Small Business Retirement Plans

One benefit to being a small business owner is access to more retirement accounts than the typical 401k, IRA, and Roth IRA. While there are many options the three most attractive are the SEP IRA, SIMPLE IRA and Solo 401k. These three plans provide business owners a way to save more while providing a valuable work benefit to key employees. Below are the different account types and a chart highlighting the key differences.

Solo 401k

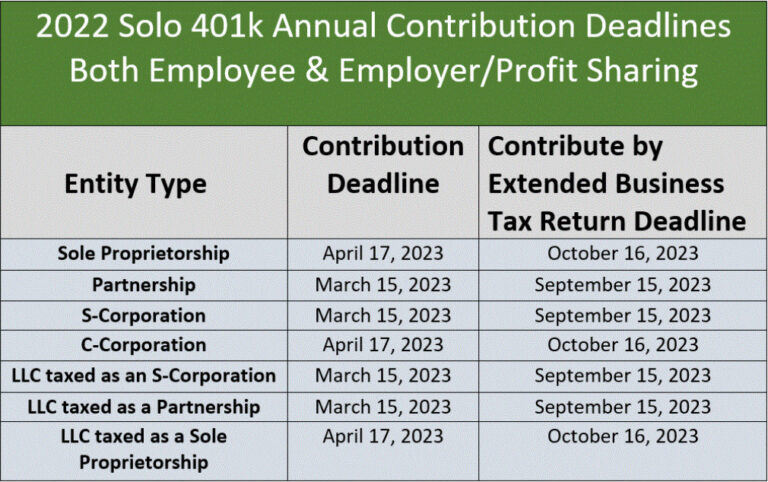

A Solo 401k can be a powerful savings tool for the right person. To be eligible, you must be self-employed with no other W-2 employees working over 1,000 hours per year, excluding a spouse. While traditional 401ks are cumbersome (paperwork, regulations, and fees) the Solo 401k is a simplified version, offering many of the same benefits as a traditional 401k. The main advantage of a Solo 401k is the higher contribution limit with lower income requirements than the SEPs and SIMPLEs. Roth Solo 401ks are also available and can be a good option for business owners seeking to take advantage of a low income tax environment.

SEP IRA

SEP stands for Simplified Employee Pension. SEP IRA’s have the same tax treatment as traditional IRAs, but do not have a Roth option. The SEP advantage is in the contribution flexibility. Business owners are never forced to match an employee’s contribution, and can delay contributions until their tax deadline (including extensions). SEPs also allow for higher contributions than SIMPLEs, for higher income individuals.

SIMPLE IRA

The SIMPLE (Savings Incentive Match PLan for Employees) is true to its name and is the most simple to set up and maintain. However, like the SEP, it also doesn’t have Roth capabilities. One of the main differences between a SIMPLE and a SEP is that employees make their own contributions to a SIMPLE with a possible employer match. Business owners could prefer a SIMPLE because employees have some skin in the game by contributing to their own accounts. Of course, not everything can be “simple” as there is a two year rule which, if not followed, can increase a participants early withdrawal penalty from 10% to 25%.

Comparison

For an HD version of the graphic below with working links then click on the hyperlink below.

Small Business Retirement Plans

Remember to speak with a tax professional about your specific situation before embarking on one of these retirement plans. If your looking to dig deeper or have any specific question then we would be happy to hear from you.