When Does Buying A Home Not Make Sense?

For most, owning a home is one of the next big steps after college. A few years pass and you’re either earning more money or starting a family and you roll your equity into a bigger house. However, after the real estate market took a hit in ’08/’09 people have started questioning this age-old wisdom with an alternative idea. Is it better to rent?

For my entire life, I’ve been a renter. From age 0-18, I was given free rent at my parent’s house thanks to societal norms, their unconditional love, and my lack of cash flow. Then during college, I rented in Boone, NC, and post-college, I rented in Greensboro, NC. However, late last year, the opportunity arose for me to purchase a house that I loved. Not one to make rash, financial decisions, I researched and called family/mentors to get a pulse on what I would be signing up for if I bought this house. (I’ll discuss what I decided to do at the end of this post). However, the hardest part of working through this decision, for people like me, is that we run into our own confirmation bias.

“a tendency to search for or interpret information in a way that confirms one’s preconceptions, leading to statistical errors.”

This bias is given to us by our parents, friends, and podcasts. Because of confirmation bias, we hear or read about a benefit to homeownership, such as (possibly) deductible mortgage interest or building equity and use that as our reasoning for buying a home. We do this because it agrees with what we’ve heard elsewhere. However, because of wide-ranging rental and home purchasing markets combined with differences in property taxes, and investment opportunities, the answer is rarely the same for everyone.

There are seven points to consider when deciding between buying and renting a home.

- What are the transaction costs?

- What are the annual homeownership expenses?

- How will taxes impact me?

- Can I afford it?

- Where else could I invest this money and what’s the expected return?

- What’s the emotional return?

- Will I save more with a home?

What Are The Transaction Costs?

Transaction costs are the amount you must pay in order to purchase or sell a home. Transaction costs are made up of two segments, closing costs when you buy and real estate agent fees when you sell. Closing costs such as attorney fees, home inspection fees, origination fees, title insurance, and other expenses add up to (2%-5% of purchase price) along with real estate agent fees (4%-6% of purchase price). These transaction costs for buying/selling a home are between 6% and 11% of the purchase price!

To make up for large transaction fees, the home must appreciate 6% – 11% to recover all of the transaction costs. But, how long will it take for my home to appreciate 6% to 11%? The answer is, it depends. If you purchased a home in Carson City, NV four years ago then one year is needed but if you purchased a home in Chicago, IL then it could easily take 5 or 6 years depending on where you purchased in their annual housing cycle. To simplify things, let’s look at the U.S. average. Based on housing data from 2000 to 2019, home values have appreciated, 2.34% per year on average. At that rate, it will take 2.6 years – 4.7 years for the home appreciation to make up for transaction costs. (6%/2.34% = 2.6 years and 11%/2.34% = 4.7 years).

But Stephen, I don’t pay any real estate agent fees when I buy the house, so we don’t need that pesky 4%-6% in there right? Not exactly, just because you are the buyer doesn’t mean you avoid real estate agent fees; instead, they act as a delayed fee when purchasing a home, because the buyer will eventually sell their home. With the average American selling their home after 13 years and 87% of buyers and 91% of sellers using an agent, it’s worth calculating their 4%-6% fee into the cost. Keep in mind that it’s possible to sell your home without an agent. However, other agents will be less inclined to bring their clients over because they will still want their 3% fee for bringing the buyer.

What Are Annual Home-Ownership Expenses?

Ongoing home expenses can be a reasonably large line item depending on, the age of the home, the quality of the building materials, and home maintenance by the previous owner.

If we exclude years with a significant home renovation, the average maintenance cost of owning a home is 1-4% of its value every year ($300,000 * 2.5% = $7,500 annually). When renting, this cost is (mostly) assumed by the landlord and includes things like

- Cleaning the gutters

- Replacing a water heater or A/C

- Replacing a washer and dryer

- Fixing a leak in the roof and rotten wood

- Roof replacement

- Landscaping

- Fireplace re-bricking

- Pressure washing

- Mold removal

- Termite damage and much more

After monthly maintenance expenses, we have the more obvious cost of owning a home, the mortgage. A mortgage payment is partially principal that adds to your home equity and partly interest that is the fee you pay the bank for the benefit of them loaning you money. Along with your mortgage, you will have to pay property taxes, homeowners insurance, possibly PMI (Property Mortgage Insurance) and HOA (homeowners association) fees. The amount going towards home equity versus interest depends on your down payment, interest rate, term, and loan amount.

