees due to misaligned incentives.

- FAQ from the Wall Street Journal: https://www.wsj.com/articles/unemployment-benefits-what-to-know-about-the-coronavirus-bill-11585256520 and NPR: https://www.npr.org/2020/03/27/822629588/lost-work-because-of-coronavirus-how-to-get-unemployment-skip-loan-payments-and-

- Paycheck Protection Program (PPP) – A loan for roughly 2.5x your monthly payroll, of which most if not all could be forgiven.

- UPDATE 4/2: The consensus seems to be that banks are being flooded with requests and are prioritizing their time. Not surprisingly, they are likely to help out their existing clients first and especially those that owe them money already. In light of that, your best avenue will likely be your existing banking relationships; especially those that you have credit with.

- UPDATE 4/2: AICPA released a set of Excel sheets to help you calculate the maximum loan amount for established, new, and seasonal businesses. A very useful resource.

- UPDATE 4/1: Updated guidance from the Treasury here. It is worth reading.

- UPDATE 4/1: The Treasury has released a website with additional information here. Banks will start taking applications for sole proprietors April 3. Independent contractors and self-employed can apply starting April 10.

- Information Sheet for borrowers here.

- Information sheet for lenders here.

- Lenders will earn a processing fee for making these loans: 5% for loans under $350k, 3% for loans $350,000 to $2mm, and 1% for loans over $2mm.

- Borrower Beware: Banks are highly incentivized to get you these loans. And while it will be the best tool and a lifeline for so many businesses, be sure to analyze your other options (filing for unemployment, ERC credits, etc) before jumping into PPP. See here for an example of how the PPP wouldn’t be the best solution.

- An “agent” can also earn a 1%, 0.50%, or 0.25% which will be paid (by the bank) out of the above processing fee. Per the lender information sheet, an agent can be an attorney, accountant, consultant, someone employed and compensated by the applicant…but it can also be the bank – meaning they keep the agent fee.

- CPAs as Agents?: No offense to the bankers, but the borrower’s accountant is likely going to do a lot of the work to help gather this information and analyze the best path forward. Additionally, the CPA will likely be the one to do the certification in a few months. Why not ask the CPA if you can name them as the agent? Some bankers might push back and say they cannot pay third party fees, but it seems that the agent is a choice of the borrower. It is worth talking through with your bank and your CPA.

- Bankers, you can blame (and CPAs you can thank) https://twitter.com/Ehjerp and https://twitter.com/adammarkowitzEA and the rest of #taxtwitter’s conversation for this one.

- Lenders will earn a processing fee for making these loans: 5% for loans under $350k, 3% for loans $350,000 to $2mm, and 1% for loans over $2mm.

- Guaranteed by SBA 100%

- 500 Employees or less

- Includes self-employed (if schedule C, it will be based on your 2019 tax return, so that will need to be filed).

- Qualification: A good faith self-certification that “uncertainty of current economic conditions makes necessary the loan request”. That is a pretty loose statement, but Peter O’Reilly contributor for Forbes puts it like this: “So if you have the whole COVID-19 situation figured out so you are perfectly sure how you will get through the crisis without borrowing any money, you don’t qualify. And everybody else in the country wants to be you.” That’s not an official word from the SBA or the IRS, but it could be a good guide.

- Loan Amount: 2.5 x Avg Monthly Payroll

- UPDATED 4/1: Please see Permanent Equity’s Sample PPP Calculation Spreadsheet

- Proceeds used for:

- Payroll, Health Insurance, Salaries, (rent or mortgage interest (not prepay)

- 1099 Contractors (see the bottom of this post for more information regarding 1099 Contractors)

- The forgivable amount equals 100% of the amounts spent on the broad items during the first 8 week period you have the loan.

- UPDATE 4/1: Further clarification here points out that “Due to likely high subscription, it is anticipated that not more than 25% of the forgiven amount may be used for non-payroll costs.”

- The catch: If you want the loan forgiven, you must keep people employed

- The number of employees during the 8 week period must be the same as it was February 15, 2019 to June 30, 2019 or January 1, 2020 through February 15, 2020

- Can’t cut compensation for <$100k employees by more than 25%

- UPDATE 4/1: 0.50% fixed rate for 2 years (applies to any amount that isn’t forgiven.).

Max rate 4% for a maximum of 10 years!. - If debt is discharged, it isn’t taxable.

- First payments can be delayed 6-12 months.

- NEXT STEP RECOMMENDATION: Talk to your banker to make sure they are SBA approved and familiar with the process, book a time with your CPA to analyze all of your options (we’re happy to be a second set of ears in that conversation), gather up the required data, and apply as soon as feasible.

