Market Commentary Q4 – 2013

Themes for 2014

This past year might go down as one of the “worst best” years in market history. The combination of cash still on the sidelines, abysmal bond returns and a poorly attended stock rally will do that. While we stay away from predictions, we have put together our important themes for the coming year.

Bernanke Got His Wish

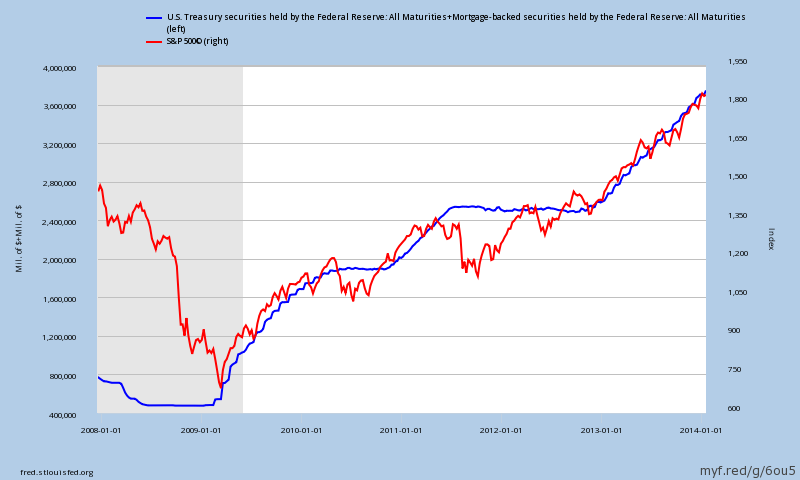

We don’t know if he got his wish (past tense) or is getting his wish (present and future tense), but either way, we have higher stock prices. The chart below on the left shows this not-so-mysterious relationship between the Fed’s Quantitative Easing (QE) cumulative purchases (blue line, left scale) and the S&P500’s progress (red line, right scale). This is important, because when Fed buys bonds, it adds liquidity to the economy. People and businesses who feel richer are more likely to spend money, and spending further spurs the economy. In addition to QE, conditions like low inflation, solid corporate profits and cheap money play a huge role in higher stock prices. These conditions are likely to persist, even while the Fed purchases are being “tapered”, thus making the case for at least some amount of rising equity prices in 2014.

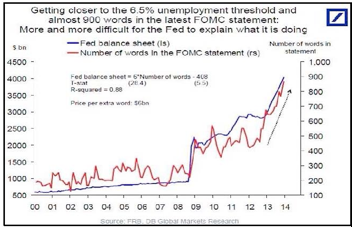

The flip side is that the story of a struggling economy (and therefore the need for continued QE) is getting harder and harder for the Fed to sell to the public as we approach a healthier unemployment rate. The chart below on the right above shows the same blue-lined balance sheet along with the number of words used to explain what the Fed has been up to. The chart is tongue-in-cheek, but the reality of slowing QE is very real.

The Search for Yield Will Stay Intense

With short term rates at zero, opportunities to earn real returns on bonds, cash, CDs and money markets have been dashed. If you held a $100,000 CD in 2006 you got $5,240, last year you got $270 and 2014 likely won’t look much different. And this is coming off a year when the majority of bond returns were negative. As we’ve talked about for what seems like far too many commentaries in 2013, the traditional safe places to invest didn’t seem so safe…and didn’t prove to be: TIPs were down -8%, Long Term US Treasuries lost -10%, non-US bonds ended -4% lower and National Muni’s (tax benefits and all) were down -4.6%.

Today, there’s about $11 trillion dollars of cash on the sidelines earning nothing. Rightly or wrongly, last year’s bond losses combined with this year’s low rates will continue to force income-hungry investors to seek investments they may not be familiar with or might have missed out on in 2013. Joining the yield-seeking fray will keep pressure (i.e. increase or stabilize prices) on any risk asset with a yield or prospect for return.

