Quarter in Charts – Q4 2021

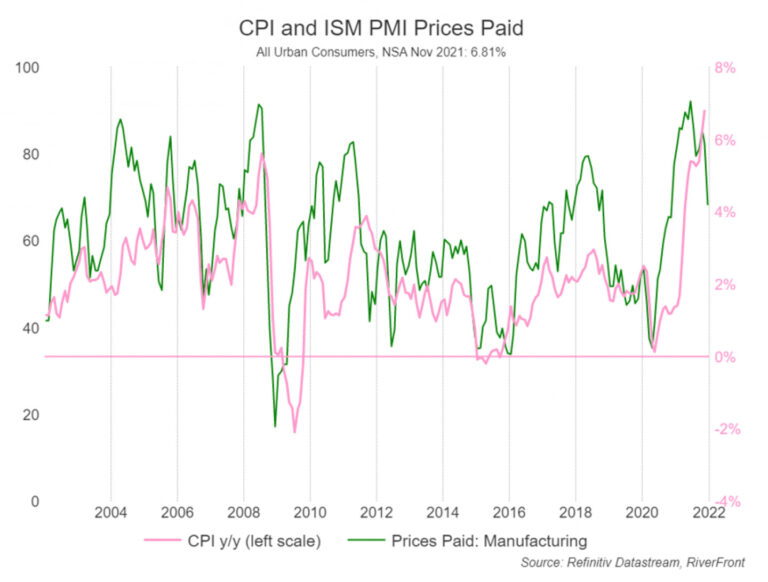

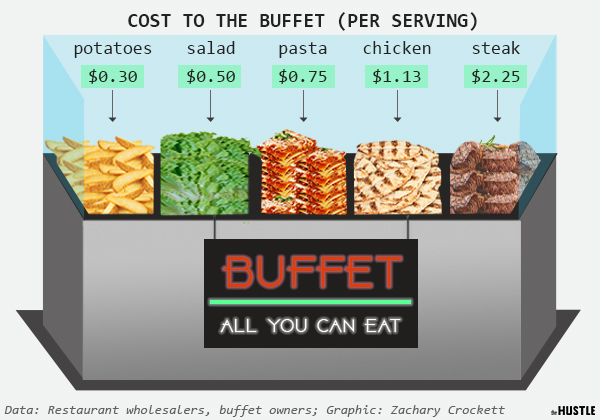

Rising prices seem to be at the top of everyone’s mind. From Social Security recipients wondering if the cost of living adjustments will keep up their actual expenses, businesses and employees wondering how to factor in wage increases, or everyday consumers struggling to keep their energy and food costs under wraps. Congress even joined in with concerns. Last week at the Senate Banking Committee meeting, Federal Reserve Chairman Jerome Powell told lawmakers,