Humans and Monkeys Fall for the Same Trick

I am sure you’ve heard of the monkey trapping technique where a hunter hollows a coconut, ties the coconut to a tree, and leaves a treat such as fruit inside the coconut. The hole is big enough to fit the monkey’s empty hand, but when it makes a fist, the monkey’s hand becomes too big to remove. Amazingly, instead of letting go of the treat and fleeing for its life, the monkey will hang on until the hunter captures it.

The monkey seems short-sighted and foolish until we realize that we find ourselves in many of the same traps. Our human traps are less deadly. However, they can still be harmful to ourselves and those around us. Human traps look like houses on the edge of affordability, a car that will depreciate more than we save every year, exotic vacations, and college choices that neither we nor our children can afford.

Our income determines the size of the hole we can pull treats through. As income grows, we then have the option to pull larger treats without endangering our attention. But what we often see, is that no matter how big the hole (income) grows, humans grab an even bigger treat. And we foolishly hold on to it, trying to force it through the hole.

Rising Debt Levels

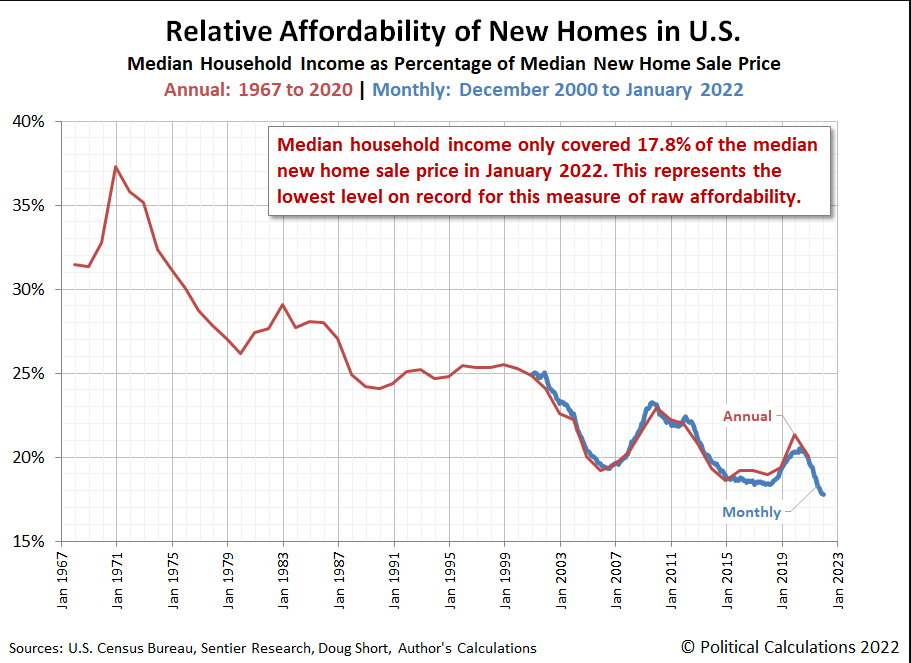

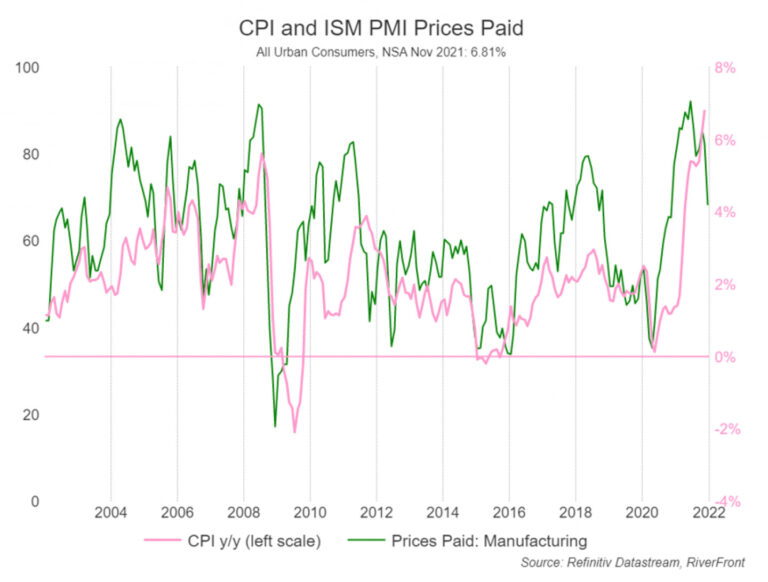

This ever-growing treat is defined as lifestyle creep. I, along with many Americans, struggle with lifestyle creep, as seen in the charts below discussing American auto loans, consumer loans, student loans, and relative affordability of homes in the US over the past 20 years. It seems Americans can’t get enough of the “new thing” and will take as much debt as lenders will allow in order to impress our friends and acquaintances.

All while the income meant to pay these debts off isn’t growing at the same rate.

*In the chart above I use median because inflated incomes in the $100 million+ range tend to skew this average more so than lower incomes.

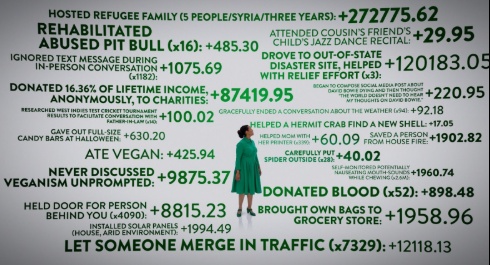

What’s the lesson here? It’s not that we can’t have nice things, pursue a larger income, or go on fun trips. Rather, the lesson is to live our lives in equilibrium so that those things, treats, and goals don’t hijack the focus of our lives. If we can do that, then we will have more bandwidth to focus on those around us, on our community, and on helping others.

A Word of Caution

Saving money and not spending isn’t a panacea and you CAN swing too far in the other direction, away from consuming and towards saving, and in doing so you trade away your attention… Nick Maggiuli said it well, in his book Just Keep Buying:

“It’s so easy to get lost worrying about not having enough money. For example, if you ask 1,000 American adults, “How much money do you need to be considered rich?” they will say $2.3 million. But if you ask the same question to 1,000 millionaires (those households with at least $1 million in investable assets), the number increases to $7.5 million.”

Both traps at the extreme (consuming and saving) are never satisfied. Like trying to empty the ocean… a waste of time.