Market Commentary Q4 – 2015

Never Before

North Carolina joined the ranks of lottery states in 2005 by introducing the NC Education lottery. As a side note, only 29% of the revenue goes into actual education and somehow, NC still ranks 50th in the nation in teacher pay and 51st (that’s not a typo) in percentage increase in teacher pay over the last decade. We might need to rename it the miseducation lottery.

Anyway, over the last week, social media and news outlets were obsessed with the recent record-breaking $1.6 billion Powerball payout. It has been hard to miss all the “man on the street” interviews, Facebook posts and complete strangers talking about how they would spend the money. All the while, another record-breaking transfer of wealth has been happening. The 2016 U.S. stock market now holds the singular distinction of the worst start in recorded history, losing 6% in the first five trading days. This selloff represents a drop of roughly $3.3 trillion in asset value or 2,062 Powerballs! It should be obvious, but still worth noting, that the market drop has real and permanent financial impact only on investors who choose to sell at lower prices. One can’t say the same about money lost buying Powerball tickets.

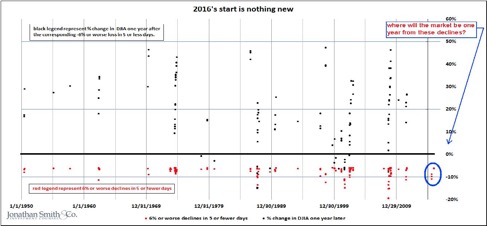

This recent drop has seemed so large and rare to so many people, that I decided to do my own “man on the street” interviews. In my unscientific study, I asked Stephen, Anne, my physician (during my annual physical), our Sunday dinner companions and the guys at the gym this question: “When was the last time the market lost 6% over several days?” I wasn’t surprised when everyone said 2008. They were surprised when I told them that the market’s lost 6% over several days 12 times, so far, since 2008. What’s more astounding is that the market’s lost 6% over several days 136 times since 1950. These events don’t feel normal, however if you’ve had an average of two per year for the last 65 years, they are.

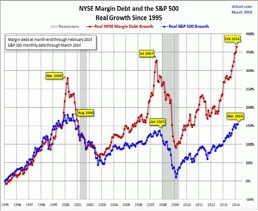

More surprising are the 1-year returns following these minus 6% events. In 8 out of 10 instances, the market was up, and at an average of +18%. The remaining two out of 10, the market was down, and at an average of -11%. Those are considerable odds. See chart below:

The Landscape

The world is volatile. In June 2015, the Shanghai composite index plummeted from 5,000 to 2,900 and recovered to 3,600. In January, it resumed steep declines and hovers at its August 2015 low. Crude Oil prices fell to $37 a barrel at year-end from a high of $61, skidded to $34 in early January and now hovers around $30. Growing inventories of U.S. oil stoke fears about demand and the market. The Russian ruble fell to 77 against the U.S. dollar, a 50% collapse since December 2014. Is the American economy sufficiently resilient against so many stumbling and interconnected global economies?

