Explaining Market Losses to a 10 Year-Old

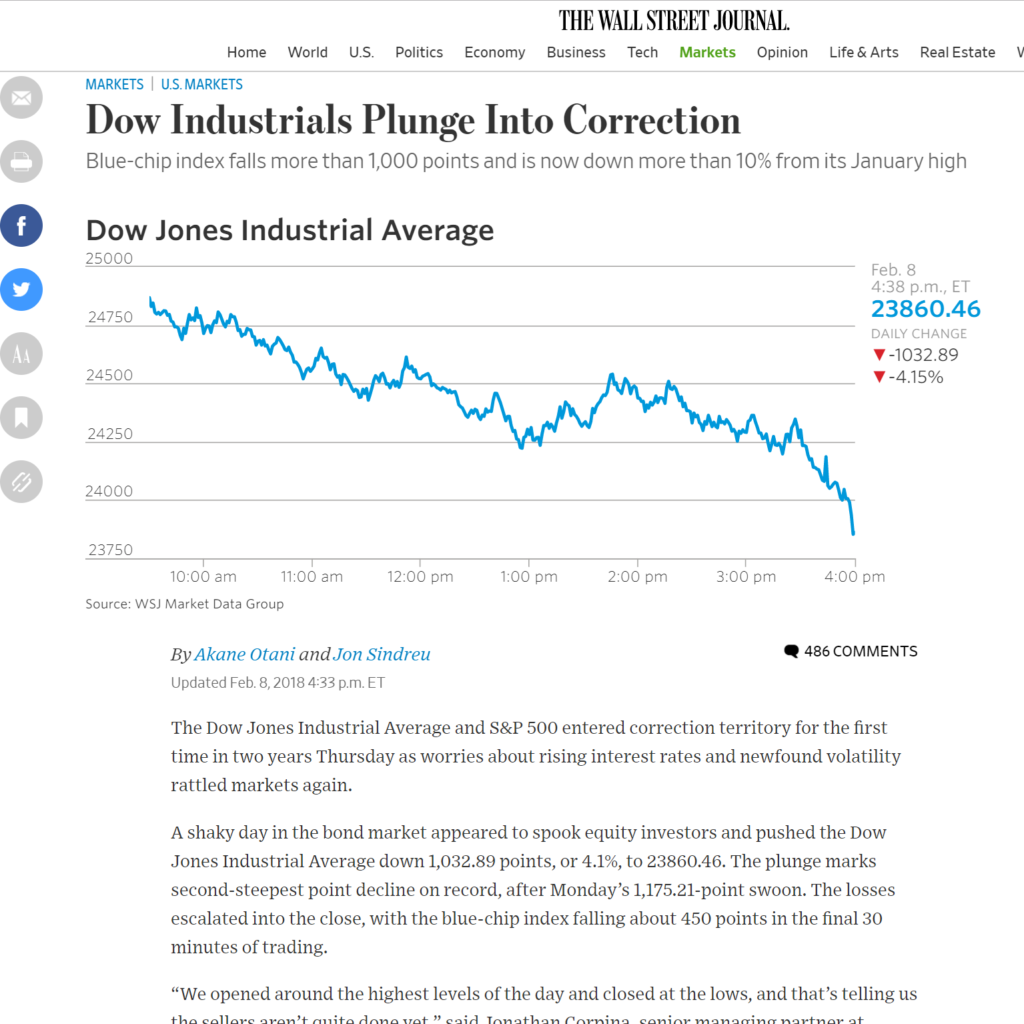

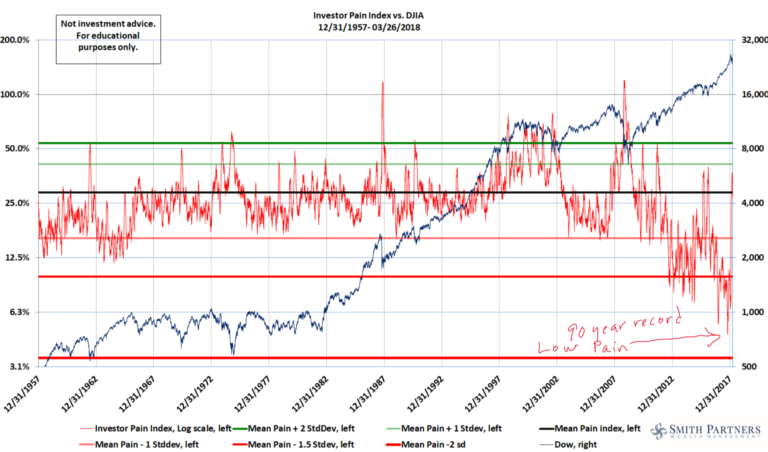

Today the Dow Jones experienced a 4% drop, closing below 24,000 for the first time since November 28th (just 72 days ago). Furthermore, in the last 9 trading days, the Dow has dropped 10.3% from it’s all-time high (thus officially earning the name “a correction”).

