If I Had to Recommend One Book About Money

There is a part of our brains called the Reticular Activating System or RAS. Our RAS acts as a filter; telling us what to pay attention to and what to disregard. An example of this is seen when we buy a new car, we suddenly notice all of the other cars on the road that look just like ours. During the car buying process, we unknowingly trained our RAS to find other cars that look like ours. Over time, this filter fades and is replaced with something else, such as the new shoes we want or a vacation we’re considering. Most people, mistakenly, overlook how valuable it is to train their RAS to work for them, subconsciously.

So, how can we best manipulate our RAS to work for us? How can I tell my brain to focus on the one or two critical things that will provide the highest return on investment?

The answer is twofold. First, you need to know some essential truths; second, you need to remind yourself of these truths regularly. This is true in relationships, in business, and certainly true when it comes to money. One tool we’ve found helpful with the first part of this equation, in regards to finance, is the book “The Psychology Of Money” by Morgan Housel. It shares timeless financial lessons in a collection of short stories that make the read enjoyable. Not only that but it’s packed with essential truths about money.

My Key Takeaways – (Link to Morgan Discussing his book – 54 minutes)

- How you behave is more important than what you know

- Results come from consistent action, not knowledge.

- Example: The janitor who died with over $8 million

- Save like a pessimist and invest like an optimist

- Getting rich means taking risks, riding volatility, and being optimistic. But staying rich often means being pessimistic and safer with your investments/savings.

- Luck plays a role in your successes and your failures

- The more successful someone is, the higher the likelihood that luck played a role in their life.

- Example: Bill Gates went to Lakeside Highschool, one of the only schools in the world with a computer, at the time.

- Learn YOUR strengths and weaknesses and play to them

- Do you panic in volatile markets and seek safe investments? If so, change your strategy now rather than during an emergency.

- Play YOUR game when investing

- If day traders drive up already overvalued stock prices, don’t let that influence your investments…unless you are a day trader.

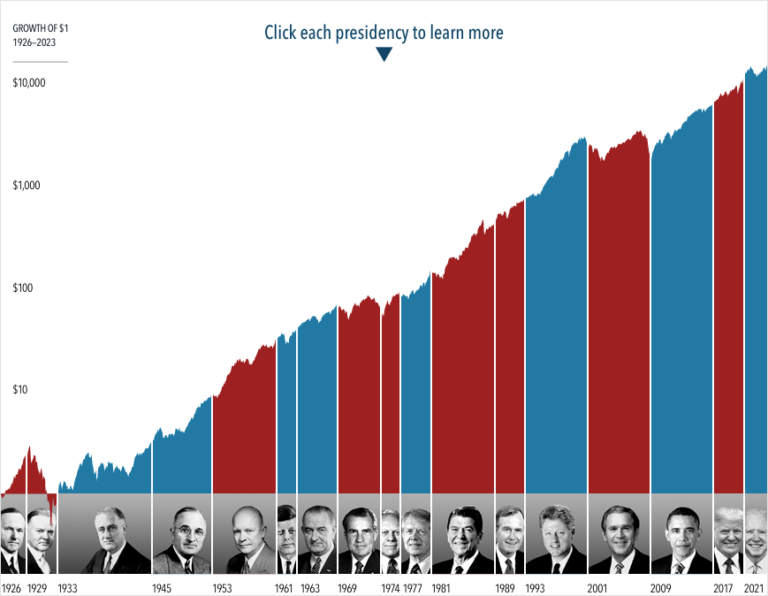

- Those who invest the longest have the best chance of having the most dollars

- Warren Buffet vs. Jim Simons, Simons has reported an annual return far higher than Buffet’s, nearly 66% since 1988. However, Buffet has more money.

Although the key points I highlighted are helpful, they aren’t a replacement for reading the entire book. One of the benefits of reading a book is the amount of time and attention we give to it. It’s because of this attention that we further train our RAS towards a singular goal for ourselves. If our attention is spread over five things simultaneously, it confuses our RAS on what it should value. If you wish to improve your financial life or enjoy well-written books then I would recommend taking the time to read “The Psychology Of Money”.