Market Commentary Q2 – 2013

Ben Bernanke probably spent at least a couple minutes reading his pocket thesaurus, looking one last time for another way to say it. When no new words came about, he stepped up to the microphone at the Fed’s June 20 press conference hoping to shed light on the FOMC Statement from the day before. Investors listened for more signals about the Fed’s plans for adjusting its $85 billion per month bond buying binge, then they heard the same word as printed the day before: “UNTIL,” which was all it took to throw bond markets into a tizzy.

“The Committee will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, UNTIL (emphasis ours) the outlook for the labor market has improved substantially in a context of price stability.” Full text: http://1.usa.gov/1atWtSl.

On the surface this sounds encouraging; however, it basically meant that this latest round of Quantitative Easing, known affectionately by some as QE Infinity, would actually end one day.

Bonds Are Boring UNTIL They Aren’t

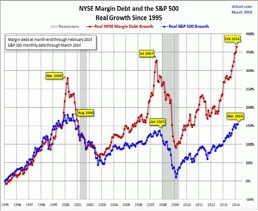

The ten largest intermediate bond funds in America (below), with maturities from 2-10 years, lost 1.6% to 2.87% in the 5 trading days following the June 19 announcement. That might not seem like much, but this falls into the worst 1% of many of these funds’ histories in terms of a “5-Day performance”. Short-term shocks are one thing, but many of these also experienced 1-Month performances in the bottom 0.50% of their fund histories…an extremely rare event. And if you, like most of America, own a bigger bucket of bonds since the fiscal crisis, you might have thought you were in the Twilight Zone. After all, bonds are assets associated with capital preservation; they don’t go down…right? Never mind that we warned against this two quarters ago, saying “Investors want capital preservation, but the assets typically associated with capital preservation (bonds) are priced at 50 year highs.”

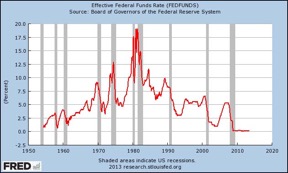

Given the recent thrashing in bonds, we thought a Bond 101 might be helpful. Bonds are nothing more than an IOU where the borrower pays back the lender what they borrowed plus interest. If the lender holds the IOU to maturity he gets his principal back…except when he doesn’t. If the bondholder sells his IOU before he’s due to get his money back, his price will be determined by what kind of interest other lenders are getting on their IOUs and whether the new buyer thinks the borrower will make good on the IOU. Bonds come in all sizes and shapes: some come due in 30 days and some in 40 years; some pay no interest at all and some pay high rates not seen in years. But with all bonds, the mechanics are the same. If rates for new bonds go up, then current bond holders will need to lower their prices to make their bonds more attractive to potential buyers. Bernanke’s “until” meant that one day the Fed would stop buying so many, thus the artificially low rates would rise and prices would have to fall.

The Federal Reserve Board: Hoping People Feel Rich Since 2008™

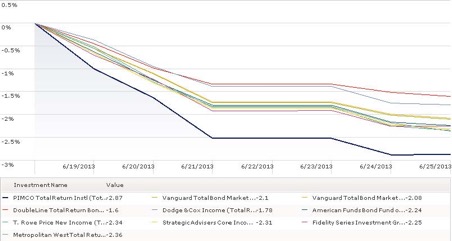

Following the bursting of the financial bubble (2008), businesses, municipalities and individuals knew they had too much debt. Federal chairman Bernanke stepped into a phone booth, put on a Superman shirt, and came out “lender-in-stead” to a nation over leveraged. This resuscitation effort became known as Quantitative Easing or QE for short. It was characterized by the Fed’s buying of higher yielding U.S.

This rising tide made everyone feel richer and Ben was happy because he knew people who “felt” richer would be more likely to loosen up their purse strings. And if richer feeling people would start buying flat screen TVs, cars and homes; pretty soon the economy would be back on its feet and we wouldn’t need stabilization. QE has been like a parent holding onto their kid’s bike-seat after the training wheels have come off. Bernanke’s mere suggestion of one day letting go, even if it won’t be for miles down the road (when unemployment falls below 6.5%), makes the kid immediately start to wobble.Government securities and mortgage backed securities already out in the marketplace, and paying its sellers with dollar bills. The Fed also cut the Fed Funds Rate to zero. Banks that formerly rented their surplus capital to other banks for profit would no longer get anything for their overnight loans of surplus capital. If banks wanted to earn money on their surpluses, they’d have to do it the old fashioned way, loan it to Joe and Jane Public.

I’ll Take Anything

The financial meltdown left lasting imprints on investors who saw savings disappear before their eyes. Seniors and those living on fixed incomes were hit hard. Even younger savers who expected to work 25 years or more began to see how bonds had outperformed stocks. You couldn’t go to a cocktail party without hearing about “the lost decade in stocks.” The Fed didn’t feel too bad about this because it made selling lower yielding securities to scared investors easier. After all, the government piled up a mountainous debt following WWII and lived to pay it off, but most buyers of today’s low interest bonds are too young to remember this. The Fed knew that in time, when the economy was healthy enough, they could let inflation creep back in. The U.S. Government could simply inflate its debts away and pay off its lenders with worth-less, inflation-eroded dollars. GMO’s Ben Inker shared this wise observation:

