Quarter in Charts – Q2 2023

Herman the Sturgeon

Last month, I got swept up in reading Brian Doyle’s posthumous collection of essays, “One Long River of Song.” I was particularly drawn to his fascination with White Sturgeon. Specifically, an 11-foot-long 89-year-old Sturgeon named Herman at the Bonneville Fish Hatchery in Oregon.

Doyle summarized what captivated him so much about these prehistoric (but somehow still living with us) creatures:

- “Part of it is bigness…there are stories of sturgeon in the Volga River in Russia weighing nine thousand pounds, which would be twenty-eight Shaquille O’Neals…”

- “Part of it is harmlessness…adult sturgeon do not even have teeth, having dropped their weapons after gnashing through adolescence.”

- “Part of it is freshwaterness…to ponder an enormous creature that is not terrifying, that lives in the river I can see from my office window, that remains pretty much a total mystery to biologists and ichthyologists and the United States Army Corps of Engineers – this gives me hope.”

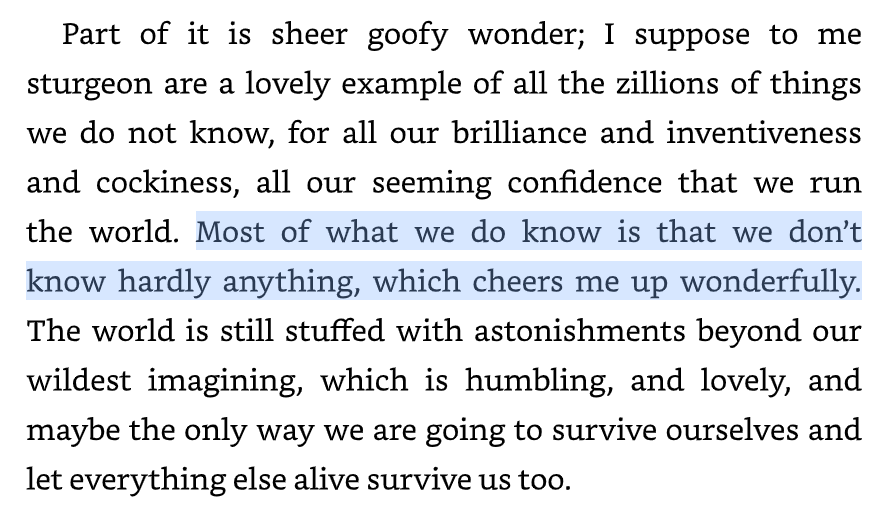

But it is Doyle’s final “part” that caused me to get out the highlighter:

When I first came across that passage, I couldn’t help but think about investment forecasts (especially the dire ones over the last year) and how markets are unknowable, even for “all our brilliance and inventiveness and cockiness, all our seeming confidence that we run the world,” as Doyle would put it.