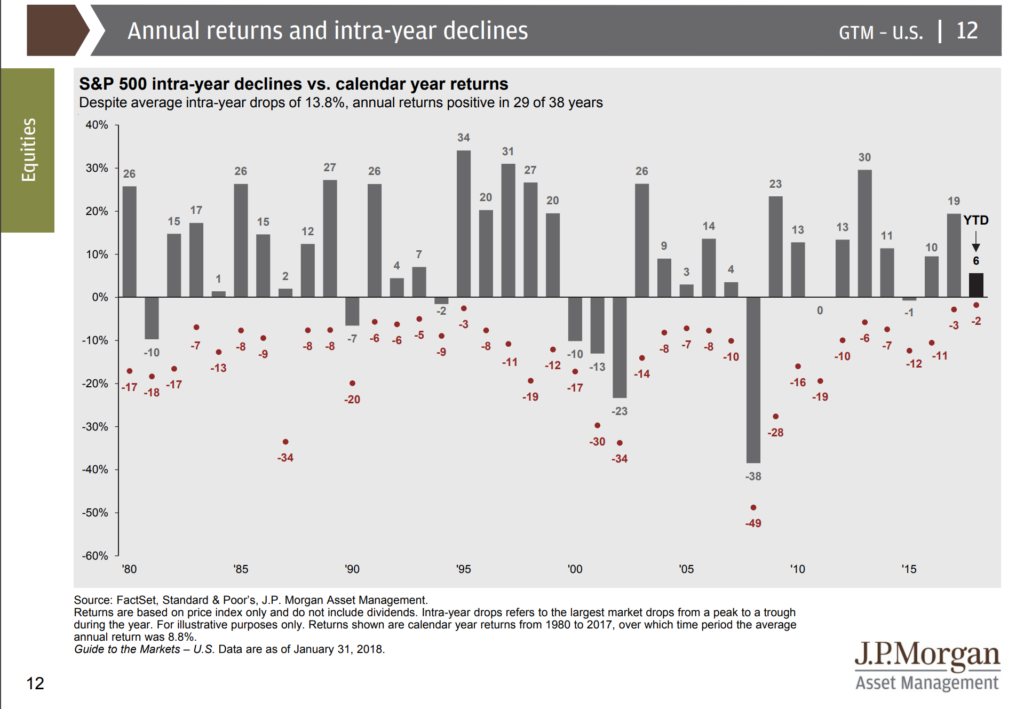

While it’s unsettling to see a pullback in the market, it pays to have some perspective. Over the last 38 years, investors have lived through a downturn of greater than 10% in more than half of those years. In fact, the average intra-year drop has been 13.8%.

Another way to see it is that stocks have been transported back to where they were just over two months ago. Our main advice is to stay away from the headlines and focus on your plan. If your plan was in great shape two months ago, then it is in great shape today. If it made sense to invest two months ago, then it likely makes sense today. If it made sense to hold cash or pay off debt then, the same likely holds for today.

