Do I Belong Here? – All-Time Market Highs and The Good Place

“On December 31st, the S&P 500 Closed at 3227.57, Within 0.35% of its All-Time High…”

I would bet that reading the above headline tells you something. Maybe “Finally, I made it” or “How long can we keep this up?” or maybe even “There’s nowhere to go but down.”

When my wife suggested that we start watching the TV show The Good Place, I agreed because it checked off a few requirements for me: good reviews, short episodes, no commercials, and a certain end after four seasons (I’m not falling for another Grey’s Anatomy for the next two decades.)

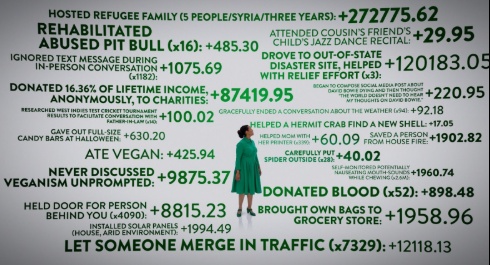

The show’s premise is that after death and some cosmic point tallying (see below,) only a tiny portion of the world’s population goes to the “Good Place” and the bulk of humanity goes to the “Bad Place.” The show centers around Eleanor, a conclusively “bad” person while on earth, who inexplicably finds herself in the Good Place after her death. She works feverishly to avoid being discovered among the Goody-Two-Shoes, perpetually nervous that she’ll be found out and sent to the “Bad Place.”

Congratulations, You Are In The Good Place

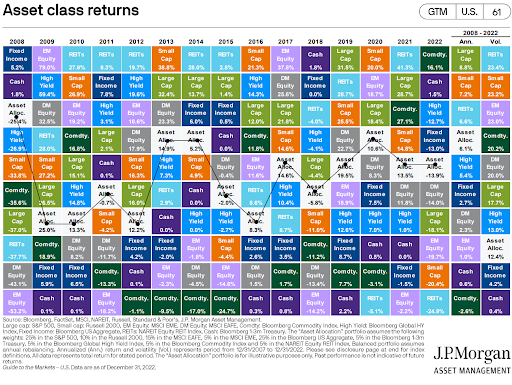

Over the last 5 years, the Standard & Poor’s 500 Index (S&P 500) has been within 5% of its All-Time High (ATH) for 78.98% of its days, with the average distance below at a minuscule -2.92%. Sure, we’ve experienced as much as a -19% drawdown from the high (9/20/18 to 12/24/18,) but overall, I would refer to our current proximity to the All-Time Market High as the “Good Place.”

