The Double-Edged Sword of Retirement Savings

How 10% Can Save You 10 Years in Retirement

It’s hard to get out of my head that “10 minutes could save you 15% on your car insurance” thanks to GEICO’s never-ending cavemen commercials. Along those same lines, did you know that 10 percent could save you 10 years in retirement? Michael Kitces, whom I honestly refer to as one of the smartest people in financial planning, recently wrote a blog post that had me audibly saying “EXACTLY!” as I read it.

Read his full post here: The Real Reason Big Savers Retire Early: Minimizing Retirement Savings Needs

Kitces first highlights the often cited but rarely adhered to benefits of having a high savings rate and starting that savings as early as possible.

But wait, there’s more…

His real “revelation” is in detailing the equally important benefit of a high savings rate: saving more means learning to live on less and therefore a lowered required standard of living in retirement.

Kitces dives into how a 10% saving difference can result in both a) having more dollars and b) needing fewer dollars. A doubled-edged sword as he calls it.

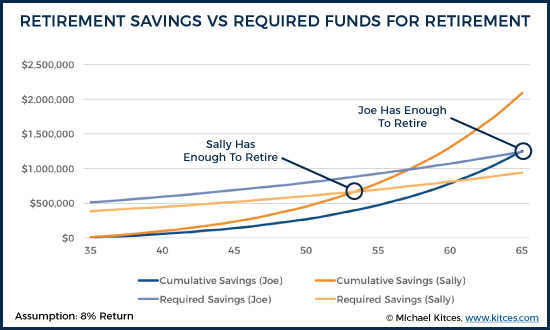

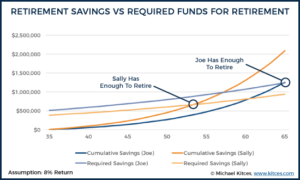

“For instance, Joe and Sally both make $65,000/year at age 35, take home about $50,000 after taxes, and want to start saving for retirement now.

If Joe starts saving 15% of his income (and his income grows at 3%/year), then by age 65, he can save over $1.25M (which on top of projected $22,000/year of Social Security benefits, should be able to maintain his lifestyle at a 4% safe withdrawal rate).

Sally, on the other hand, can save 25% of her income (also growing at 3%/year), then by age 65 her account balance is up to nearly $2.1M instead. In fact, she had already reached Joe’s retirement account balance of $1.25M by the time she was just 60!”

Note that Joe is living on 85% of his income, Sally is living on 75% of hers.

“But the key distinction is that because Sally is saving more, she’s living on less, which means she doesn’t need as much as Joe to retire in the first place (at least to maintain that same lifestyle). Given that Sally is living on only $37,500/year instead of $42,500, she could have actually retired by age 54 instead – because her retirement savings need never climbed as high as Joe’s in the first place!”

The Impact of Time

Remember, this 10% difference is only a $6,500 change, but it goes both ways. Its impact can result in a decade of extra retirement because it is an annual addition to net worth and an annual subtraction from the retirement expenses. Often when we’re running through different financial planning scenarios with clients, they are surprised at what a $5,000 or $10,000 change can have on their probability of success, this is simply a result of long time horizons: decades of additional savings combined with decades of a lowered retirement income need.

Remember, this 10% difference is only a $6,500 change, but it goes both ways. Its impact can result in a decade of extra retirement because it is an annual addition to net worth and an annual subtraction from the retirement expenses. Often when we’re running through different financial planning scenarios with clients, they are surprised at what a $5,000 or $10,000 change can have on their probability of success, this is simply a result of long time horizons: decades of additional savings combined with decades of a lowered retirement income need.

I encourage you to read the full post where Kitces goes into far more detail including graphs and some social security nuances. But his overall message is one we have certainly observed over the years: our happiest clients are often not the ones with the most money, rather they are the ones living within their means.