I come from a long line of people who can’t keep track of their things. When I was a kid, it was my soccer cleats or my homework. My dad (you might know him as Jonathan) would try to help. He would ask if I looked in the den or on the back porch. When I, at peak tween angst, would blurt out, “No! But I KNOW it’s not there” he would respond:

“You need to look where you think it is, but you know it’s not.”

We read a lot of academic papers, continuing education pieces, market research, and even the same popular press that many of our clients run across. Some of it is to inform and make us better investors, but much of it is to know what occupies the minds of our clients and other investors. Many of the headlines today imply, with some degree of certainty, the future direction of interest rates, the economy, foreign and domestic stock markets.

Being a diversified investor can be frustrating because it means looking for investment returns (like my soccer shoes) even where you “know” they aren’t. That was the case with many bond investors a year ago. Many “knew” that yields couldn’t get much lower and were “certain” that rates couldn’t drop any. But then they did. And so far this year, the Barclays US Bond Aggregate index has returned 8.5%, its highest return since 2002.

Of course, if investors looking for yield and safety were scared away by 3% yields a short time ago, the prospects of 2% (or negative yields) can be even harder to comprehend. As a recent Bloomberg piece points out: “Even if 30-year yields just rose back to the level they were at two weeks ago, it would mean double-digit losses for anyone who purchased them on Wednesday (10/9/2019).” Bank of America has gone so far as to suggest the end of the 60/40 portfolio because they don’t believe bonds are going to cut it.

The current 30 year treasury yield as of October 10, 2019 is 2.16%.

