Mama, Where Do Stock Returns Come From? (An Update)

The Birds and The Bees

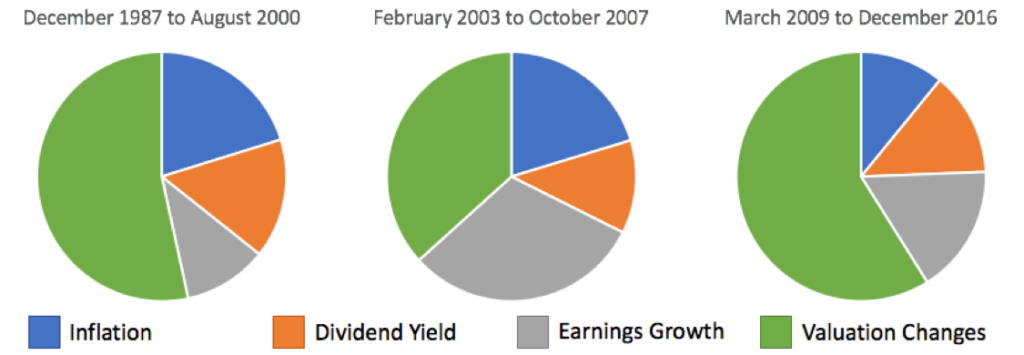

In our 2016 3rd Quarter Market Commentary, Justin wrote a wonderful “birds and bees” explanation of where stock returns come from based on Vanguard founder and investing pioneer Jack Bogle. You can find the full commentary here. The return on any stock, we concluded, is it’s Dividend Yield + Earnings Growth + Change in Price to Earnings (P/E) Ratio. Further, the returns of any stock market index, mutual fund or ETF are simply the the aggregate returns of all the underlying stocks in that market, index, mutual fund or ETF.

