4 Myths About Roth IRAs

“Is a Roth IRA right for me?” is a simple question with a complex answer. Even worse, myths and misconceptions surrounding Roth IRAs make them seem more complicated than they are. We’ll address the four most common rules covering withdrawals, contribution limits, home purchases, and taxes. Even if these rules don’t apply to you, it’s nice to know they exist.

First things first, Roth accounts come in all shapes and sizes: Roth 401(k), Roth 403(b), Roth Solo 401(k) and the traditional Roth IRA. When you see the word Roth, it means your contributions use after-tax income, causing all the growth of the account and the future withdrawals to be tax free.

Myth #1, I Make Too Much Money to Open a Roth.

In 2018, if your earned income is more than $135,000 (single) or $199,000 (Married Filing Jointly), then you cannot contribute directly into a Roth. However, you can still get into a Roth IRA through a Backdoor Roth IRA Contribution. A Backdoor contribution uses a non-deductible IRA contribution, followed by a Roth conversion into a Roth IRA after 6-10 months have passed. It’s far from simple (and should only be done with great research and care) but can be an effective way for high income earners to contribute to a Roth.

Myth #2, I Can’t Withdraw from My Roth IRA until I’m 59.5.

Roth IRA principal may always be withdrawn free of taxes and penalties, even if withdrawn before age 59.5 and without a 5 year waiting period since the first contribution. However, investment earnings have restrictions. To avoid paying extra penalties, you must be over age 59.5 and have made your first contribution over 5 years ago, see exceptions here. FYI, you must be able to prove to the IRS, if you plan to make an early withdrawal, your exact principal amount.

First Time Home Buyer Caveat: One big exception is that you can withdraw principal AND earnings tax and penalty free from your Roth IRA before age 59.5 for the purchase of a home. You must first have made the Roth contribution more than 5 years ago. After the 5-year clock is up, you may use up to $10,000 as a down payment on your first home. Even better, the same goes for your spouse, allowing a couple to withdraw up to $20,000 from your combined Roth IRAs before age 59.5, tax and penalty free.

Conversion Caveat: If your Roth is the product of a Roth conversion then you must wait 5 years, from each conversion, to withdraw the converted principal penalty free.

Myth #3, My Tax Rate is too high for a Roth.

For young individuals in low tax brackets, Roth IRAs almost always make sense because there is a long time for the investments to grow and a low tax hurdle (lessening the attractiveness of traditional IRAs) when starting the Roth. However, Roth’s have a place in the high earner’s portfolio too, which seems counterintuitive: Why would I happily pay my taxes now when I could get a deduction now and postpone paying taxes on withdrawals till later.?

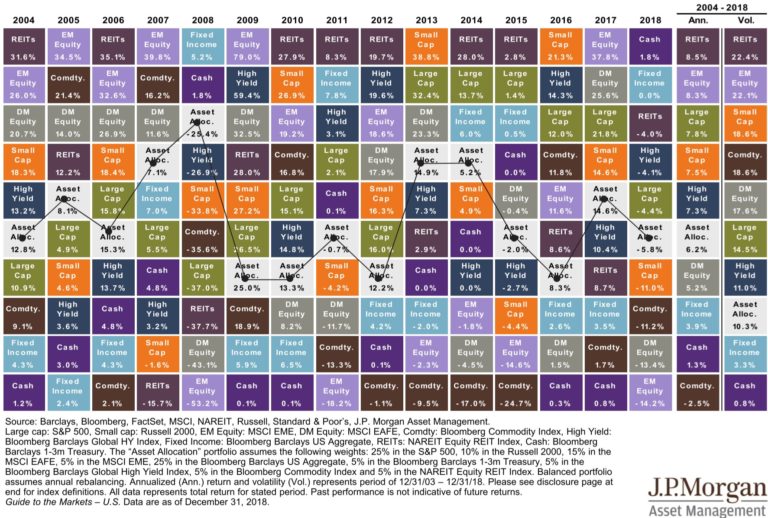

- a) Rising Tax Brackets: The U.S. will likely have higher tax rates in the future. When you look at the historical trend of tax rates, current tax brackets are comparatively low.

- b) Tax diversification: If you have pre-tax (traditional IRA) and post-tax (Roth IRA) dollars in retirement, you have better control over your tax burden. For example, if your tax rate happens to be high the year after you retire, you can pull tax-free capital from your Roth IRA. But if tax rates are low, then you can pull capital from your traditional IRA.

- c) No RMDs: Required Minimum Distributions (RMDs) are IRS legislated withdrawals from an IRA or 401(k) when you are over 70.5 years. RMDs accelerate IRS’ receipt of their share of taxes on your tax deferred accounts.

Myth #4, Roth IRA’s and Traditional IRA’s have the Same Contribution Limit.

Technically you can contribute $5,500 per year into your Roth IRA OR your Traditional IRA. With a traditional IRA you receive a deduction based on your contribution and you are taxed upon the eventual withdrawal. With a Roth IRA, you receive no current deduction, but your withdrawals are tax free.

Roth IRAs incentivize you to direct your savings into a vehicle producing greater after-tax capital. The only way to equalize your total savings when comparing a Roth vs. Traditional IRA strategy, is if you squirreled your entire Traditional IRA deduction, including taxes you saved from making the deductible contribution, into a separate investment account. This works in theory, but in practice, most people will take the tax savings from contributing to the Traditional IRA and spend it. Directing your savings into a Roth IRA should result in greater income after all taxes are paid.

Every Roth IRA or Traditional IRA contribution should be discussed with a qualified tax professional or fiduciary advisor. If you have any questions or concerns, feel free to call or email us.