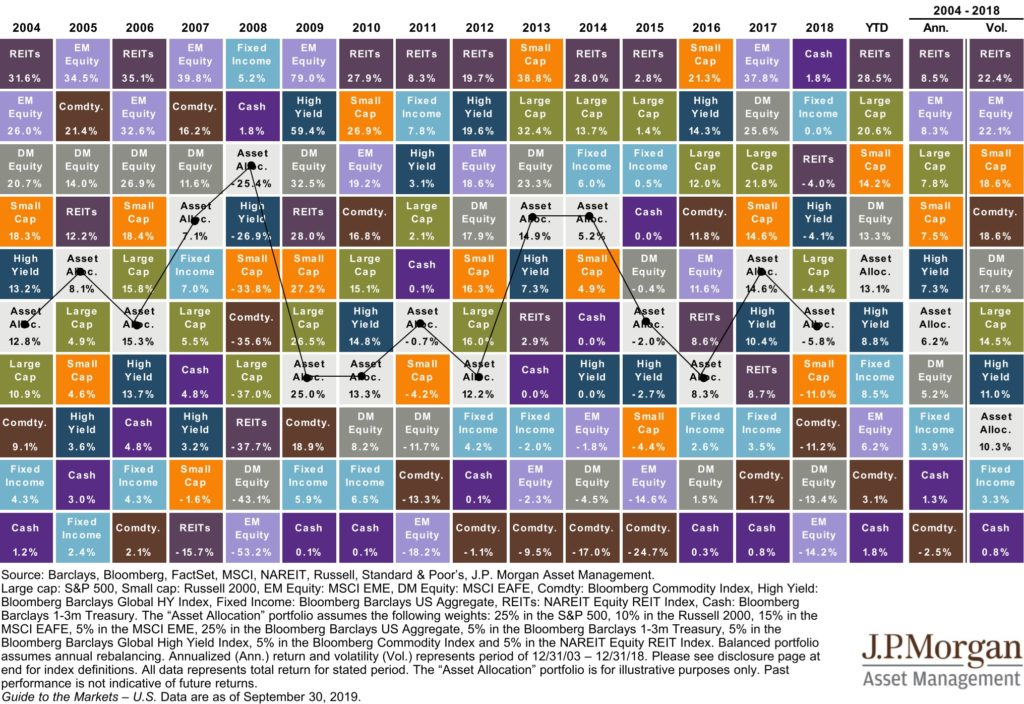

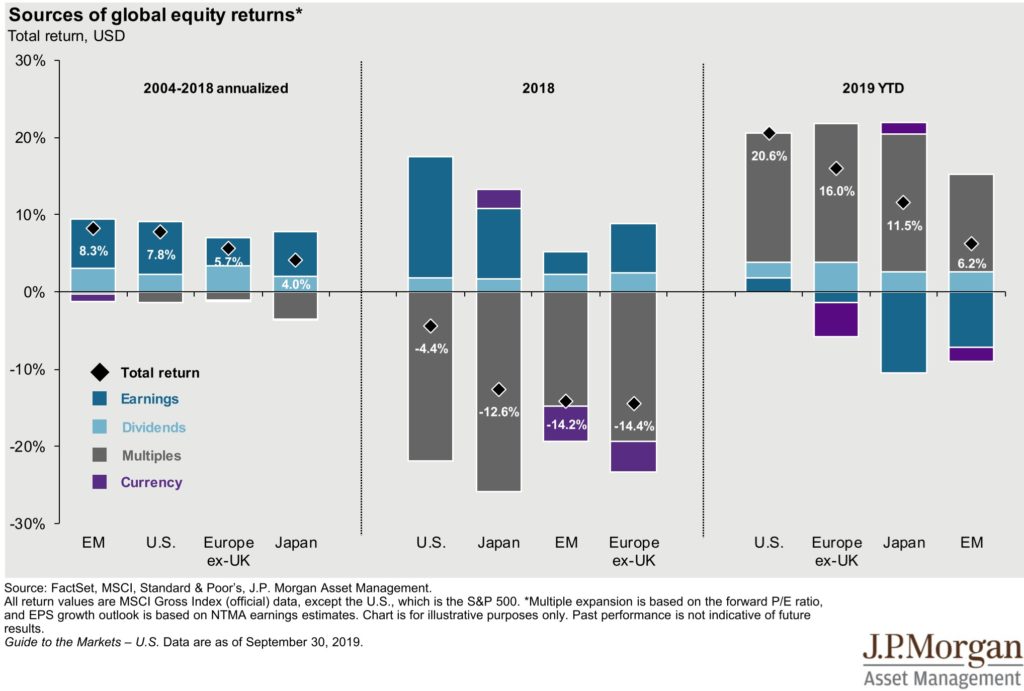

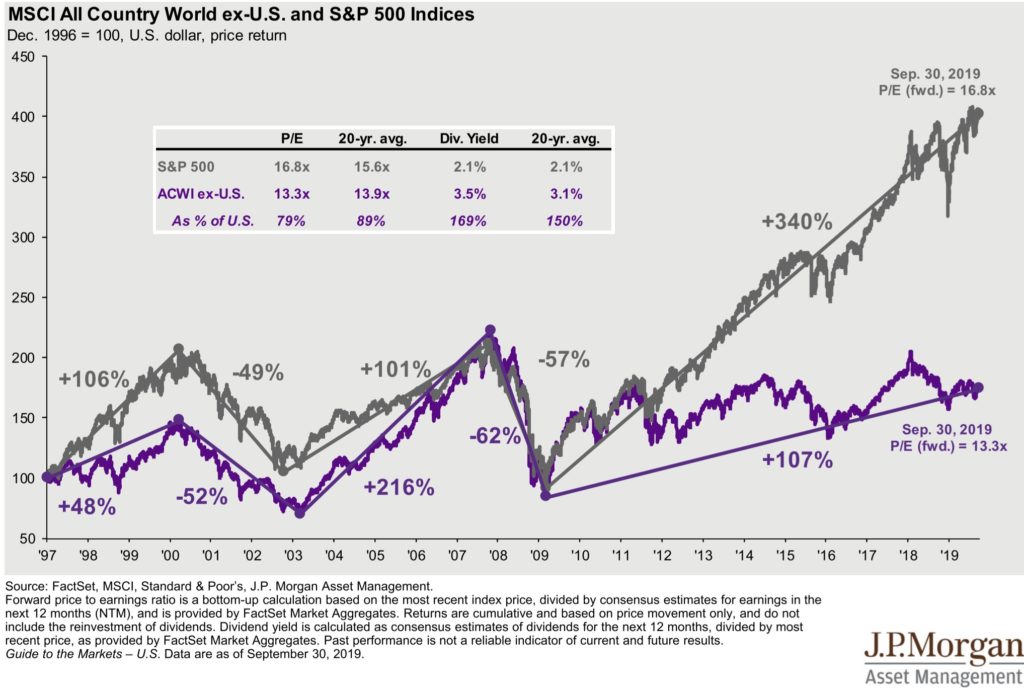

We’ve seen similar “certainty” with the returns of Developed and Emerging Markets in recent years (DM Equity and EM Equity respectively, in J.P. Morgan’s patchwork chart above and represented below). Foreign markets trailed the US when all equities were down in 2018…and have trailed again in 2019 when all equities have been up. Why would anyone want to own foreign assets?

But this sort of Sample Size of 2 can lead to some pretty dangerous responses when we are “looking” for returns: “No, dad…I know I won’t find my expected investment returns (or my soccer cleats) in emerging markets or in bonds…everyone knows that.” We think a wise investor should consider looking (and allocating) even if they “know” their returns aren’t hidden there.

One of my least favorite phrases is “the stock market hates uncertainty.” For one because, even with the rise of algorithmic trading and passive investing, the “market” is made up of “humans.” And to say that humans dislike uncertainty is a grand understatement. But more so, there is always uncertainty in the market. Frankly, the danger is when our perception of uncertainty is dramatically off.

Joachim Klement wrote a wonderful piece for CFA Institute’s Enterprising Investor blog. In “Sunny Saturday and the Risks are Rising” he mentions a taxi ride in London where the taxi driver noted that a beautiful sunny Saturday was the most dangerous time to drive. Klement learned that drivers tend to pay attention when the weather is bad, but drop their guard when all seems well.

It is healthy to recognize that all seems “sunny” with US Stocks (and all seems cloudy with Bonds and Foreign equities). But we would encourage investors to be mindful of both a) their perception of the markets and their financial situation and b) what informs those perceptions.

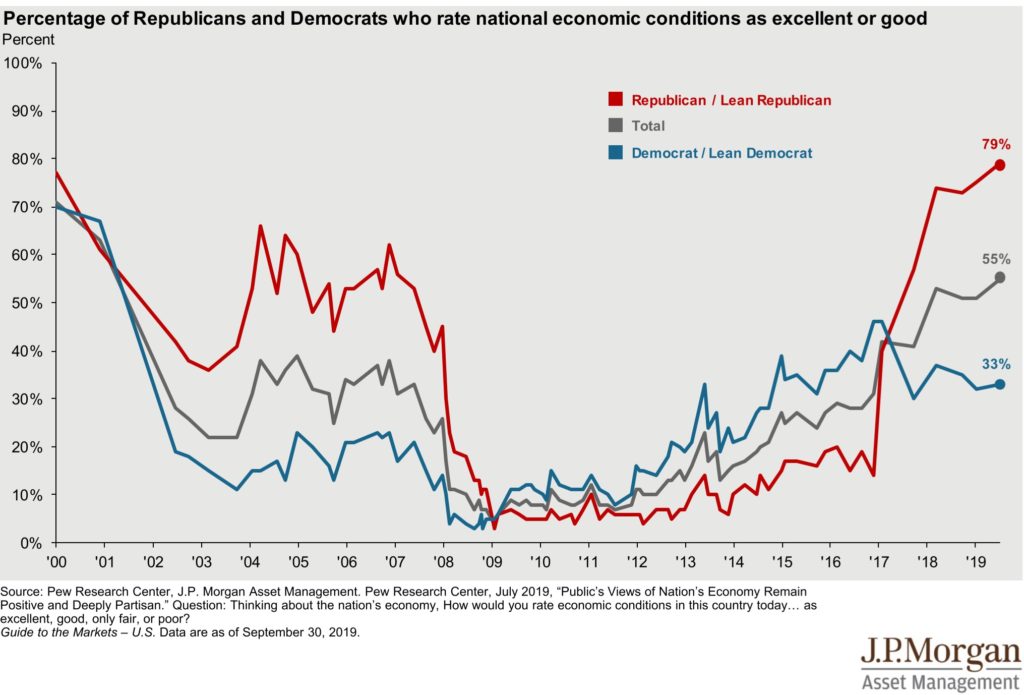

A great example of the latter is the J.P. Morgan graph below. For the last 20 years, Pew Research has survey data on how people currently feel about economic conditions (note: not how they think those conditions will be in the future, but right now.) We can see that a change in who is in office drastically changes how people perceive things to be today.