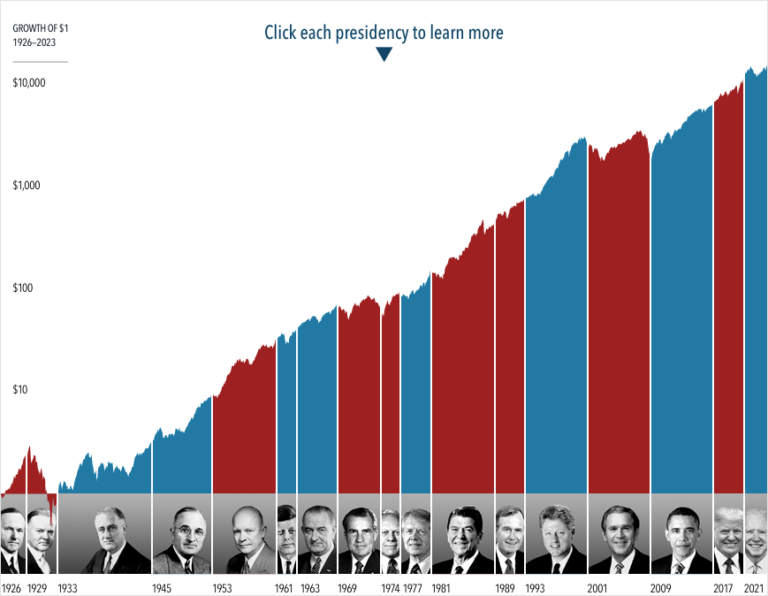

US Stock Valuations are Rich, But Elsewhere Still Attractive

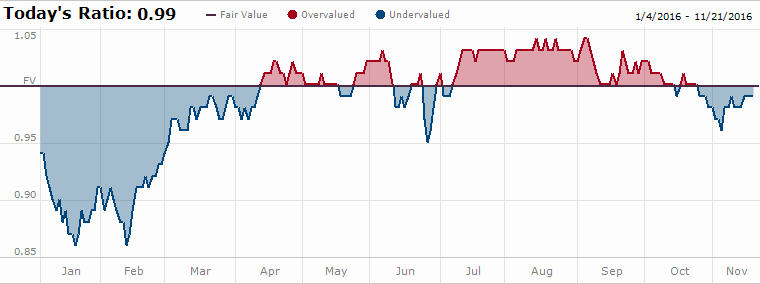

Morningstar’s Market Price to Fair Value Ratio, which was 0.99 (fairly-priced) on January 1, 2013, was 1.05 (over-priced) a year later. This 6% increase seems to disconnect from the 32% returns that the US Markets had (see chart below). Using a housing analogy, when a homeowner makes a profit on a house, it is because of two things: A) an increase in real value of the house from adding square footage or remodeling or B) someone is willing to pay more, regardless of any changes to the size or condition of the house.

This year, the earnings of publicly traded companies increased by about 6%. That would be like adding 6% to the square footage to your house; it would make perfect sense that the market price would go up. But imagine if that additional

square footage also drove more traffic to the open house and a bidding war broke out on the front lawn. The final result: a 32% price increase. The new buyer bought your original house plus the 6% addition and also paid 24% more per square foot than they would have just 12 months ago. That seems rich, but we have to put it in context. The Fed is keeping rates low, and the lack of return available from bonds and money markets have effectively condemned the rest of the houses in the neighborhood.

Outside of the US, last year the leading Foreign Developed Markets Index was up 22.8% while the Emerging Markets Index was down -5%. Of all of the publicly traded stock, roughly 50% is outside the US, and of all of the Global GDP, roughly 80% is outside the US. Considering the investment options detailed above and the distribution of economic growth across the world, we think these foreign markets deserve a larger tilt than usual in our portfolio. The key, however, will be to continue to target the higher quality portion of these markets that would be less affected by a shock to the US stock or interest rates.

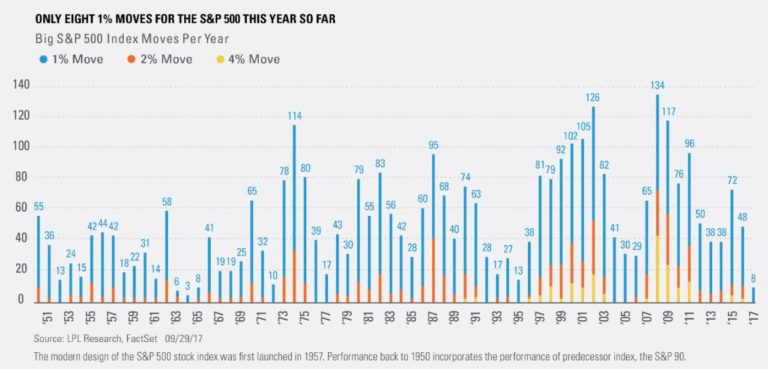

Record Low Stock Market Pessimism

One of the more striking features of the stock market is the decreasing pessimism among investors. After the dot-com bust in 2001, we sketched out an algorithm to analyze daily stock market data all the way back to 1928. This innovation records each day’s level of pain and pessimism. Our model shows that high levels of pessimism correlate with future good performance and low levels (like we’re experiencing today) produce lower than average returns. The correlation isn’t perfect, but it’s good enough to give us some warning signs. And while the markets don’t follow a schedule, it is worth noting that we haven’t had one of the market’s “100 worst days” in over 890 days (which, if evenly distributed, we’d have every 210 days). But the financial memory is very short; investors have forgotten what pain feels like. Sir John M. Templeton, who was renowned for buying stocks at the point of maximum pessimism, said “Bull markets (long periods of above average returns) are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.”

Maybe the Fed is Working on The Wrong Problem

It’s hard to understand how the corporate sector can prosper when so many of its participants aren’t, which begs the question, if by counting on higher asset prices to spur job growth, are we working on the wrong problem? Shouldn’t we be focusing on more structural problems, like awakening investment and capital spending from its twenty year downtrend instead of slapping a new coat of paint on a building with foundational problems? Gains in jobs are more tightly correlated to changes in corporate spending than they are to changes in the S&P 500, so why is the Fed relentless about higher stock prices? My worry is that unless the Fed and Corporate America can be persuaded to reignite investment and capital spending, sending stock prices higher may fool us into believing the recovery is waiting around the corner.