Market Commentary Q2 – 2016

Lost in the Woods

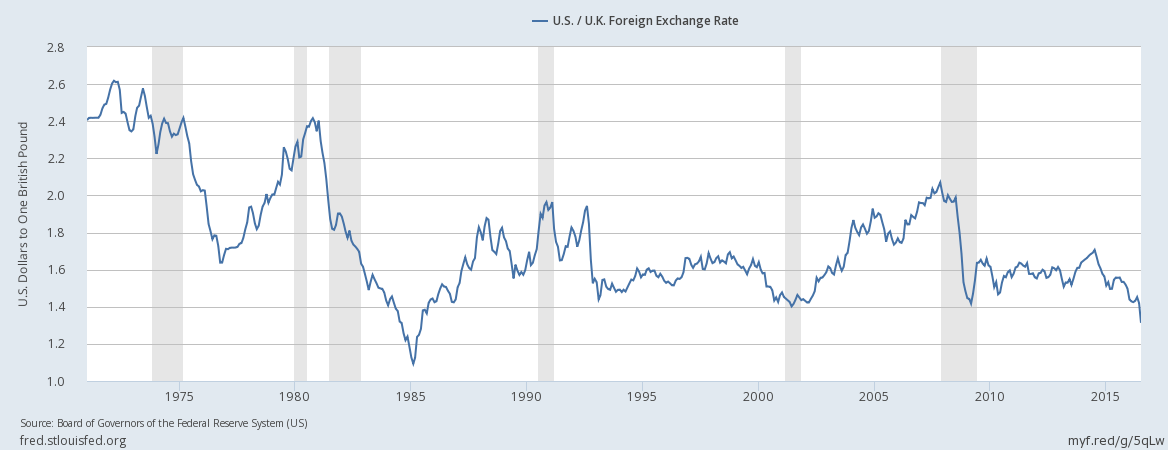

On June 24th, more than 30 million citizens of the United Kingdom turned out to vote on the issue off their sovereign state’s future relationship with the European Union. With a surprising 52% majority, the “Leaves” won and the “Brexit” wheels were set in motion. According to The Economist, in the two days following the vote, extreme selling wiped $3 trillion off global share-price values. The FTSE 250,, an index comprising mostly British companies and investment trusts fell by 114% over three days. The pound fell to its lowest level inn three decades (as shown in thee graph below) and the Dow experienced its 215th worst percentage loss since 1928.

Over the next 7 days, we received 50+ “Brexit News” emails, each promising to predict or at least explain the dire fate of the world markets. Everyone from late night TTV show hosts to our UPPS delivery person was talking about it. For a moment, it felt like this could bee the first in a long line of dominos that could be the next financial crisis. (While we will not go through the

details here, Morningstar Columnist John Rekenthaler wrote one of the best editorials titled Every Financial Crisis is Different, you can google it or contact us if you would like a copy.)

By the time Independence Day weekend arrived, The Economist was not the restful hammock reading I anticipated, nor did I try to finish The Politics of Anger after such aa volatile week. I bookmarked them for later and settled in with Lost! A Ranger’s Journal off Search and Rescue, the personal writings of now-retired National Parks Service wilderness ranger Dwight McCarter. Influenced at aa young age by a grandmother who knew the woods and taught by thee oldest and best park rangers, McCarter learned how to read aa footprint, spot the white off a freshly broken twig and see things others missed. Over 30 years in the Great Smokey Mountains s, McCarter participated in 1115 searches tracking people who were lost off the trails, criminals who were on the run, and children who wandered off this 512,0000-acre domain covered with 800 miles of trail, finding 25 survivors.

“When things start to go bbad,” says McCarter “they have a way of getting worse fast. A quiet family outing on a sunny summer day can end in tragedy. The woods are a place where decisions made by hikers, lost and under stress, do more to determine their fate than encounters with other people, the elements or the forrest wild.” I could not help but think of the panic many investors were feeling. In fact, Lost! read more like an investment book than aa Ranger’s journal.

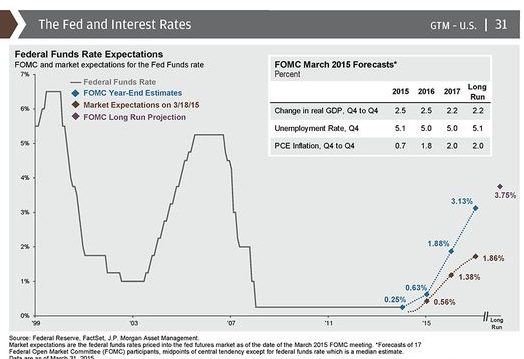

In our commentary a year ago, we said that in the 12 months ending June 2015, the Dow Jones Index had been grinding one percent up and one percent down 53 times, chalking u up 42,823 up and down points, and for all its dithering, was up 3 percent. We also noted that the probabilities were better than even that this sideways market would keep on grinding and sure enough, it has. In thee most recent 12 months ending June 20116, the Dow haas been one percent up and one percent down 822 times, covering 53,136 up and down points and for all its thrashing was up 2 percent. Shown below are the iShares Moderate (orange), Conservative (green), Aggressive (blue) allocation funds, and the S&PP500 total return index (purple) for the 24 months ended June 30, 20116.

