Buying vs. Leasing a Car

I often overhear conversations of someone discussing how leasing a car is the most intelligent approach to having transportation. However, seconds later, I hear the audible scoff of the car buying group, as if buying a car is the best financial decision since Seward’s Folly. Luckily, we don’t like to pick sides. Instead, we let the numbers do the talking.

Best Case Scenario

Below, we’ll explain the differences between buying a new car versus leasing a new car. But first, it is worth mentioning that a buyer will often save the most money by buying a reliable, slowly depreciating, well maintained, used car. This strategy saves money because it offloads the largest cost (a car’s depreciation) onto the previous owner. However, when buying a used car, you may have increased maintenance costs along with the mental/social cost of not driving a new car. But in the wise words of Click and Clack from CarTalk…

Owning an older car should be a source of pride. You’re showing that you’re sensible, not swayed by the latest models and capable of keeping your car well maintained. Who knows? That sort of no-frills common sense can be very appealing to members of the opposite sex. It might even land you a date! After all, who wants somebody who’s always got his eye on a new model?

Even if it doesn’t score you the babe or hunk of your dreams, owning an older car can offer you something else: a truly liberating experience. You no longer care about scratches, dents or bird droppings.

And, best of all? It’s paid for!

So who cares what your neighbors think? Shoot them a broad, smug smile the next time they eye your jalopy puttering down the street.

Buying New Vs. Leasing New

When deciding whether to buy or lease, it’s important to know that we will “pay” for the car’s depreciation in either scenario. We don’t avoid “paying” for depreciation by leasing, because dealerships calculate the estimated depreciation costs into the lease payment. Leasing avoids the hassle of selling our car at the end of the lease and it has a lower monthly payment. But, we give up flexibility in how far and how long we can drive our car.

If we want to return the car before our lease is up, then there is a penalty. And if we go over our allotted miles (typically 10k-15k per year), then there’s yet another penalty. When buying, we have a higher monthly payment but no mileage or time restrictions. And if we wanted to sell our car two years later, there’s no penalty. It’s worth noting that the difference in maintenance costs between buying and leasing is negligible.

Leasing

We’ll get into the numbers below, but in general, leasing makes the most sense for someone who:

- Buys a brand new car every 3 years

- Dreads the process of selling their car

- Drives less than 15,000 miles per year

- Buys cars that depreciate quickly

Buying

Alternatively, buying tends to make the most sense for someone who:

- Drives over 15,000 miles per year

- Doesn’t mind the process of selling their car

- Typically keeps their car longer than 3 years

- Buys slowly depreciating vehicles

Math

To know what option is cheaper, we need to compare a few different variables, such as depreciation, down payment, sales tax, disposition fees, and property taxes.

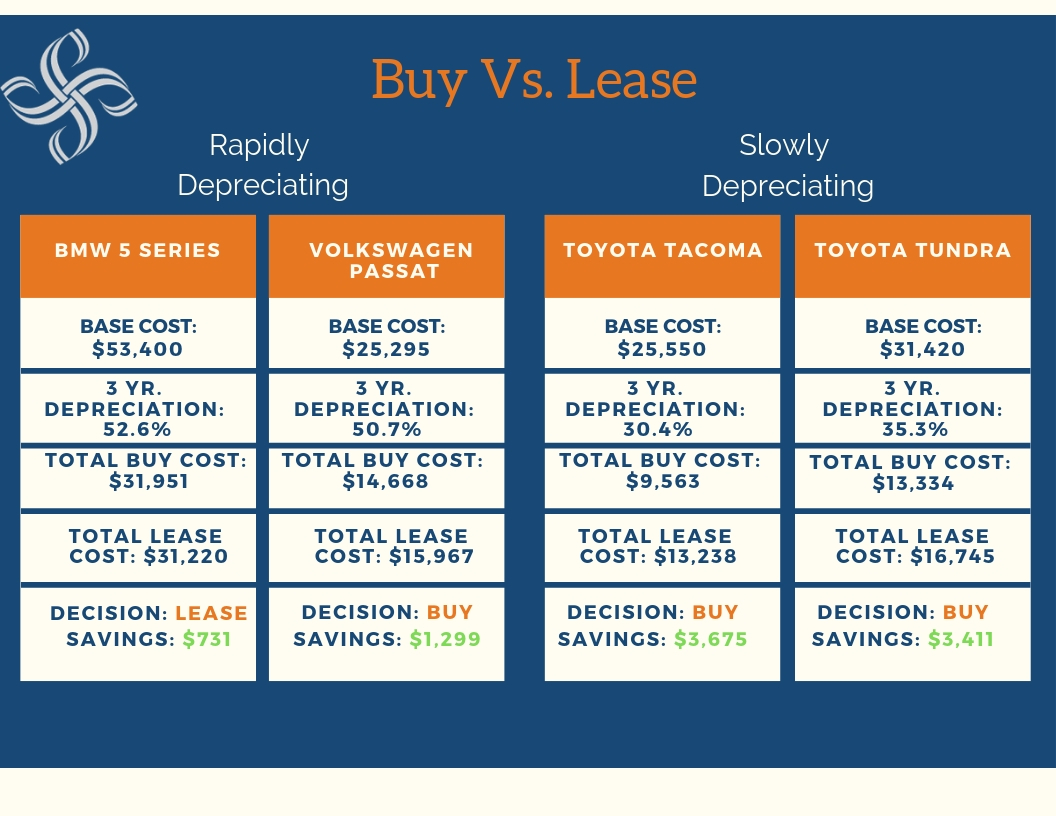

Rapidly Depreciating Example, BMW 5 series:

Buy: According to AutoTrader, the BMW 5 series should depreciate 52.6% in the first 3 years. This brings it down from an initial cost of $53,400 to a value of $25,312 (losing $28,088 to depreciation). Add in the NC 3% highway use tax of $1,602, a downpayment of $5,054, and a 2.99% interest rate will cost an additional $2,261 over 3 years. All in, the total cost of buying a BMW 5 series in this circumstance would be $31,951, or $10,650 per year.

