Annual Financial Checklist (May through August)

This is the second in our three part Annual Financial Checklist series. While not exhaustive, it will help you to continue to think proactively about stacking the odds for financial success in your favor. See our previous “January through April Checklist” for more ideas.

May

- Look into College Scholarships: If you have a child in their junior year of High school up to their junior year of college, between May and September is the perfect time to investigate softening the cost of college. Remember, no one pays sticker price for college. Schools hand out millions of dollars every year to students who consistently put forth the effort to write scholarship applications. If you want scholarship money, look into the College Board’s Scholarship Search or your university’s scholarship page. You can even make this a part time job for your child. We suggest having kids search for scholarships and for every $1,000 of scholarship they receive, you give them $250 cash. That’s a 300% return on your investment!

- Save Your Tax Refund Check: If you overpaid your taxes and received a refund from the IRS, don’t absorb this “bonus” into your everyday spending or buy a frivolous item. This money was taken out of your paycheck and should be used towards previously set financial goals.

- Meet with Your CPA: Now that your CPA isn’t buried in tax returns, it’s a good time to review your tax situation in light of the new tax bill. With so many changes in the tax code, from deduction limits to new tax rates, planning opportunities are plentiful.

June

- Review Your Monthly Cash Flow: Look over all your debts to ensure you’re aware of the payment amounts, term, and refinance options. Check to see that you’re saving the proper amount in retirement and savings accounts. Examine how much you’re spending annually versus this time last year by adding up credit card and bank statements. If you’re spending more than planned, the answer is simple: adjust your spending to meet your goals. We would love to help you in this area that is necessary to get right as you move forward.

- Teach Good Financial Habits to Kids and Grandkids: With kids out of school for the summer, it is a great time to encourage them to pursue summer jobs: mowing lawns, putting

on their own summer camp, working at the local kid’s museum, or cleaning out dryer vents for the neighbors. You can use their work opportunity to discuss how to use hard-earned money and help build invaluable habits that will stand for decades. You can teach them how to create their first budget, save for a goal, give, or invest in something they’re passionate about. If you would like to learn more about this topic we would suggest reading “The Opposite of Spoiled”.

on their own summer camp, working at the local kid’s museum, or cleaning out dryer vents for the neighbors. You can use their work opportunity to discuss how to use hard-earned money and help build invaluable habits that will stand for decades. You can teach them how to create their first budget, save for a goal, give, or invest in something they’re passionate about. If you would like to learn more about this topic we would suggest reading “The Opposite of Spoiled”.

July

- Analyze Your Energy Spending: The heat of the summer can drive up energy costs. If you’re overspending here, start with altering your thermostat so that your home gets warmer during the day and kicks in at night. You could also buy energy efficient light bulbs, ensure the dryer vent leading outside is clear and consider installing a smart thermostat. The biggest benefit to expense awareness is that it forces you to focus on the small things that should translate to a larger mental shift in spending on larger items.

- Buy Big Ticket Items on July 4th: The holiday isn’t an excuse to go all out, but if you’re looking to purchase a pricey item, like a flat-screen TV, a grill, or even a few gallons of paint, holidays are great times to pull the trigger. Just be sure to do some research before you head to the store.

- Learn Something New: Add one good book for educational purposes to your summer reading list: history, science, religion, finances, business or anything else you want to learn about. Keeping your brain active and open to learning is vital to being healthy. If you aren’t the bookworm type, learn a new instrument. If your goal is to learn the “Lava” song on

a ukulele, go buy a $30 ukulele and start practicing! Constant learning helps postpone aging and could help you avoid early brain degeneration.

a ukulele, go buy a $30 ukulele and start practicing! Constant learning helps postpone aging and could help you avoid early brain degeneration.

August

- Look Into Your Employer’s Open Enrollment Period: Each fall, employees have a brief window when they can make changes to their insurance policies or set up and adjust contributions to health savings accounts (HSAs) and flexible spending accounts (FSAs). Look into any new options available and decide whether you should make any changes. And remember to include the often-overlooked disability insurance and life insurance company benefits. We review these with clients often and would be happy to look at them with you.

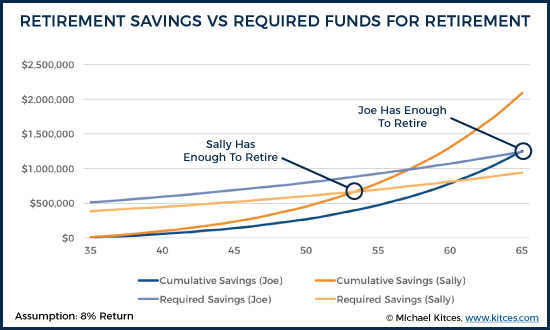

- Assess College Savings: It’s never too early to begin investing for the university years. A good first step is to set up a college savings account for your child, like a 529 plan or Roth IRA. Already have one? Consider asking family members to contribute to that account in lieu of gifts for your kid’s next birthday or holiday. If you’ve already been saving for college then it’s worth revisiting the risk of having too much saved in your 529. You want a balance of around 75% of total college costs saved in your 529. The reason you don’t want 100% is in case something happens to lower costs in the future or to give you flexibility in current cash flow. It’s worth noting that 529’s can now be used for middle and high school costs, as opposed to only college costs pre 2018.

- Review Vacation Spending and Plan for Next Year: Compare actual spending on vacations to what you budgeted. This will help you gauge your expectations and needed savings rate for future trips. Set up a separate savings account for next year’s vacation so that you will enjoy yourself even more knowing everything can be covered without straining the budget.

If you enjoyed this post and haven’t read the last one, I’d encourage you to give it a read by clicking HERE. Keep an eye out for our final annual checklist blog post around September of 2018 and if you have any Summer tasks that you enjoy accomplishing let us know by emailing us at team@smithpartnerswealth.com.