Is Social Security Going Bankrupt?

In short, yes. But don’t take our word for it: as seen in their 2017 annual report, the Social Security and Medicare Board of Trustees “project that the combined trust funds will be depleted in 2034“. However, the Social Security Administration and Congress have a few “levers” they can pull to extend this 2034 date and continue paying benefits.

History Lesson

The idea of social security has been around for thousands of years. It started with guilds and poor houses caring for their aged and has slowly transformed into the system we know today. America’s Social Security grew from dire circumstances in 1935, in the midst of the great depression. The system provided citizens with enough bread to make it through the week, but it has grown into playing a much bigger role than originally expected.

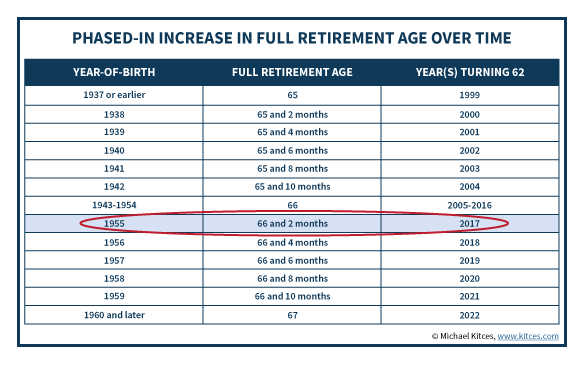

In 1935, Social Security began with a FRA (Full Retirement Age) of 65, based solely on the standard railroad pension retirement age. Then, the average American only lived 14 years past age 65. However today the average American lives 20 years past age 65. With cost of goods rising and people living longer today than ever before, Social Security’s expenses are exceeding their income.

Why Is Social Security Going Bankrupt?

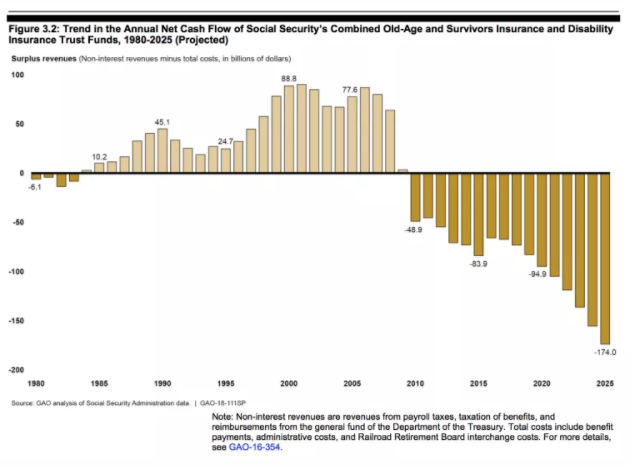

Social Security has been operating under a massive cash deficit since The Great Recession, illustrated below. In order to avoid the looming $174 billion deficit year in 2025, and eventual bankruptcy in 2034, the system needs to change.

We’re faced with this deficit because living past 65 is astronomically expensive! Social Security provides an average benefit of $16,000 per year to over 61 million families…or 976 billion dollars every year! Making it worse, that 61 million number is growing with a quickly retiring baby boomer generation.