- For examples and more details: https://www.markowitzaccounting.com/payroll-protection-program

- More details on the timing and application process: https://www.forbes.com/sites/peterjreilly/2020/03/30/paycheck-protection-programmaybe-next-week/

- Employee Retention Credit (ERC)

- 50% of wages up to $10k per year per person (maximum credit of $5,000 per employee)

- Eligibility – If your business has been partially or fully suspended OR you have experienced a quarter in 2020 with a 50% or greater decrease in revenue

- It could be best for a business that will have a slower recovery but many other factors need to be considered.

- Economic Injury Disaster Loan (EIDL)

- This will likely be the starting place for most small businesses.

- This is a loan where the first $10k advance is a grant. Supposedly, even if your loan is denied, you keep the grant.

- This is open to self-employed individuals.

- It covers more expenses than PPP but there is some crossover.

- If you have already applied for EIDL and received a $10k grant, that will go against what is forgiven under PPP.

- EIDL should take about 15 minutes to complete and the $10k grant should come within the week. Here’s a sample form: https://johnmccarthycpa.com/wp-content/uploads/2020/03/EIDL-Application.pdf

- Here’s a good chart comparing the EIDL and PPP programs: https://www.foxrothschild.com/content/uploads/2020/03/CARES-Act-Comparison-Chart-EIDL-and-PPP-Updated-3-30-2020.pdf

- More detail from Markowitz: https://www.markowitzaccounting.com/eidl-loans

- To get started, we recommend first talking with your CPA and then downloading this guide from bookkeeping company Bench.co here: https://bench.co/blog/resources/sba-disaster-loan-application/. You have to give them your email, but it is worth it.

- SBA site to apply: https://covid19relief.sba.gov/#/

- ERC, PPP, EIDL, UGH!

- All of this is overwhelming. Here’s is a great post on the key differences between the three with some helpful questions to help see which might be best for you: https://www.markowitzaccounting.com/ppp-vs-ertc

- We would be more than happy to talk through your situation and help navigate this with your CPA.

- Other Employee Relief Measures:

- Families First Coronavirus Response Act (sick leave and FMLA)

- Employers must provide 80 hours of sick leave (capped at $511/day) if an employee is sick or seeking care or diagnosis of coronavirus.

- If an employee is caring for others with symptoms, pay is reduced to 2/3.

- If an employee is caring for a child out of school, pay is 2/3 plus 10 additional weeks.

- Any of the above will be credited to the employer in the form of payroll tax credits.

- A helpful summary here: https://www.permanentequity.com/writings/what-ffcra-means-for-small-biz

- UPDATED 4/1: Here are some sample memos for both Sick Leave and FLMA are here.

- More information here from the DOL: https://www.dol.gov/agencies/whd/pandemic/ffcra-questions

- And a chart detailing what employers must pay employees: https://republicans-waysandmeansforms.house.gov/uploadedfiles/overview_table_paid_leave.pdf

- Deferral of Payment of Payroll Taxes

- Applies to anyone

- 50% due 12/31/21 and the rest 12/31/2022

- Applies to the employer portion of Self Employed

- Families First Coronavirus Response Act (sick leave and FMLA)

- Helpful Resources for Small Businesses:

- Bench.co: Online bookkeeping company with easy to understand summaries and action plans for small businesses. This is a great starting point: https://bench.co/blog/

- Kitces.com: More technical and detailed post by Jeff Levine https://www.kitces.com/blog/analyzing-the-cares-act-from-rebate-checks-to-small-business-relief-for-the-coronavirus-pandemic/

- Permanent Equity: https://www.permanentequity.com/essays-letters-interviews Helpful information written for small business owners on the nuts and bolts of these government and tax programs but also how to think through managing your business during these times.

- Markowitz Accounting: Florida-based CPA firm, but very extremely. https://www.markowitzaccounting.com/ppp-vs-ertc (Note regarding their website: The coronavirus resources are best found in the hyperlinks within the articles rather than under the heading).

- Forbes Taxes Column: https://www.forbes.com/taxes/ for ongoing coverage, specifically:

- Kelly Phillips Erb https://www.forbes.com/sites/kellyphillipserb and

- Peter O’Reilly: https://www.forbes.com/sites/peterjreilly/

- Rosen & Associates – CPAs Specializing in Dentistry. While some of the content is specifically for dentists, the majority of it is the most helpful I’ve seen for small businesses on the procedures to file for these programs: https://www.rosendentalcpa.com/resources/taxscriptions/

- Tax Notes: Some good examples, especially the chart which details how all of the employee retention/SBA loan/sick leave programs interact: https://www.taxnotes.com/tax-notes-today-federal/credits/economic-analysis-embattled-employers-now-must-navigate-multiple-relief-measures/2020/03/31/2cby9

- Fox & Rothschild: Extensive and industry-specific information on legal implications. Helpful information regarding employment law: https://www.foxrothschild.com/coronavirus-resources/