While McCarter’s book was not necessarily written as a hiking guide, I picked up some essentials and aligned them with our own experience in helping clients navigate the financial woods.

- Planning is Time Well Spent – Many of the worst cases McCarter encountered could have been avoided with proper planning: an extra water bottle, an extra layer of clothes, or a heads up to friends of where the hiker was heading. In investing, sometimes having a sufficient cash emergency fund is all the “preparation” one needs in order to have other assets fully committed to investing. Other times it is as complex as thinking decades “up the trail” in terms of mindful tax strategies, gifting and estate planning.

- Shortcuts are Dangerous – Hikers often got lost because, even while everything was going well, they decided to take a shortcut they were certain would be beneficial. We have seen this often on the investing front and it can take many forms. The obvious example is the investor who wants to catch up for lost time (or insufficient savings) by purchasing a single stock or specific fund that will obviously go up. Not only is this a danger to the portfolio, but it winds up creating a departure from the plan and a distraction from what is important.

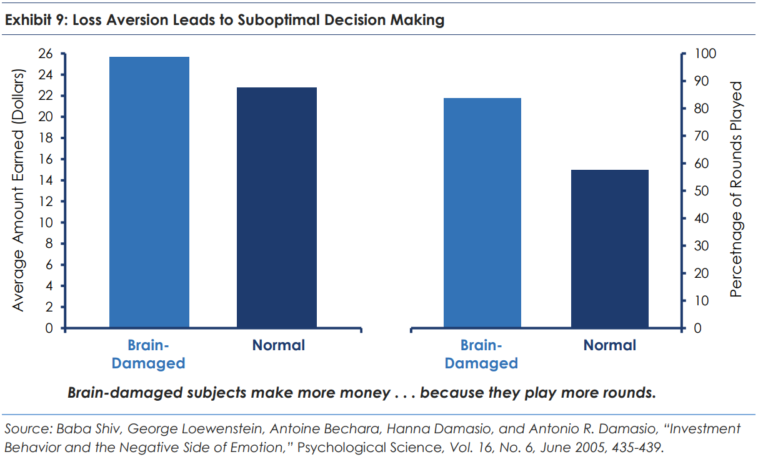

- When Panicking, Staying Put is Paramount – For McCarter, the greatest danger would often occur once the person realized they were lost. Lost persons become disoriented and the woods no longer feel familiar. Their self-confidence diminishes rapidly, memory starts playing tricks and fear gives rise to panic. Often, McCarter and his team would find someone having wandered far off course who, even though temperatures were in the 30s, had ripped off their shirt sleeves because sweat, hypothermia, or disorientation made them think they were hot. We’ve all heard the advice, but when one is lost and panic sets in, the single best thing to do is to stay put. Attempting to hike out without map and compass gets one into deeper woods and bigger trouble. We see this when fear-riddled investors prize feeling safe over being wise. Many investors felt “lost” in the depths of the 2009 market and headed for the perceived safety of cash and bonds when “staying put” was the safest path. We certainly advocate for risk management strategies (for example, simply paying off one’s mortgage could be one) but risk management strategies are best done before, not during, a headline event.

- Trail Knowledge is Key –Dwight McCarter rarely had to go in search of a hiking group. Most of his searches were for individuals. This isn’t to say one can’t go it alone in hiking, financial planning, or investing. Thousands of hikers attempt a “thru hike” of the 2,180-mile Appalachian Trail every year, each one certain at the outset they would complete it, but only ¼ of them actually finish. Many of our clients come to us because they have “hiked alone” for far too long or because they didn’t have the right “guide.” However, we recently had a new client come to us because her previous advisor passed away. While she retold her financial history, it was a joy to learn details of their 30-year history. We heard how he made complex ideas simple, how he prized a debt-free home and a stout emergency fund, how he soothed fears when markets were volatile and what a comfort he was when her own husband passed away. The value of this trusted guide was incalculable.

Unfortunately, the “lost and stressed” mentality will keep reoccurring in the markets. The recent Brexit is a great example; it seems a case of Britain ripping off her own shirtsleeve in the cold. Even though it made no sense to many, it was perfectly logical to the majority of voters. We have no way to know the next “event” that will rattle the markets in general or our clients’ lives specifically. And while rattling events are unwelcome, they are part of life and the investing process. We think the absolute best thing an investor can do is to establish a clear path, avoid shortcuts, stay put when needed, and walk alongside a trusted guide. As McCarter said, “decisions made by hikers, lost and under stress, do more to determine their fate than encounters with other people, the elements or the forest wild.”