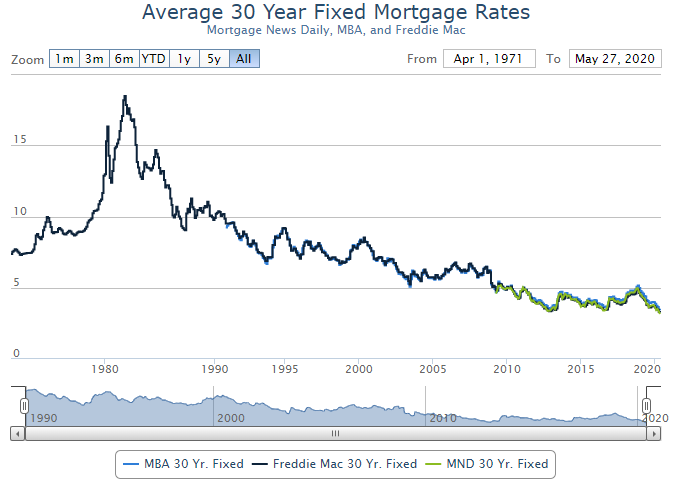

What’s Real About Nominal Returns

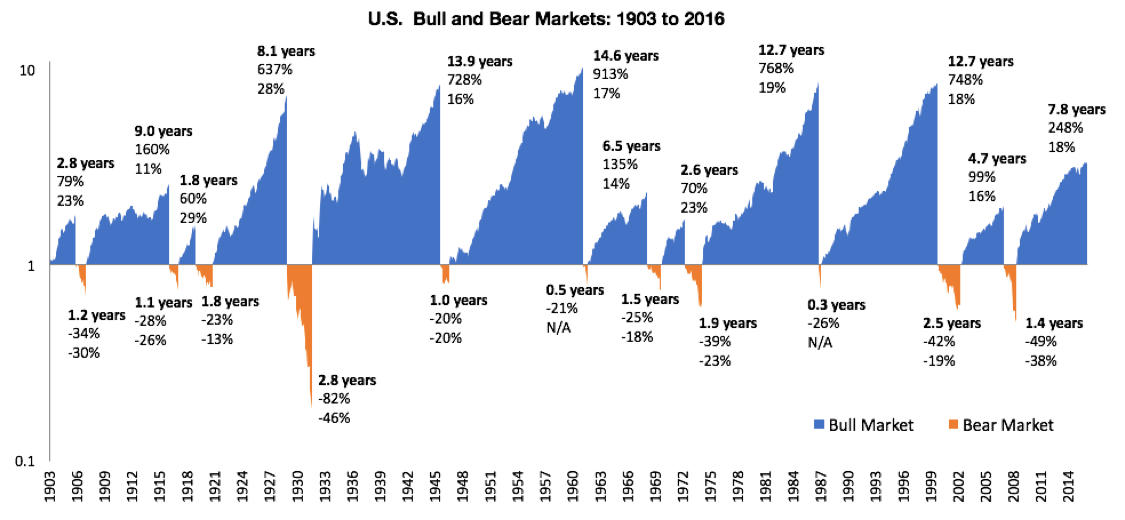

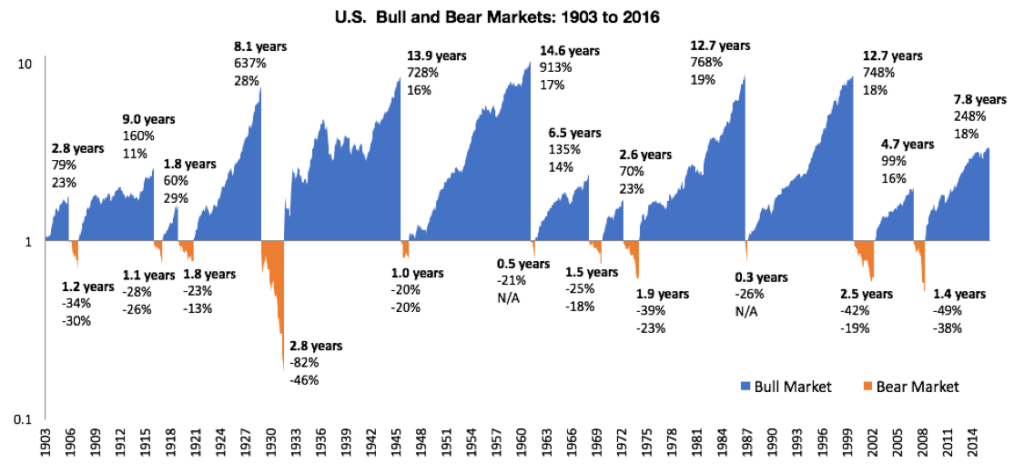

We ran across a fascinating research report by Newfound Research titled “Anatomy of a Bull Market” which touched on the same “birds and bees” factors and, importantly, brought inflation into the equation, thereby distinguishing real stock returns from nominal (published) stock returns. The authors give relevant context to our current Bull Market by pointing out that, of the 12 Bull Markets since 1903, the current Bull Market is the 7th longest and 6th strongest.

Recipe for a Bull Market

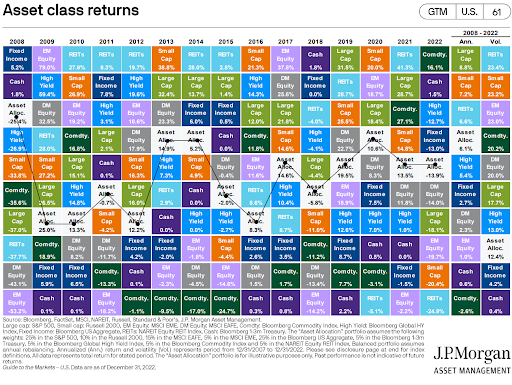

I’ve heard lots of different theories over the years about where stock returns come from; some plausible, some not. The most preposterous was “those people on Wall Street dial up the price of the stock, whatever they want the price to be, just like your volume knob on the TV.” But for us, and for every other well-calibrated numbers persons, the stock returns of each Bull and Bear Market (past, present and future) are simply the sum of four “ingredients”: Dividend Yield + Earnings Growth + Change in P/E Ratio + Inflation. Here’s something you might want to think about: the proportions of those four essential “ingredients” differ markedly in each Bull and Bear Market such that no two Bull or Bear Markets have been the same. The Anatomy of a Bull Market is a great read. Here’s a preview: