Quarter in Charts – Q3 2024

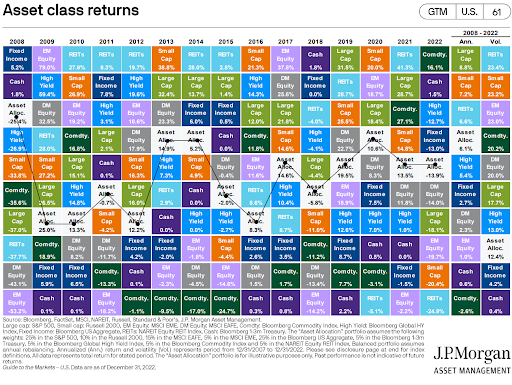

2024 is shaping up to be one of the rare years with no major asset class in decline (see far right column in the chart below.) Large Cap US, Foreign Stocks, and Real Estate have led the way, while Bonds and Commodities have returns barely more than money markets. Below, we will detail the relevant…