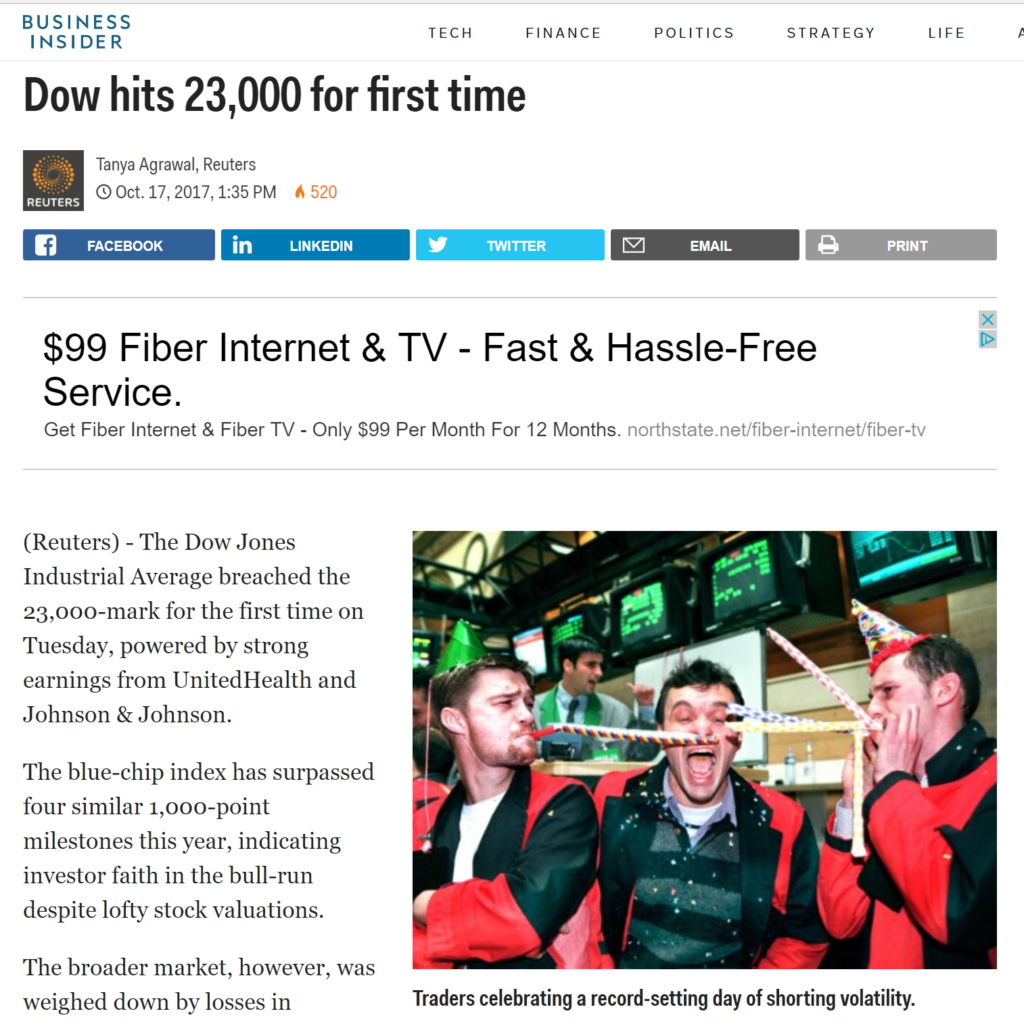

For proof, look no further than the pictures below. The picture on top captures elation as the Dow crossed 23,000 in October. The one below captures today’s fear and worry of a Dow closing below 23,900…or 3.5% higher than the picture on top.

Explaining Market Losses to a 10 Year-Old

As she often does, my 10 year-old had a fair point: “So, if my money can go down like that…why would I invest?”

This past weekend, I must have been high off NBC’s This Is Us hype. With all the confidence of Jack Pearson and all the enthusiasm of Randall, I unveiled to our kids the “Smith Family Investment Model” (it’s a working title…I might actually go with “The Big Three Investment Model”).

In a world of 1% interest savings accounts, it is hard to get inspired by the power of compounding. So I have taken matters into my own hands. Every month, I’m paying 1/12th of a (very generous) 18% annual return on each kid’s month-end savings balance.

To drive the point home, I made a fancy 216 row Google spreadsheet showing the impact of allowance, additions, subtractions, and the compounded growth until they go off to college. Not surprisingly, the reaction was mixed: the 4 year-old was oblivious and the 8 year old started figuring how many Legos she could buy next week.

But our 10 year-old (the one who dreams up math problems for fun) was mesmerized.

She quickly realized that by the time she was 14, she could be earning more from her “investments” than from her monthly allowance. Then she started to plug in “additions” to see how she could back that up to age 13…and then 12.