Assumptions ($300k purchase price, 10% down, 30-year term, 4.5% interest rate)

Monthly Mortgage Payment: $1,368.05

Monthly Homeowner’s Insurance: $83

Monthly Average NC Property Tax: $220 (0.88% of home value per year)

Monthly Property Mortgage Insurance: $85 (Due if the down payment is less than 20%)

Total Fixed Monthly Payment: $1,756.05

2.5% monthly maintenance cost: $625

All in: $2,381.05 with no HOA

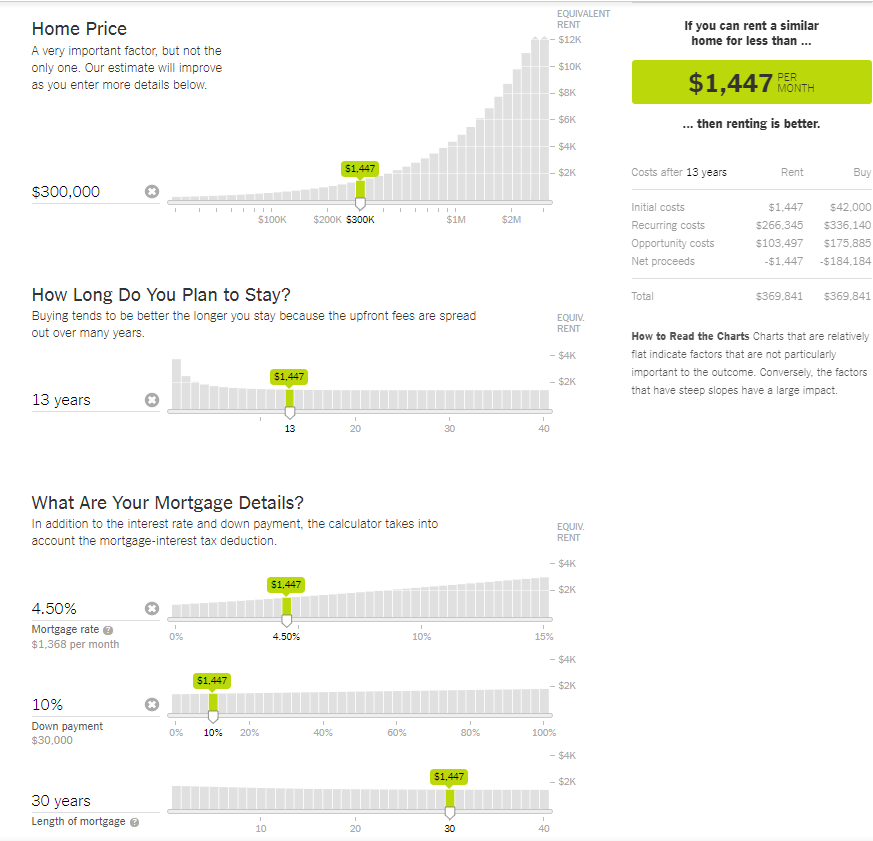

Out of this $2,381.05 per month number, only $355 will go towards your Home Equity off of the first payment with that equity number increasing around $1.50 per month as the loan progresses. Which means that if you can rent a comparable space, all in, for less than ($2,381.05 – $355 = $2,026.05), then your net worth will be better off for that first month. Assuming you save the difference in an investment/savings account of some sort. However, this number isn’t accounting for the mortgage changing as time goes on. So let’s look at a 13-year scenario using a more accurate calculator below. We can see that based on the assumptions below if our comparable rent is over $1,447, then it makes financial sense to buy. Meaning that if rent is below $1,447 for a similar living scenario, then your net worth is better off renting.

If you want an in-depth look at comparing renting vs. buying with your numbers, then the New York Times calculator above can be found at NYT Calc.

How will Taxes impact me?

Depending on when the home was purchased, homeowners can deduct interest expenses on up to $750,000 of mortgage debt from their income taxes. However, when the owner itemizes these deductions, they void the standard deduction of $12,000 for individuals or married couples filing individually, $18,000 for the head of household and $24,000 for married filing jointly. Which means if your interest + other deductions aren’t higher than the above numbers then you won’t deduct any interest and if you do the benefit may be marginal. Also, according to the Joint Committee on Taxation, only 12% of Americans are expected to itemize after the new tax bill went through. This tax bill is expected to leave 80%-90% of American’s with no benefit for paying mortgage interest. All taxpayers are now limited, regardless of their income, to deducting no more than $10,000 of total state and local taxes, including property taxes. (read more here)

Can I Afford it?

We recommend that a home buyer’s Mortgage + Insurance + Property Taxes + PMI = 30% or less of net income. The difficulty with using a hard and fast number is that individuals and families don’t have the same expenses. Two families could earn the same amount of money, but one family has their kids in private school, are members of the country club, have high debt levels, and drive new cars. While the second family avoids the country club and debt, uses public school, and drive 10-year-old cars. In this case, because the first family has higher fixed expenses, they might put themselves in a bind, even if they only spend 20% of their income on housing.

Where Else Could I Invest This Money and What’s the Expected Return?

Looking at other possible investments is looking at your Opportunity cost,

“the loss of potential gain from other alternatives when one alternative is chosen.”

Simplified: When I choose to eat pizza for dinner, the opportunity cost is the burger, stroudle, salad or anything else I could have eaten for that same meal with the same amount of money. If you want to read more about the opportunity cost of your next dollars, then take a look at our post, “What Should I Do With My Next $_____.”