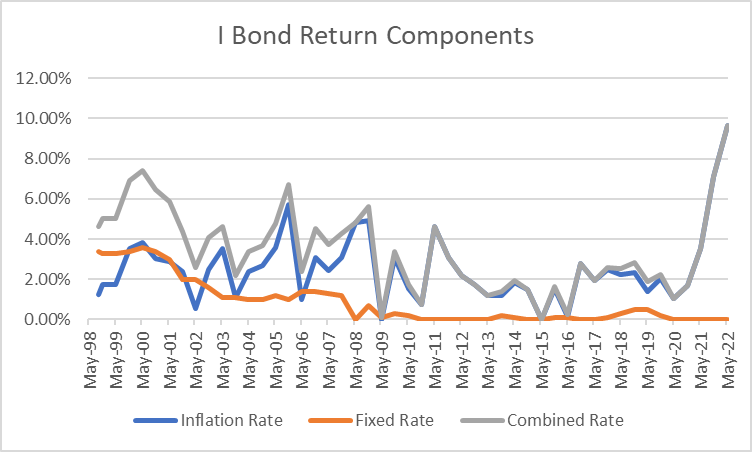

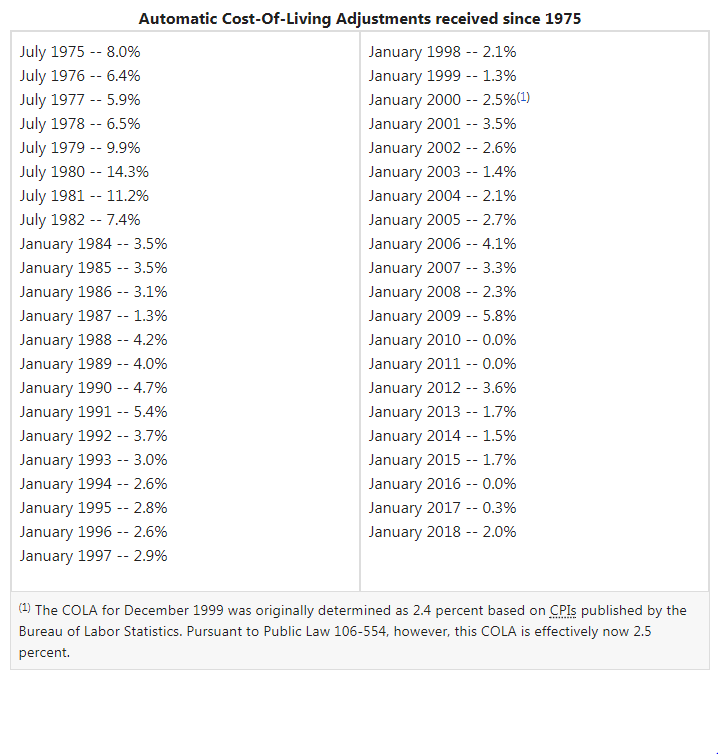

Not only is the number of people receiving a benefit expanding the average annual benefit amount is also increasing. The rise in benefits is due to prices going up nationwide, most commonly referred to as inflation. These adjustments for Social Security are referred to as COLA (cost of living adjustment). This years COLA adjustment of 2.0% is a pleasing sight compared to the last 2 years. However, for many recipients, the increase will almost all be offset by medicare costs.

How Do We Fix The Problem?

It isn’t rocket science, but the solutions fall into two categories: increase income (taxes) and/or decrease expenses (benefits).

- Increase Income:

- Congress could vote to change the Social Security payroll tax, possibly raising it by 3.58% . Currently the tax is 12.4%; 6.2% is paid by the employee and 6.2% by the employer up to the applicable taxable maximum amount (ATMA).

- Congress could also increase the ATMA to $300,000 or eliminate the cap entirely so that more of a higher earning individual’s income is taxed. For 2015 and 2016 that taxable amount was $118,500 or a tax payment of ($118,500 * 6.2% = $7,347). In the 2017 the ATMA was increased to $127,200 and will be increased again to $128,700 in 2018.

- Congress could also earmark other taxes (like the Additional Medicare Tax in 2013) to pay for increased costs.

- Decrease Expenses:

- In order to lower expenses the Social Security Administration has been raising the Full Retirement Age (FRA), which is the age at which you receive 100% of your benefit. The FRA is currently changing from age 66 to age 67 over a 6 year period. Congress could continue to push out this FRA age to 68, 69, or even 70.

- We could see benefits cut to 80 or 90% of what has been promised.

- While it would have a smaller impact, we could also see the COLAs suppressed (below actual inflation) as a way to limit the payout.

Evidence

While these sort of changes seem hard to fathom, the Social Security Administration and Congress have made tough calls in the past to ensure the future viability. For example, in 1983, when the program was operating at a deficit (as you can see in the first graphic), they bumped FRA from age 65 to age 66 which caused a positive cash flow for the next 30 years!

Social Security Isn’t Going Anywhere

For now, all we know is what Social Security will do next year (raise the ATMA to $128,700 and begin raising the FRA to age 67 over a 6 year period.) These “improvements” (which are really a tax of sorts) are projected to delay the bankruptcy an additional 15-25 years (until 2050-2060). While we don’t know how or if Social Security will get a permanent fix, I believe that for current and imminent retirees their benefits are secure. For those of us expecting to receive benefits in the next 30-40 years we would suggest not counting on much (if any) future benefit and being pleasantly surprised if they stay intact.