Lease: Total payments are $649 x 36 = $23,364 over 3 years. Add in the $1,602 sales tax and a $200 disposition fee (cleaning fee at lease end) plus a $5,054 down payment and $1,000 leasing fee brings you to a total of $31,220, or $10,406 per year.

In the above scenario, leasing saves you $731. However, that could change if you negotiate an interest rate below 2.99%, or if you drive more miles than allotted. However, with a decision this close, it comes down to preference and the flexibilities you value.

Cost Comparison

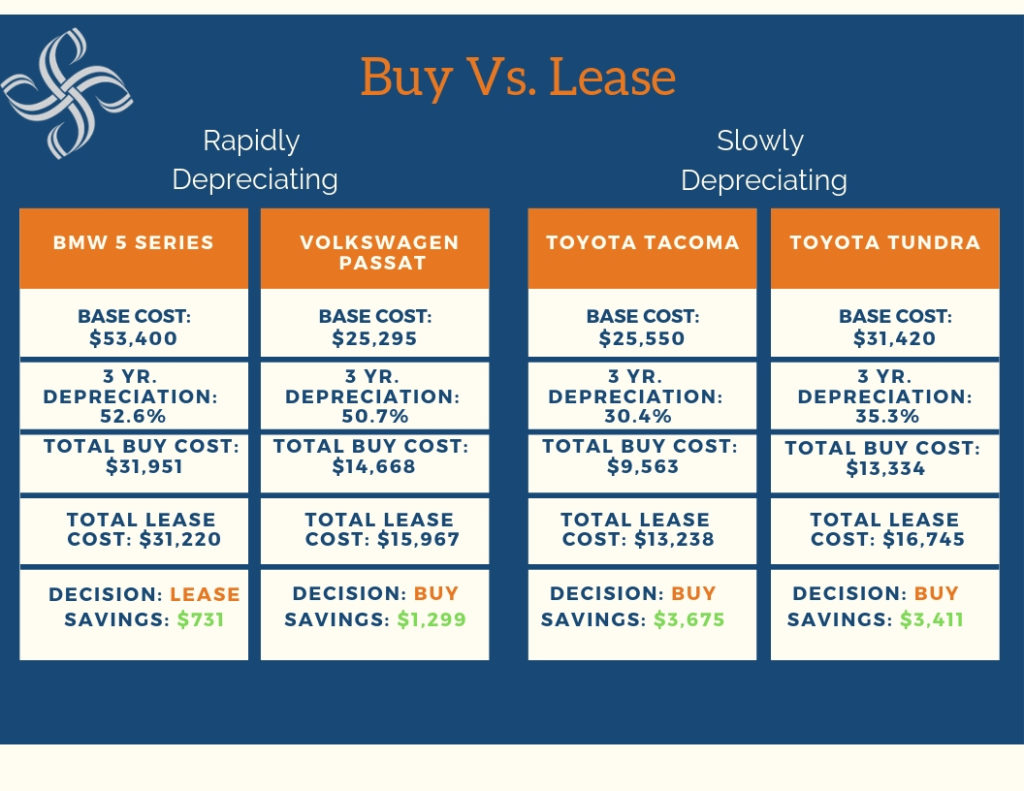

Below I’ve summarized the total costs of buying and leasing four different vehicles, sampled from a list of the top ten fastest depreciating cars and the slowest depreciating cars of 2018.

The chart above shows that some buy vs. lease decisions like the Tacoma are no-brainers. However, some, like the BMW 5 series,

Opportunity Cost

The last argument I hear is that someone can invest the difference in their monthly payments to make up for the lease shortfall. This is possible, but it depends on the investment opportunities you have available, market and the timeline. Also, people rarely save more with this strategy and will typically buy more car than they should. They use the “invest the difference” argument to rationalize the larger purchase, but when life happens, they revert to their typical savings rate.

Focus on Net Worth

It is worth noting that while buying is often better than leasing, the most important number to consider is the total cost. For instance, you may ask yourself if it’s better to buy or lease the Passat. However, regarding net worth, you’d be better off leasing the Tacoma compared to buying or leasing the Passat. Despite being similarly priced, the Tacoma depreciates slower and will allow you to have approximately $1,430 more, at the end of the day ($14,668 cost of buying Passat – $13,238 cost of leasing Tacoma = $1,430).

Process

There is a right and wrong process of thinking through a purchase. The right way is to first, see what you can afford and know how that decision will impact your other financial goals. Then, shop around for what’s in your price range. However, all too often with cars, houses, and clothes, people shop first and budget later. This thinking can cause a buyer to favor low monthly payments as the primary variable instead of depreciation and overall cost. Low monthly payments may seem great for month-to-month living, but they are poor for long term planning.