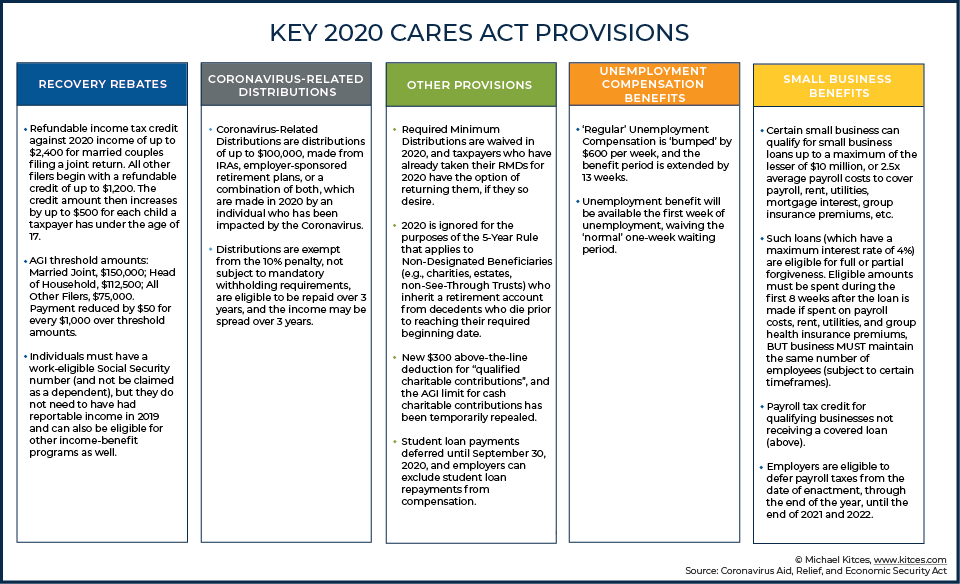

Individual Focus: Coronavirus Aid, Relief, and Economic Security Act (CARES)

Disclaimer: We’ve pooled several resources together to give you a comprehensive look at the new developments in tax and unemployment law changes since the onset of the Coronavirus. However, do not consider any of this to be tax, legal, or financial advice. We would be happy to talk with you more about your specific situation, but do not pursue anything detailed below without consulting another professional who knows your particular situation or us.

The following is an overview of how the CARES Act provisions could impact individuals. (You can see our Small Business post here.) Below, we’ll cover the tax filing deadline changes, recovery checks, RMDs, Qualified Charitable Contributions, Net Operating Losses, retirement account distribution and loan changes, unemployment insurance, and student loan relief. If you would like to talk about how any of these impact your specific situation, please don’t hesitate to reach out.

We are grateful for Jeff Levine from Kitces.com for his thorough summary, with graphics, about the relevant issues concerning the tax law changes. You may access his full post here.

- Tax Day has been moved to July 15, 2020, including the extension to make IRA and Roth IRA, HSA, and Coverdell contributions. Filing an extension will still only get you until October 15, 2020.

- NOTE: While North Carolina is waving the penalty for payments made after April 15, state law does not allow the NCDOR to waive the interest due. NC charges a minimum of 5% interest per year. More information here: https://files.nc.gov/ncdor/documents/files/2020-3-31-Important-Notice-COVID-4.pdf

- Recovery Checks

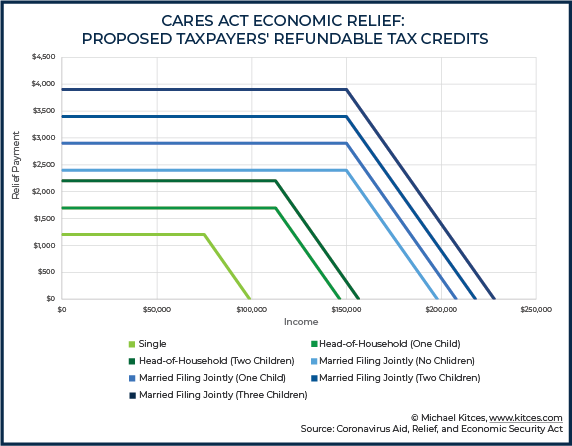

- $1,200 for Individuals, $2,400 for Married Couples,

- $500 for each kid UNDER age 17.

- And it isn’t taxable income!