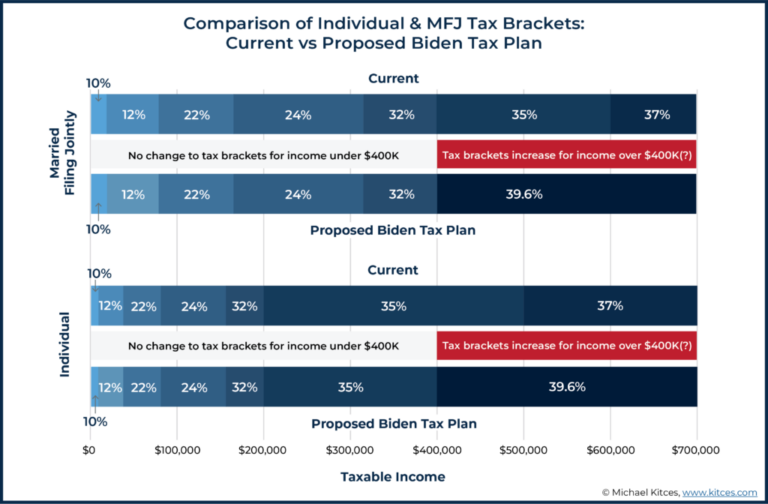

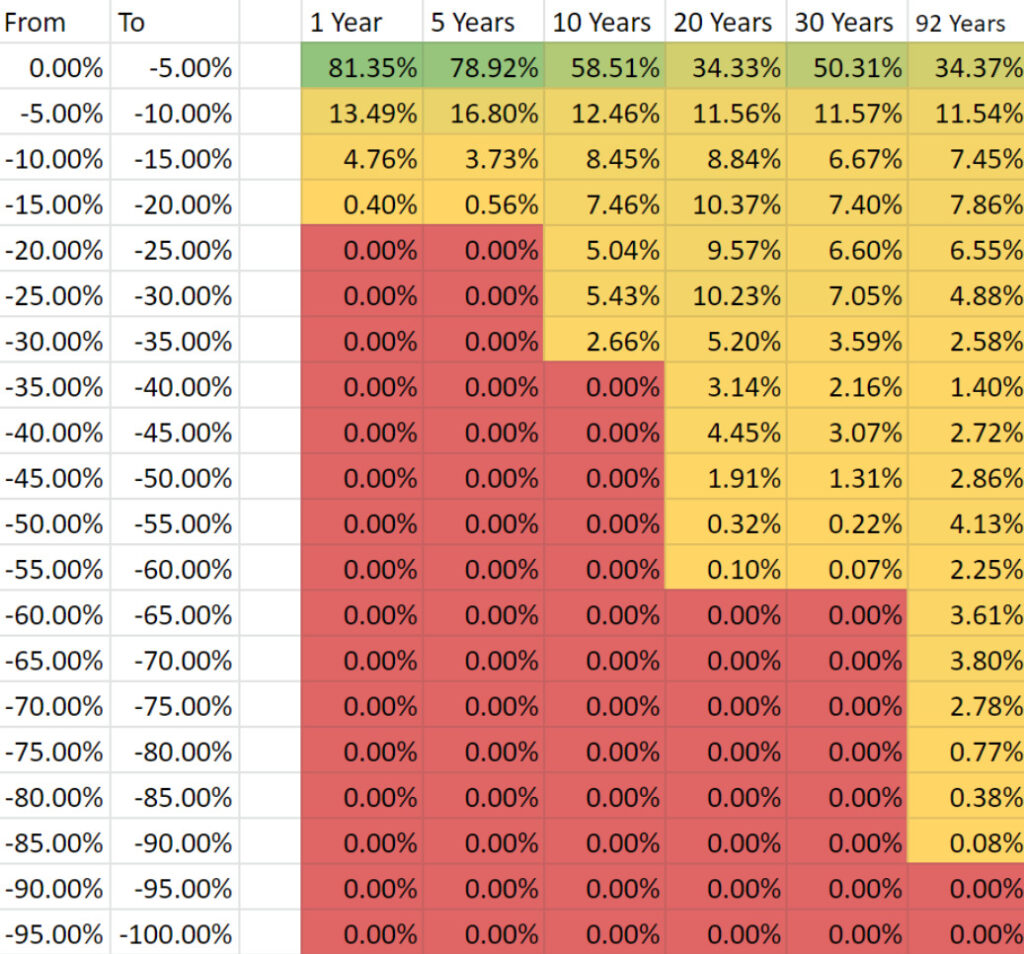

But, like Eleanor, we might question if we really belong here. To put those last five years in perspective, let’s take a look at the percentage of days the S&P 500 has been at different levels below the All-Time High over the last 1, 5, 10, 20, 30 and 92 years.

% of Days Below the All-Time Market High

Anyone who has only been in the S&P 500 for the last 5 years has had a relatively pain-free investing experience. Whenever they turned on the news, once every two weeks (on average) they saw the headline “Market Closes at All-Time High.” And on nearly eight out of ten days (78.92%), they saw the chyron scrolling across at the bottom of the TV screen saying “S&P 500 Within 5% of the All-Time High.” They never saw the market close more than 19% below the All-Time High. That’s a rosy last 5 years.

Anyone (perhaps a retiree) who has invested in the S&P 500 for the last 20 years has experienced more frequent and more intense volatility. Whenever they turned on the news, they saw a new All-Time High only once a month. They spent as much time 20-55% below the All-Time High as they did within 5% of the All-Time High (34% of their days).

Do I Belong Here?

In the show, Eleanor spends most of her days doing two things: 1) convincing everyone (including herself) that she belongs in the Good Place and 2) coming to the sad realization that she is an outlier. As investors, we should be able to identify with both undertakings.

We Belong In The Good Place…

Over the last thirty-two years, we’ve had a number of clients tell us they feel that certain doom awaits simply because we’re at an All-Time High. But when we look at historical returns, that hasn’t been the case.. Over the last 20 years, when an investor has been close to (within 5% of) the ATH, their average 5-year cumulative return (excluding dividends) has been a respectable +33.73%. If they happened to have started investing on the day of an All-Time High, their average 5-year return was a cumulative +45.15%. Again, we don’t know what the future will hold, but it has hardly been a signal to retreat.

…We Are Also Outliers

But just as Elenor realized, we are a bit of an outlier right now. Investors over the last 1 and 5 years have spent ~99% of their days within 15% of the All-Time High. However, over the last 20, 30, and 92 year periods, most investors spent only 53-68% of their days within 15% of the ATH.

Can I Afford to Go to the Bad Place?

No one can consistently predict when we’ll spend some time in the Bad Place, but we should expect it at some point. Market drawdowns are as much of a fact of life as All-Time Highs, and they will impact investors differently:

- If an investor cannot afford (emotionally and financially) to spend some time in the Bad Place, then the time to prepare for that outcome is now. That might mean rebalancing to take on less risk, increasing a cash reserve, or paying off debts.

- However, for the investor who accepts that they can’t predict a downturn and has the time to ride out a stay in the Bad Place (at least with a portion of their portfolio), then the eventual trip “down there” shouldn’t be too painful.

- Even more so, for the person in their 20s or 30s, who has much of their saving and investing life in front of them, they should welcome the lower prices that come with a trip to the Bad Place.