Understanding Probabilities of Success in Financial Planning

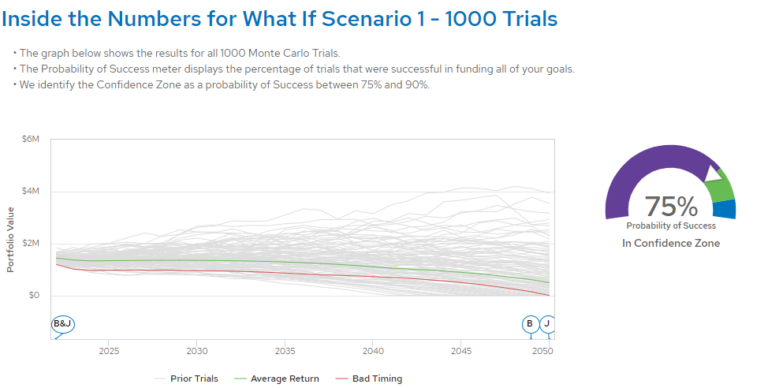

It Looks Like I’ve got a 75% Chance of Making it Home From Work When we talk about achieving financial goals, we use the term “Probability of Success”. It comes from a Monte Carlo mathematical model that produces a number ranging from 1% to 99%. But what does a 50%, 75%, or 99% probability of…