And of course she had more questions:

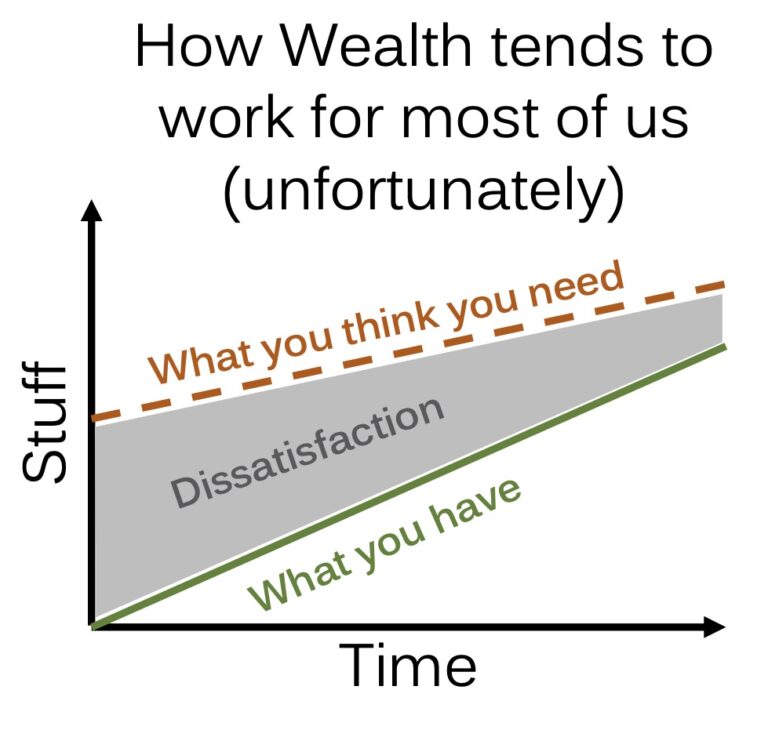

- “So, if the bank pays 1%, why are you paying 18%?” (Because I want you to learn something).

- “Then why won’t you round it up to an even 25%” (Because that would cost me a lot more money…and if you can’t be happy with 18%, you won’t be happy with 25%).

- “Why do my siblings get to invest for longer…shouldn’t I start off with a little more money to make it even?” (blank stare as I wonder if I am the patsy at the table).

History Lesson

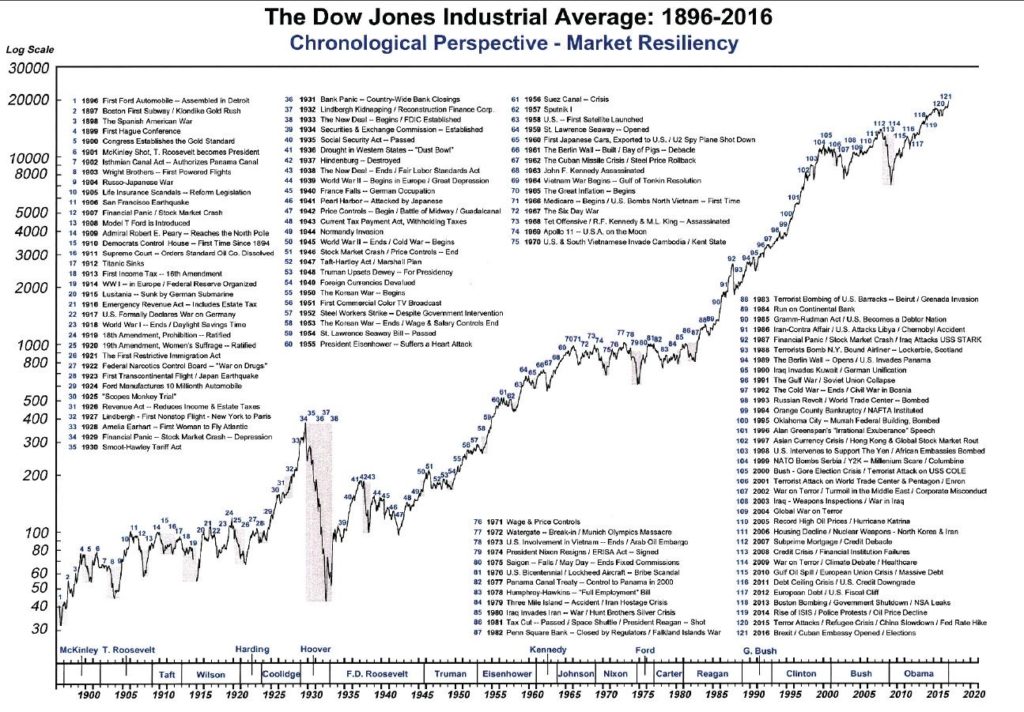

My primary goal in this process is to instill a love for diligent saving and intentional spending. But at some point, we’ll switch the kids from the “Bank of Mom and Dad” over to dealing directly with “Mr. Market“. So we also talked about the history of market returns,