- Begins to phase out at $75k AGI for Individuals, $150k for Married, and tapers off at different amounts depending on the number of kids (see chart above.)

- +90% of taxpayers will likely get recovery checks.

- The checks are based on 2018 or 2019 AGI (whichever is most current with the IRS). With that comes some issues and opportunities:

- Issues: Let’s say you’re married with no kids and earned $250k in 2018 and 2019, but now find yourself out of work in 2020. You will not receive a recovery check (because your 2018 and 2019 income disqualifies). You will have to wait until you file your 2020 taxes to receive the benefit a year from now.

- Good Timing: On the other hand, if you would qualify for a check based on 2018/19 AGI, but you wouldn’t be eligible based on your 2020 earnings (Jeff Levine’s example is a Toilet Paper Distributor) you still get to keep the money, and it won’t be clawed back when you do your 2020 taxes.

- Planning Opportunity: If 2018 was a qualifying income year, but 2019 earnings were up and would decrease or eliminate your check amount, then delay filing your 2019 tax return. Similarly, if 2018 was your higher (non-qualifying) income year, but your 2019 income is low enough to qualify you for a recovery check, then expedite your 2019 filing.

- Watch Out For:

- Changed Bank Accounts or Mailing Address? The IRS is depositing and mailing the checks to the most recent destination on file. The IRS will send a notice AFTER they deposit or mail the payment. If you moved, you could submit an update using Form 8822. Additionally, the IRS is rolling out a new website that should allow individuals to update their banking information. See https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know for more updates.

- Any Births, Death, Marriages, or Divorces since your last tax return? This can get complicated and likely won’t be resolved until taxpayers file 2020 tax returns.

- Coronavirus Related Distributions from Retirement Accounts:

- Intended to help individuals immediately impacted by the Coronavirus, but qualifications seem pretty loose:

- Have been diagnosed with COVID-19;

- Have a spouse or dependent who has been diagnosed with COVID-19;

- Experienced adverse financial consequences as a result of being quarantined, furloughed, being laid off, or having work hours reduced because of the disease;

- Unable to work because they lack childcare as a result of the disease;

- Own a business that has closed or operate under reduced hours because of the disease; or

- Meet some other requirements imposed by the IRS.

- This applies to any distribution from a retirement account since January 1, 2020 (i.e. before the Coronavirus) if you meet the above qualifications.

- Features:

- No 10% penalty (for those under age 59.5)

- Individuals still owe income tax, but it can be taxed over 3 years or all in the year 2020 (whichever is preferred).

- Flexibility to repay the withdrawn amounts over 3 years in order to “restore” the account’s tax-deferred benefits. One could file an amended return to get a refund of the taxes paid when distributed.

- Self-certification (i.e. the onus is not on the 401k plan administrator or custodian to prove qualifications.

- Could be used to withdraw from an IRA, put money into a Roth IRA (Roth Conversion) and pay the tax over a 3-year time horizon. Still waiting for further guidance.

- Intended to help individuals immediately impacted by the Coronavirus, but qualifications seem pretty loose:

- Retirement Plan Loans

- Similar to the relaxed IRA qualifications.

- Elimination of 10% early withdrawal penalty if not repaid.

- Max loan amount increased from $50k to $100k.

- Max loan % of the vested balance (typically limited to 50%) has increased to 100%.

- Loan repayments must be made (to avoid taxes), but can be delayed for up to one year.

- As with any 401k loan, if you lose your job while the loan is outstanding, you could owe taxes if it is not repaid.

- If the loan is not repaid, taxes can be spread out over three years.

- As always though, the real cost of a 401k loan or withdrawal from an IRA is that those funds will not be invested. If the market goes down, that would be a good thing, but since the market typically goes up over time, more often than not, it is a potential “cost” to consider.

- RMDs

- RMDs are not required for all retirement accounts (IRAs, 401k, 403b, 457 plans) for 2020

- Applies to inherited/beneficiary IRAs

- IRS is allowing individuals to undo 2020 RMDs

- You can do a 60-day rollover but need to watch out for the 1 rollover per year rule.

- If you missed the 60-day rollover window, you could possibly have the distribution classified as a Coronavirus related distribution, giving you three repayment years. See above Coronavirus Related Retirement Distributions.