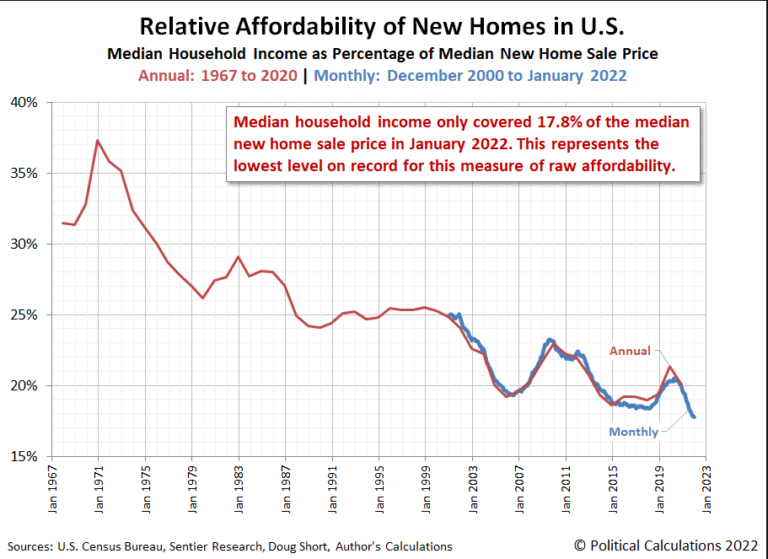

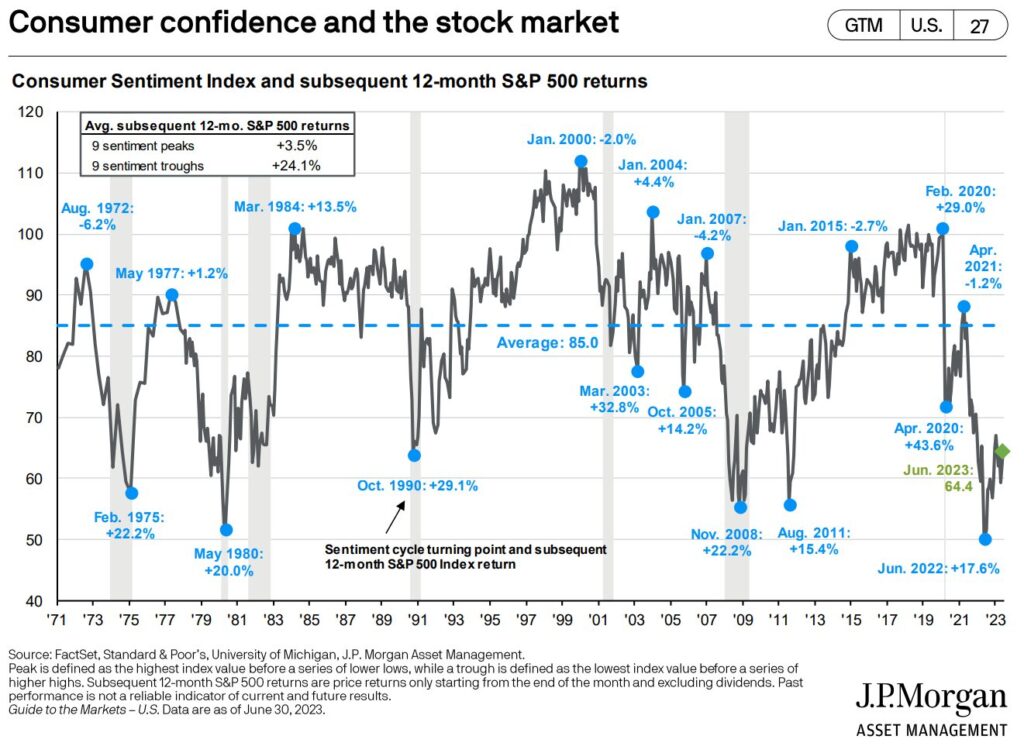

One year ago, the University of Michigan’s Consumer Sentiment Index (CSI), which started in 1952, fell to an all-time low of 50.0 (see chart below). The CSI gauges everyday Americans’ feelings about current and expected future financial conditions. (This is similar to the AAII sentiment survey we referenced in our Q3 2022 Commentary.)

Those June 2022 responses were more dire than during COVID, the Great Financial Crisis, and the Gulf War!

Since June 2022, the S&P 500 has gone up +17.6%, which puts the June 2022 data point (lower right blue dot below) in some good company alongside the other CSI lows. The dots along the bottom represent times with awful headlines and above-average future returns. Note that the current sentiment (green diamond) is still far below average.