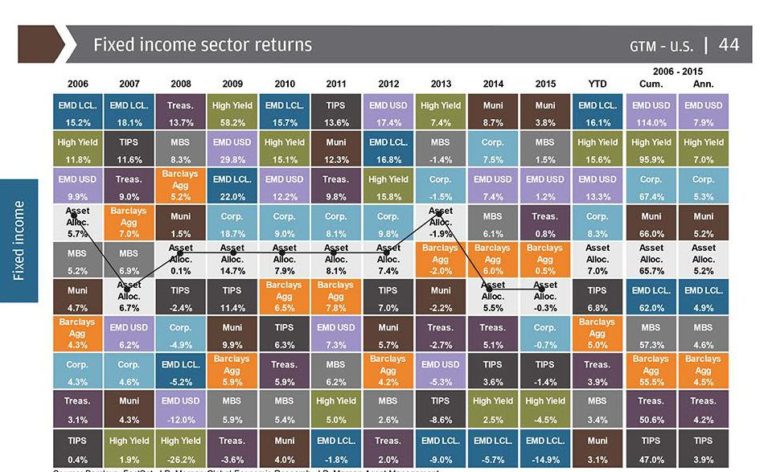

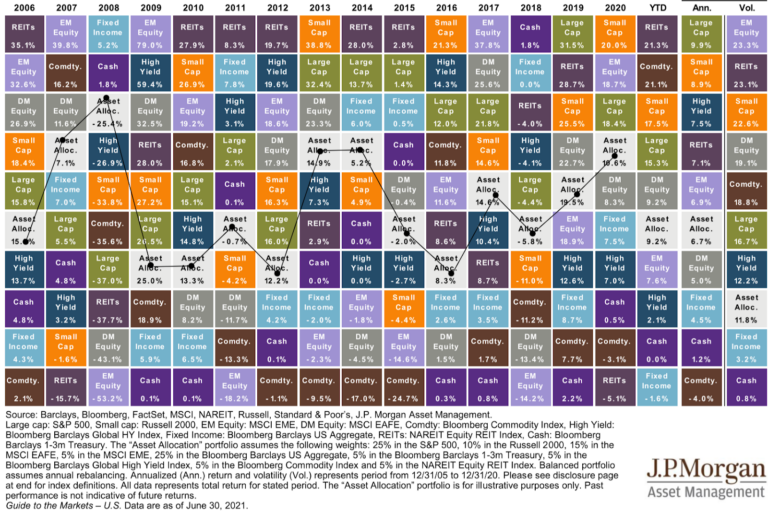

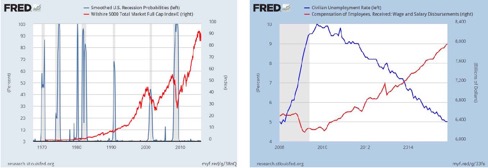

Despite global selloffs, currency devaluations and geopolitical hazards, the American stock market remains above its August/September lows. Against a shaky international economic backdrop, the International Monetary Fund forecasts 2.8% economic growth in the U.S., unemployment is at a level not seen since early 2008 and wages are rising. This amazing bright spot could also attract foreign assets from investors seeking a safer haven. See charts below:

Investors in U.S. shares have been rather complacent for four years, not pessimistic and not euphoric. In August 2015, and again recently, we noted an increase in investor pessimism. Contrary to what you might think, Bull (upward moving) Markets do not die on pessimism, rather, that’s where they’re born. Bull Markets die on euphoria, when the headlines are all positive, and we haven’t seen euphoria. As long as the probabilities of a U.S. recession are low and the yield curve remains uninverted, we will continue business as usual. We’ve already built dips like these (and worse) into every financial plan we build for our clients. They hurt emotionally, but aren’t cause for alarm.

Powerball Dreams

I’ve heard that people really don’t buy lottery tickets because they think they will win. Rather, they are paying a fee to dream about what life would be like if they did. This is both fascinating and sad. It’s fascinating because it’s true; I didn’t buy a ticket but just the talk of it made me start dreaming about things I would do if I won. It’s sad because it took a lottery to make me dream.

One Powerball story got my attention. Shlomo Yehuda Rechnitz, a California health care magnate and philanthropist, bought 18,000 Powerball tickets for 18,000 employees in 80 assisted living communities. He attached a card to each ticket with this message, “We will provide the ticket. You provide the dream.” When asked why, he said, “In the new year, everyone wants an extra bit of hope.” Our takeaway is that we see too many investors with too few dreams, and even less hope. It need not take $1.6 billion to make dreams happen. If my Powerball Dream is to own a mountain house, maybe I could start by simply taking my grandkids up to the campground for the weekend. If your Powerball Dream is to fund 10 full college scholarships, maybe you could start with one $500 gift to your local community college’s scholarship fund? Either way, what’s your Powerball Dream?