Since we are looking at home purchases, let’s compare the opportunity cost of investing a 10% down payment in a home vs. the opportunity cost of investing in a 60/40 stock/bond portfolio over 19 years. Note that in the example below, we are only considering the down payment, not on-going fees, expenses, or the effects of leverage.

Home Growth: Based on the Consumer Price Index (CPI) American homes have increased in value an average of 2.34% annually from 2000 to 2019. $30k – (3% closing costs of $9,000) = $21,000. You then grow $21,000 at 2.34% for 19 years which gives you $32,589.83 – $18,000 (6% of $300k home value -real estate agent fees) = $14,589.83. If you were to start with $30,000 and end up with $14,589.83 over 19 years, then your return would be -4.14%.

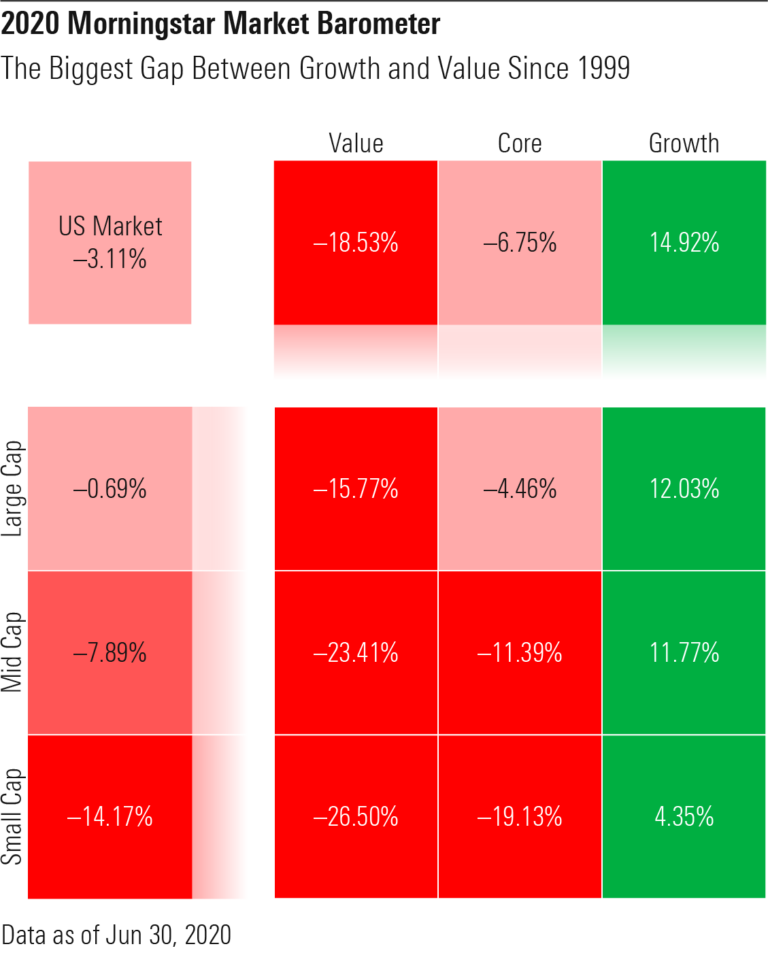

60/40 Portfolio: Based on Morningstar’s research, a 60/40 portfolio returned 5.9% annually over the 2000 to 2019 period. $30k growing at 5.74% (5.9% – .16% fee) over 19 years = $86,629.95

With such a drastic difference in value, it’s easy to see that, on average, investing your money in the 60/40 portfolio would have left you better off for the 2000 to 2019 period. $86,629.95 – $14,589.83 = $72,040.12.

What’s the Emotional Return?

Emotional Returns and Forced Savings are harder to fit in a model because they are subjective returns. However, that doesn’t mean they shouldn’t be considered. There can be a significant emotional return to both owning or renting a home. When you own a home you don’t have to worry about scuffing the walls, you can plant a tree in the backyard and expect to watch it grow for years to come, and you can put your own spin on the house. However, if you rent there could be an emotional return of not being tied down to one city or neighborhood, you can offload the stress of appreciation/depreciation onto the landlord, and you don’t have to be in love with your space because you can always move when the lease is up.

Will I Save More With a Home?

If saving doesn’t come naturally, then having a mortgage could be an excellent forced savings tool. You plod along, making your mortgage payments, and in the background, equity builds in your home. Although home equity is rarely realized in the homeowner’s life, it can be a significant asset to pass to inheritors or use in emergencies through sale, decreased living expenses if paid off, renting out rooms, HELOC (Home Equity Line of Credit), or a reverse mortgage.

What Did I End Up Doing?

After much deliberation, I ended up purchasing the four-bedroom home and am currently renting out three of the rooms to help me cover the mortgage and other expenses. This means I take on added responsibility and risk when compared to renting. But, I get the pleasure of owning a home. If you’re wrestling with purchasing a home vs. renting, remember to take your time and run a few numbers. With great leverage comes great responsibility.