- Qualified Charitable Contributions (not to be confused with QCDs)

- Individuals who use the standard deduction (which is +90% of tax filers), can now tack on an additional $300 of their cash contribution to 501c3 charities (Note: these cannot go to Donor Advised Funds or 509a3 supporting organizations).

- Long story short: don’t throw away your charitable giving receipts thinking, “Well I don’t itemize anymore.”

- Net Operating Losses

- A loss in 2018, 2019 or 2020 can be carried back up to 5 years and can offset up to 100% of income.

- More detail here: https://www.foley.com/en/insights/publications/2020/03/cares-act-summary-of-tax-provision Search for NOL.

- Students Loan Relief

- No federal payments from March 13, 2020, through September 30, 2020.

- Auto-debit payments will be halted automatically by April 10th. If you’ve made a payment from March 13 to April 10th, you can ask the loan servicer for a refund.

- If you want to continue paying, contact your servicer. Your payments will count toward the principal.

- Suspended payments count toward rehabbing a defaulted loan.

- Counts towards 120 PSLF payments (saves you six months of principal and interest at best!)

- Employers can pay down $5,250 of an employee’s student debt and it is excluded from the student’s income.

- Be careful with loan consolidation. Per StudentAid.gov: “…you can consolidate your FFEL Program or Federal Perkins loans not owned by ED into a Direct Consolidation Loan, which would be eligible for 0% interest. However, if you consolidate, after the 0% interest rate period ends, the interest rate on your loan may be higher than what you are currently paying. In addition, when you consolidate, any outstanding interest will capitalize, meaning that any outstanding interest is added to your principal balance.”

- More information and an extensive FAQ can be found here: https://studentaid.gov/announcements-events/coronavirus

- Healthcare Provisions

- Greater Telehealth accessibility

- Ability to get 90 day supply of Rx for medicare

- Unemployment Compensation

- The Federal Government is taking each state’s unemployment programs and giving them a boost (they will be paid quicker, for longer, and the average benefit will increase +150%).

- Since Unemployment Insurance is governed by the state, each state has its own set of rules and procedures. Here is a list of each state with a link to their website: https://www.savingtoinvest.com/maximum-weekly-unemployment-benefits-by-state/

- Note that while typically I could not just quit my job and apply to unemployment, there seems to be some consensus that the rules will be relaxed. For instance, in a world where we are being encouraged to stay home, I’m not sure if the UI office wants me to go out looking for work or not. Here’s a great Q&A on the specifics from Markowitz: https://www.markowitzaccounting.com/coronavirus-unemployment-benefits (Parts of this are Florida specific, but it is the best explainer of how UI works and its downfalls and benefits).

- If I am given the option to work from home or take sick or other paid leave, then I am not eligible. More information from the tax foundation can be found here: https://taxfoundation.org/unemployment-compensation-changes-cares-act/

- Details of Unemployment Insurance (UI) changes:

- Pandemic UI: Those who are typically not eligible for UI such as the self-employed are now insured.

- Furloughed or Hours Cut: Possible expansion of UI if your hours have been cut but you are not officially unemployed.

- No Waiting Period: Typically there are no benefits paid for the first week of unemployment, but now the Federal Government will cover the first week and the States will cover after that.

- All states will provide UI for 13 additional weeks.

- $600 Bonus Check: This is the provision that stalled the bill when it was at the goal line…and for good reason. There are many scenarios where employees will be paid more to not work.

- Standard Unemployment Benefit + $600/week

- Typical Unemployment is $380/week so it is a huge increase.

- The $600 bonus is for up to 4 months only

- This seems like an area ripe for planning by a proactive business owner who wants to help out both their business and their employees. But it could also be an area of frustration for employers who want to keep operating but can’t keep employees due to misaligned incentives.

- FAQ from the Wall Street Journal: https://www.wsj.com/articles/unemployment-benefits-what-to-know-about-the-coronavirus-bill-11585256520 and NPR: https://www.npr.org/2020/03/27/822629588/lost-work-because-of-coronavirus-how-to-get-unemployment-skip-loan-payments-and-

Because each individual has a unique situation, it is critical that you consult with a qualified professional before embarking on any of these relief opportunities. We are happy to walk you through any of these options, answer questions, and include your legal advisor or tax professional. In closing, we encourage you to stay home, protect yourself and others, and be safe.