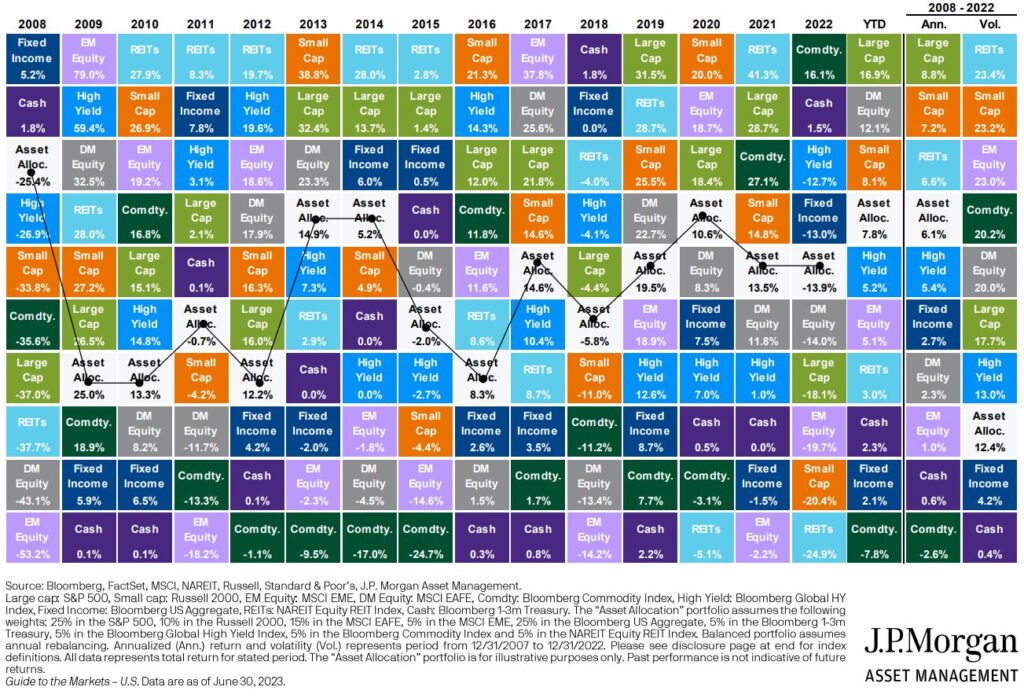

So far in 2023, stock investors in the US and Developed Foreign nations have led the way, while Emerging stock, REIT, and money market allocations have outperformed Bonds. Commodities are the only major asset class to have trailed this year as inflation slowed.

As Charlie Bilello points out in his article 10 Surprises From the First Half of 2023, the S&P 500’s return has surprised many. For the first time in decades, Wall Street analysts (in all their “brilliance and inventiveness and cockiness,” as Doyle would say) projected a down year for the S&P 500 (below.) Imagine their surprise that 2023 ranks as the 13th-best first half of the year since 1928!