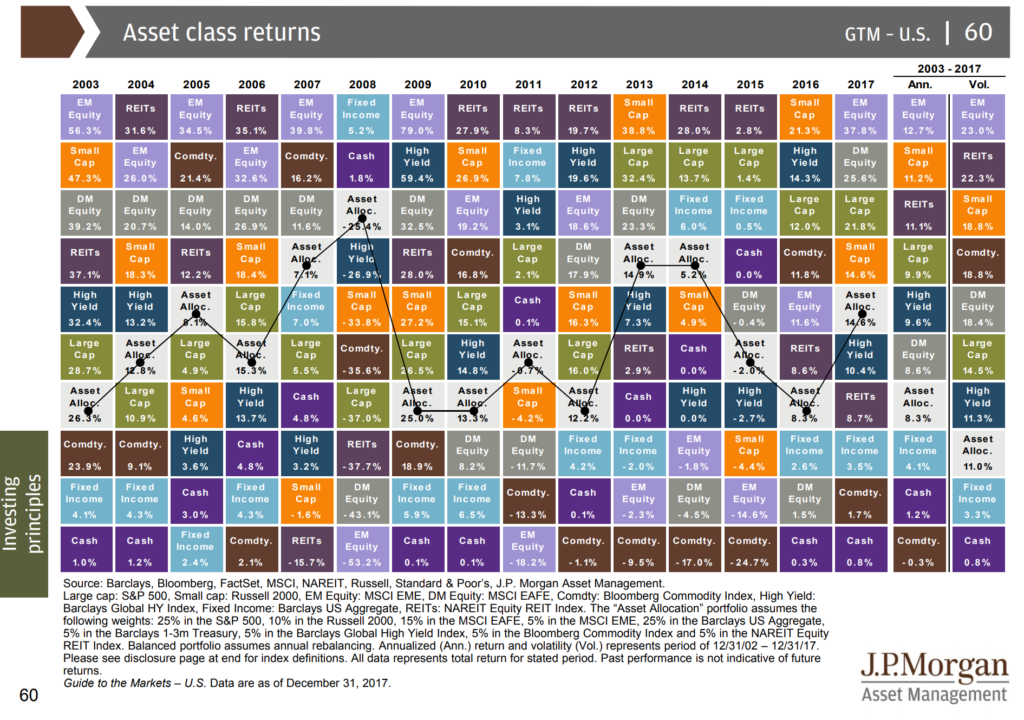

and how an investor can earn a return from different kinds of investments (asset classes),

and how it is normal to experience large drawdowns in the short term on the way to earning large long term returns:

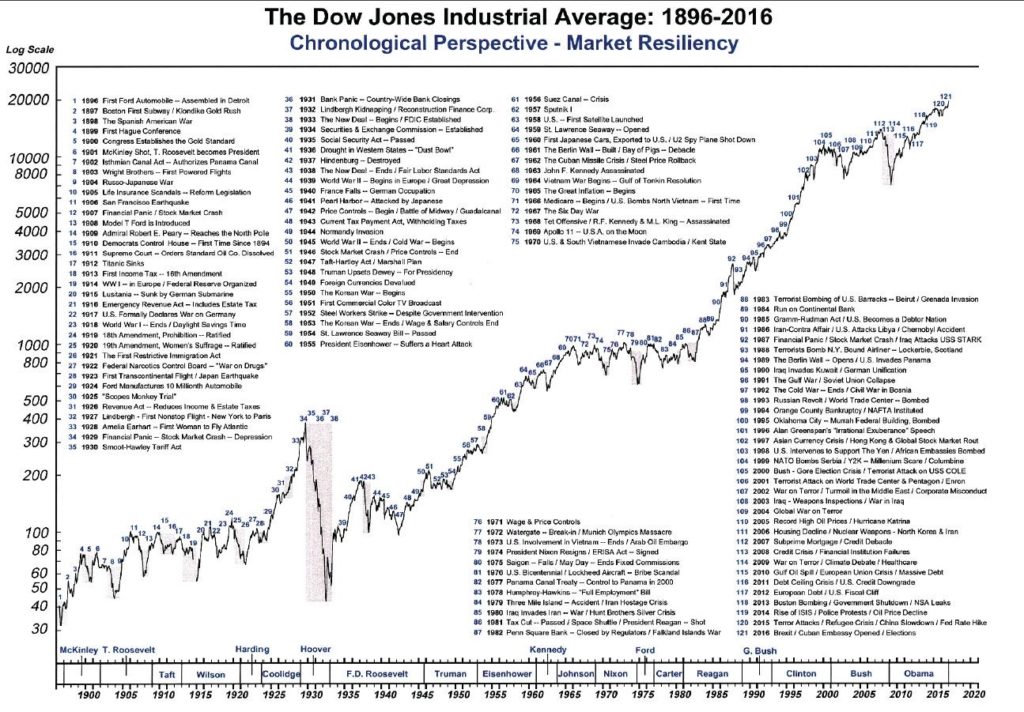

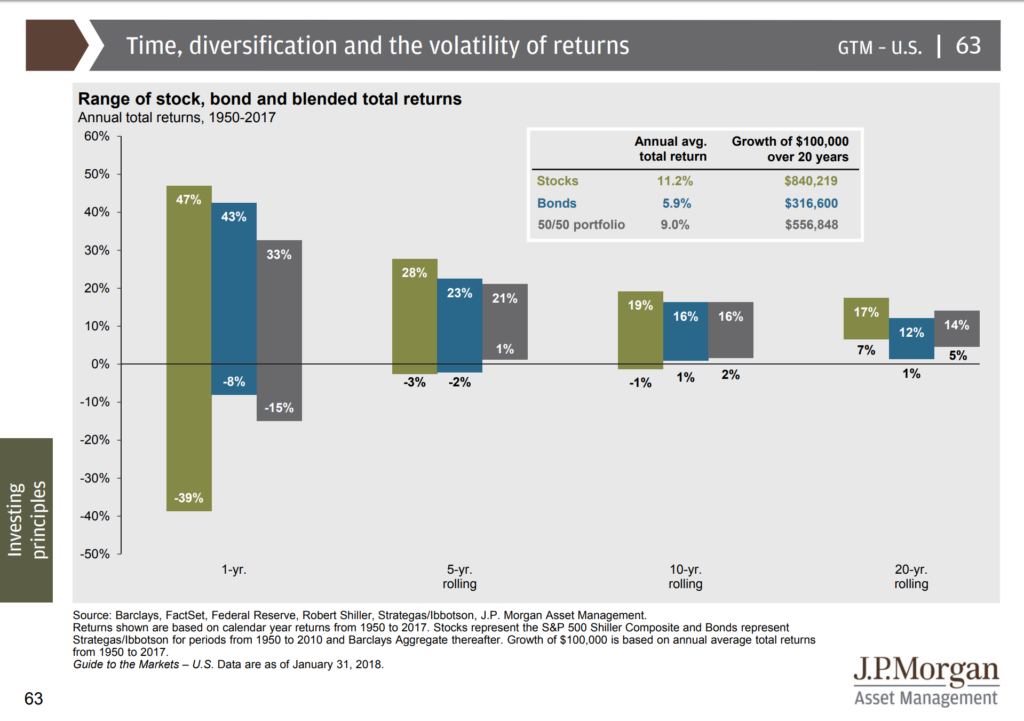

She struggled with the next chart. It shows the extreme pendulum of what can happen in the market both to “safe” and “risky” investments. Even over 10 year time horizons, the market can be worse than sticking money under the mattress. But over the longest term, it is hard to not make a life-changing return on your investment.

It Clicks

“So if I’m 15 and about to buy my car, I guess I don’t want to invest…but if I don’t need the money, it probably makes sense to stay invested?” I couldn’t have said it better myself.

Investing only makes sense in the context of a financial plan. If we don’t know the “what, when, and whys” of our money, we’ll be rudderless vessels in the market, drifting from headline to headline.

The Plan Matters Most

Yes, I realize we’re only teaching our kids a portion of the investing story, but frankly it’s the most important part. If grown adults, who have lived through numerous market cycles and have large 401k accounts to show for it, have a hard time making sense of (and staying invested through) market corrections…then what makes me think my 10 year-old can?

For now, we’re choosing to lay a foundation on the things our 10 year-old can control (her earnings, her spending, her saving, her time horizon…basically her financial plan). Sure, that’s easier when it’s “The Bank of Mom and Dad”, but as we can see above, “The Bank of Diversified 5, 10, and 20-Year Returns” isn’t so bad itself.