The Child Tax Credit 2021: What’s Changing?

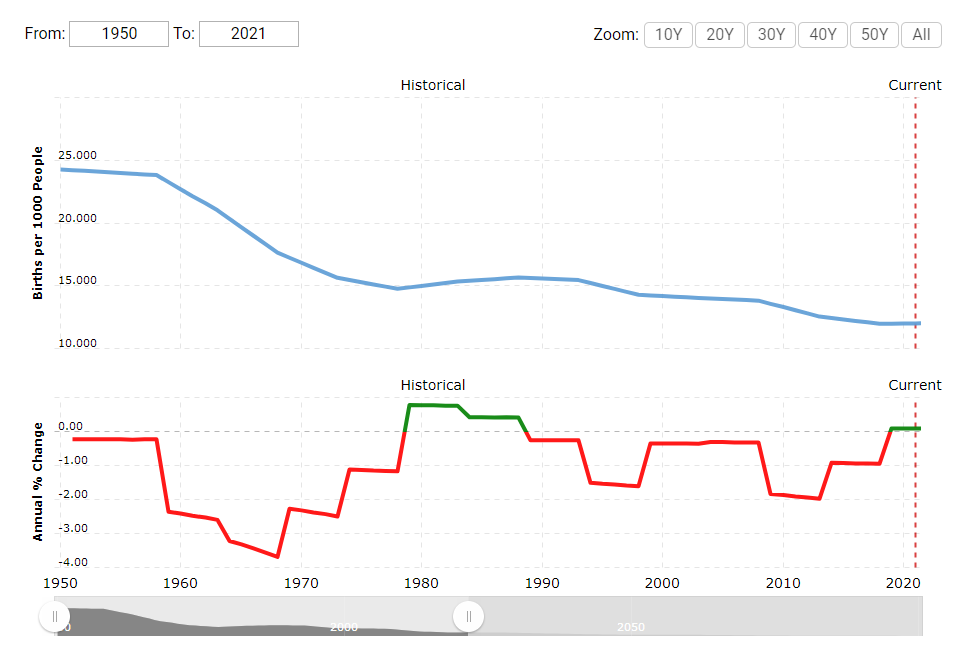

Last week, an estimated 35 million households received a monthly payment for the expanded Child Tax Credit. And even though the U.S. birthrate continues to decline (chart below), those households still care for roughly 60 million children! Below we’ll detail who is eligible, how you can check on the status of your payment, and why some families might want to opt-out of this “free money.”

Changes to the Child Tax Credit

In March 2021, a year after the onset of COVID-19 in America, the $1.9 trillion American Rescue Plan passed, making some significant changes to the child tax credit. Families will see a one-time increase in the tax credits for the 2021 tax year. For this year only, eligible families may receive up to $3,600 for children under 5 and up to $3,000 for children ages 6 to 17.

Eligibility Requirements

The American Rescue Plan has changed several eligibility requirements for families, opening up the child tax credit to more parents who may previously not have qualified.

For this year only, parents with children age 17 will be eligible for the child tax credit. Previously, children over the age of 16 did not qualify.

Additionally, the $2,500 earnings floor no longer applies, and the credit is fully refundable. This means that families who report less than $2,500 in adjusted gross income may still qualify for the tax credit and could be refunded up to the full amount.

Other eligibility requirements are still in place. Just as in previous years, children must:

- Be claimed on your tax return

- Be related to you

- Live with you for at least six months during the year

- Have a Social Security number

- Be a citizen or U.S. resident alien

Reduced Amounts for High-Income Families

For 2021, not all families will be eligible to receive this additional $1,000 or $1,600 in enhanced child tax credits. Single filers with an AGI of $75,000 or joint filers with an AGI of $150,000 will start to see a reduction in enhanced benefits.

It’s important to note that these reductions only refer to the additional amount, not the base $2,000. The enhanced credit will be reduced by $50 for every $1,000 over the AGI threshold based on filing status.

For the base $2,000, the phase-out system is the same as it was for 2020. Single filers with an AGI above $200,000 and joint filers with an AGI above $400,000 will see a reduction in child tax credits – $50 for every $1,000 over the AGI threshold.

Advanced Payments for 2021 Child Tax Credit

The IRS is required to send out payments to qualifying families in advance. These payments represent half of the amount families are eligible to receive for 2021 and have started landing in bank accounts and mailboxes and will continue through December 2021.

The IRS will determine eligibility based on your 2020 tax return or your 2019 tax return if no 2020 return is on file. If your circumstances have changed and you either become eligible or ineligible for the credit, the IRS has a portal where you can update your information. This will be important for families who may have lost income or had a baby in 2021.

Should You Say No to “Free Money”?

Families have the option to unenroll from the monthly payments. Some may want to do this for cash flow reasons if they depend on a larger tax refund in April and want to make sure they don’t spend it throughout the year. Families in that situation would receive all of their credit in April of 2022.

Other families may want to unenroll because their 2020 income made them eligible, but their 2021 income will be high enough to make them ineligible. In that instance, the taxpayer would have to pay back the credit in April of 2022. That could result in an unwelcome tax liability, so declining the monthly payments now might be wise.

These changes to the child tax credit are temporary, but they can offer eligible families some important financial relief. If you have questions about receiving your Child Tax Credit, feel free to give us a call.