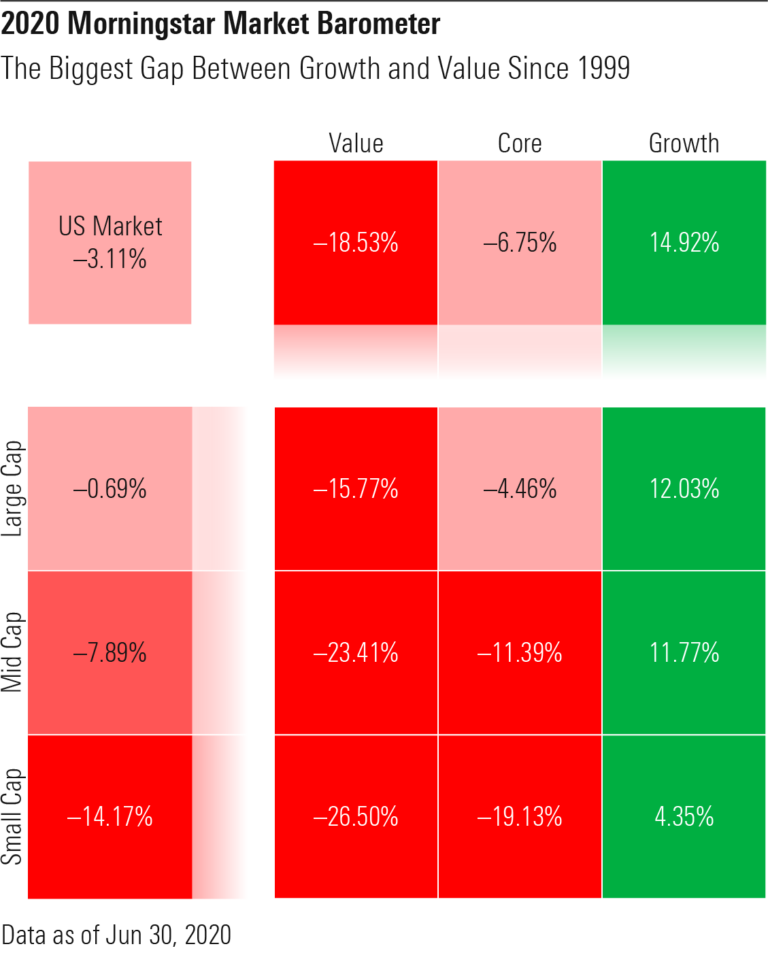

But even the makeup of those S&P 500 results comes with a surprise. This year, the top 10 largest stocks have accounted for 97% of the total market’s gain. Compare that to the top 10 contributing “only” 37% of the total market’s growth in 2020. But 2020 and 2023 are even more surprising when we understand that historically, the top 10 largest stocks have only accounted for 5% of the market’s gain!

These returns are more surprising still when we realize they mostly came from tech giants that were all but written off at the end of 2022.

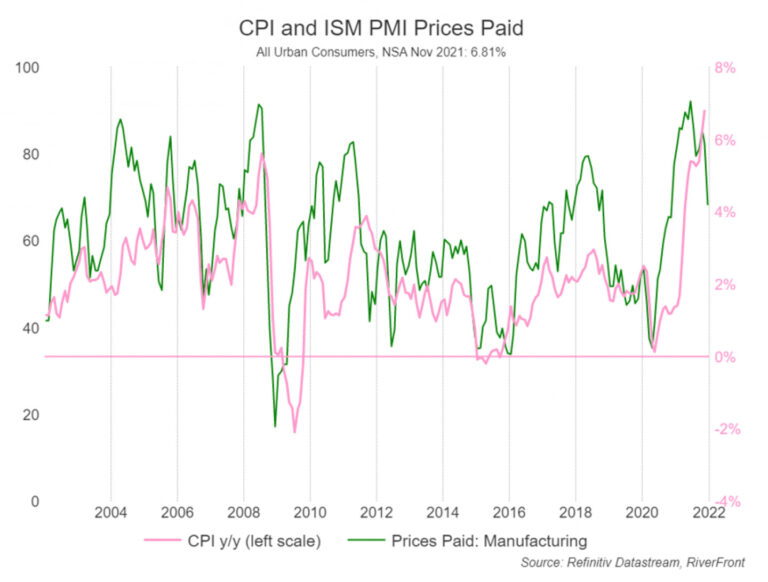

Inflation has been the other big surprise of the quarter. June’s CPI numbers show just a 3% increase from a year ago, closing in on the Fed’s 2% target. While that doesn’t mean goods, services, homes, and energy feel cheap, it does mean that the rate of price increases is slowing to a more digestible pace.

While this slowdown in inflation is still likely to prompt one more interest rate hike at the end of July (CME’s FedWatch predictor sits at a 92% probability of a hike as of publication), it could be our last rate hike for a while. The chart below shows implied rate movements based on how investors buy and sell Fed Funds futures contracts. Currently, the Fed’s interest rate target is 5.00-5.25. The market believes interest rates will drift meaningfully lower a year from now (which lines up with an inverted yield curve.)

Our Q1 2023 commentary highlighted JP Morgan CEO Jamie Dimon’s statements about the uncertainty and storm clouds ahead for US investors. Just because stocks have been up six months after his statement doesn’t mean Dimon was wrong. We will always have uncertainty and storm clouds and reasons not to invest. As Brian Doyle said, “Most of what we do know is that we don’t know hardly anything…”

But I also agree with the same Jamie Dimon who, in 2016, said some timeless reasons to be optimistic about investing in the US (which I think we could also apply to some degree in other areas of investing.) It is worth listening to the first two minutes below.

Doyle closes his essay on Sturgeon with thoughts on how humility and wonder lead to wisdom. In the context of investing and planning, humility and wonder could mean many things. For example, “humility” could mean not regretting a diversified portfolio when I hear about those five tech stocks. And “wonder” could look like actively considering how to spend your time and money in ways others don’t. Whatever humility and wonder look like for you, it is hard to see a scenario where heavy doses wouldn’t “swim” us toward wisdom.