Uncertainty is always going to be closely correlated with investing returns. And while investors can rely on conventional asset allocation approaches to decrease uncertainty, there is no guarantee that investors will “find” the returns they’re looking for over the time period they require.

It feels like we’re entering a period of greater uncertainty in the investing realm (mostly due to the uncharted territory of near-zero bond yields at the same time as all-time stock market highs).

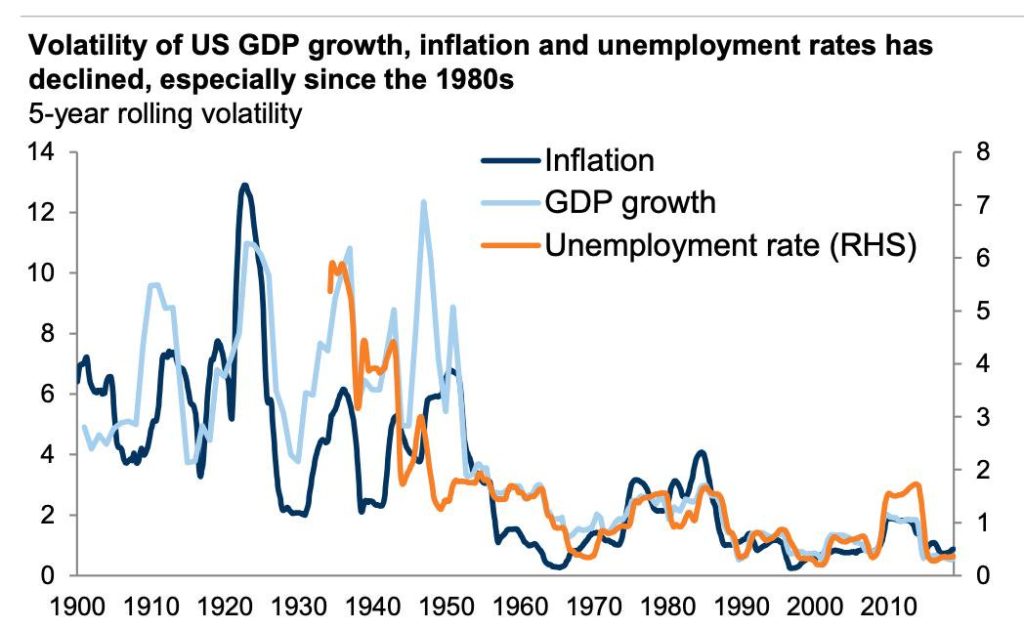

To the extent that uncertainty translates to volatility (and volatility translates into periods of below-average investment returns), it is important to keep our current situation in light of our history. As the Goldman Sachs chart above details, we’ve been in a period of declining economic volatility. While we could certainly return to the blips of 2010 or even the first half of the 1900s, we don’t think that is the most likely scenario.

Although it feels like we end every Quarter in Charts this way, it is important to remember that any assumption or belief about future returns and volatility should be filtered through a person’s specific financial plan.

For example, we have a client with an extensive history and knowledge of doing business in and with a certain country. They asked that we do our best to limit our exposure there. We talked through the potential impact on their portfolio and financial plan, determined it wouldn’t put their goals in danger, and were able to better align their portfolio with their beliefs.

Now that is a simple example. What if the investment in question had been “bonds” or “ETFs” or “All Foreign Equities”? Or even outside of the typical portfolio. What if the investment in question is “Pay Off Debt” or “Invest in Real Estate” or “Put Money into my Business”? The conversation and process of education and plan realignment would have been quite different, but no less important. The point is to be conscious of why we are looking for returns in certain places and to be open to the idea of looking where we know they aren’t.