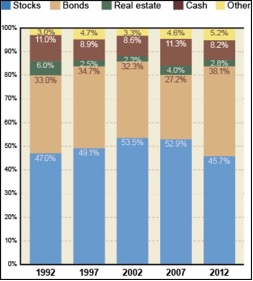

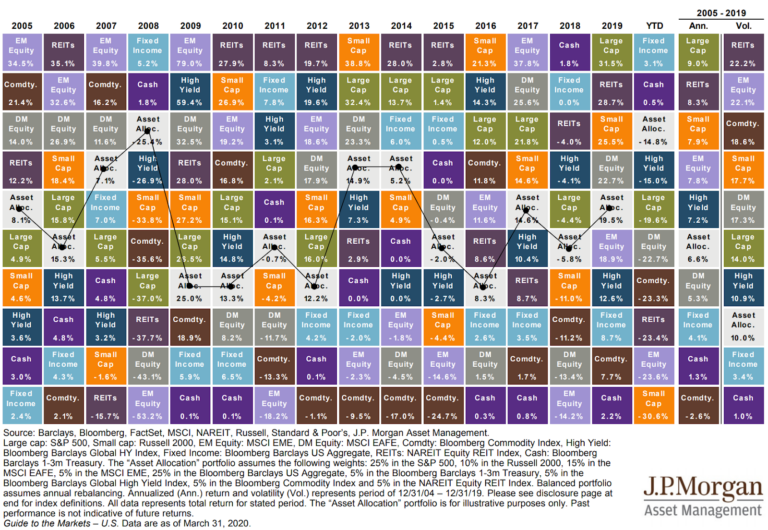

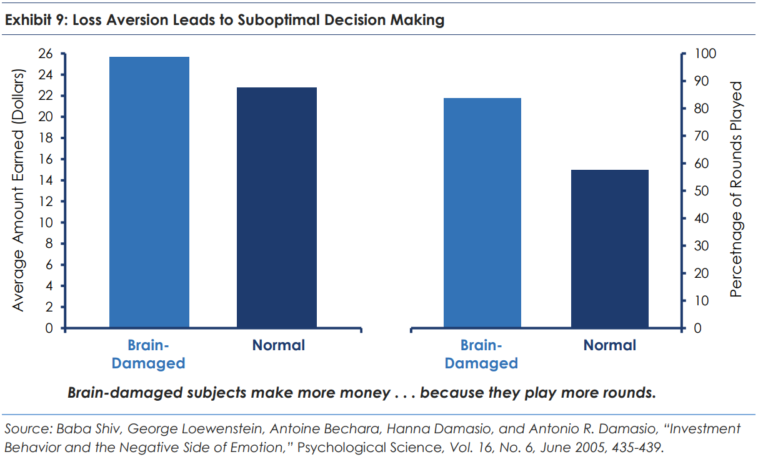

“Investors have a natural tendency to lose faith in asset classes or strategies that have not been working and gain confidence in those that have (the lost decade). That tendency is amplified by investment managers, consultants, and Wall Street, all of whom are in the business of selling new ideas. They know the ideas that will sell are those that either have worked or would have worked in the recent past, and they do a great job of parading those ideas in front of investors, usually with elegant-sounding ideas as to why they are the right solutions for the future. The result is that investors are quick not only to lose faith in assets and strategies that aren’t working, but also to embrace assets and strategies that appear to offer a better way, often with too little critical thought going into the decisions (See the chart below, far from impeccable timing – JS). Investment managers, consultants, and Wall Street are not going to change, so how can investors avoid doing in 2020 what they did in 2000 and may be doing again in 2010? In our opinion, a crucial part of why investors find themselves swayed so much by the winners and losers of the last cycle is that they lack a strong anchor to their investment beliefs1.”

Why Own Bonds At All Now?

All of our target asset allocations, from Ultra Conservative to Very Aggressive, have some exposure to bonds, because bonds are key to effective asset and income diversification in the same way that U.S. and Non-U.S. Stocks, hard assets and income- producing real estate are key ingredients. Bonds produce current income and also lower volatility. But we try to be strategic by owning bonds and bond funds offering the highest risk-adjusted returns. Today we think those consist of shorter maturities over long maturities and mid to lower quality ratings over high ratings. Our asset class return forecast for high-quality U.S. stocks is positive and exceeds the return forecast for bonds. Despite offering a significantly smaller reward to risk ratio than during the 2009 lows, high quality, dividend paying stocks are, in our view, the wisest long-term capital preservation assets worth owning. Despite their vulnerability to sudden, temporary price setbacks, high quality stocks are not just the cleanest dirty shirt in the closet. They’re more associated with long-term capital preservation, especially now that bonds threaten to produce negative real returns. As we said three quarters ago:

“With interest payments capped and principal at risk of declining, bondholders could finally get fed up. If this happens, bondholders’ path of least resistance would be to sell bonds and look elsewhere. If the expected returns from stocks are attractive, bondholders plowing money into stocks could keep the rally going longer or at least provide stabilization.”

**1 GMO White Paper October 2010, Back to Basics: Six Questions to Consider Before Investing, Ben Inker

Our comments about the economy and the stock market are based on our own analysis and are not representative of the future performance of any security, fund or of the overall market. Any discussion of specific securities is provided for informational purposes only and should not be deemed as a recommendation to buy or sell.