Annual Financial Checklist (January through April)

Anticipating the start of the swim portion of Raleigh’s 2017 Half Ironman, 99 strangers and I waded into Jordan lake. Five hours of grueling effort and quad cramps later, I finished the race to the sound of crowds chanting my name. Ok…maybe not the “crowds chanting my name” part, but I crossed the finish line. The only way for me to swim 1.2 miles, bike 56 miles, and run 13.1 miles was to prepare for it ahead of time. Instead of seeing grueling months ahead, I boiled a year-long training regime into realistic weekly goals. That’s what this is, a training regime for the year, broken into manageable bites. This checklist isn’t all encompassing, but it’s a basic training schedule. Someone training for a Half Ironman needs to train much differently than someone competing in the Iditarod. Speaking of…does anyone know where I can get 16 dogs?

name. Ok…maybe not the “crowds chanting my name” part, but I crossed the finish line. The only way for me to swim 1.2 miles, bike 56 miles, and run 13.1 miles was to prepare for it ahead of time. Instead of seeing grueling months ahead, I boiled a year-long training regime into realistic weekly goals. That’s what this is, a training regime for the year, broken into manageable bites. This checklist isn’t all encompassing, but it’s a basic training schedule. Someone training for a Half Ironman needs to train much differently than someone competing in the Iditarod. Speaking of…does anyone know where I can get 16 dogs?

January

- Reset Your Budget: If you have a tally of your financial spending from last year, consider how you might tweak your budget for the coming year. Remember to include less-frequent maintenance costs, like a new roof, furnace or set of tires. If you don’t have a 12-month spending tally, then review your past three months spending history. Once you’ve categorized your spending into the basic food, clothing and shelter, you’re ready to create a starter budget. We recommend several helpful Apps: Mvelopes, Mint, and You Need a Budget.

- Review your Employer Retirement Plan: Are you are contributing enough to get your full employer match? If you’re 50 years old (or will be by December 31st) consider making additional Catch-up contributions. Depositing 1/12 of your IRA’s annual contribution each month provides dollar cost averaging benefits and it’s less painful than writing one big check.

- Save For Fun: In addition to saving for retirement, we suggest saving some of your income for the fun

category (after you pay off consumer debts and have an emergency fund). What you save for is up to you; maybe it’s a ski trip, a renovated kitchen or a mountain bike. Regardless of the goal, figure out exactly how much you need to save, and then create a separate savings account for each goal so you can easily track your progress and gauge if you need to ramp up your efforts throughout the year.

category (after you pay off consumer debts and have an emergency fund). What you save for is up to you; maybe it’s a ski trip, a renovated kitchen or a mountain bike. Regardless of the goal, figure out exactly how much you need to save, and then create a separate savings account for each goal so you can easily track your progress and gauge if you need to ramp up your efforts throughout the year. - How to Use Your End of Year Bonus: If you received a year-end bonus, pat yourself on the back and enjoy it by spending 10% on something fun—and then allocate the remainder toward a financial priority. (You have until April 15 to max out your IRA.)

- Pay Your Tax Bill If You’re Self-Employed, Own a Small Business or Freelance: You have until January 15th to pay your fourth quarter estimated tax payments. And be sure to put reminders on your calendar to pay quarterly estimated payments on time for the coming year.

- FSA and HSA’s: Make contributions to your HSA account (which in some circumstances can be a better move than getting your employer match). Also be sure to empty your FSA account before January 1, unless you have a 2.5 month extension or a $500 annual rollover available.

February

- Prep for Tax Time: By the beginning of February, you should have received your tax forms, such as a W-2 from your employer, 1099’s for supplementary income, etc. Keep them in a safe place and start collecting any other information that you’ll need to do your taxes, receipts for business expenses and charitable donations. If paying for college then check out the American Opportunity Credit and Lifetime Learning Credit.

- Get Your Credit Score: Go to www.annualcreditreport.com, read the report carefully and report any discrepancies to the appropriate agencies.

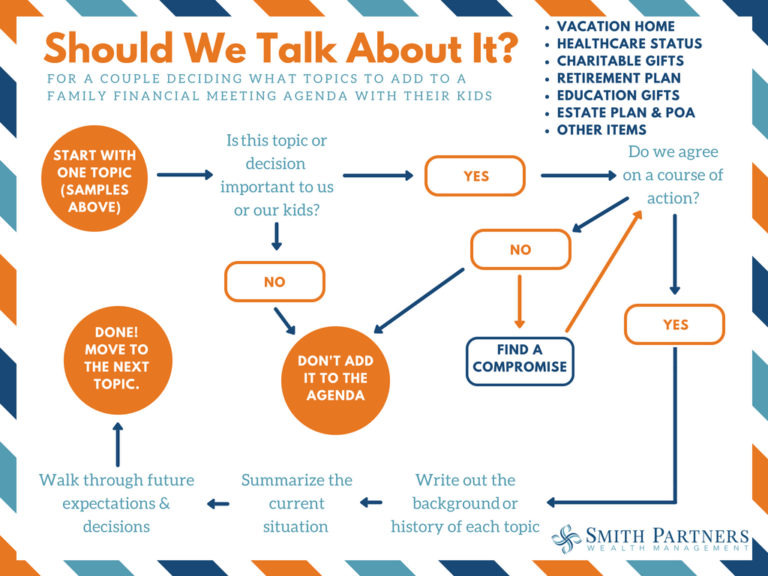

- Have the Money Talk with Your Significant Other: No matter what stage in your relationship—be it dating or happily married—significant others can either be great partners to help you stay on track with your finances or weights around your ankles. Meeting your financial goals will be more likely when two persons share identical priorities.

March

- Wrap Up Your Taxes: One of the best ways to avoid tax identity theft is to file as early as possible. Your goal should be to finish your taxes in March—well in advance of the April 15 deadline. If you get a tax refund from the government, treat it the same way as your year-end bonus: Put 10% toward something fun, and funnel the rest toward financial priorities.

- RMD: If you turned 70.5 years old last year and haven’t taken your first required minimum distribution (RMD) you have until April 1 to do so.

- Pin Down Your Child’s Summer Plans: If you have kids in the home, you know that their attention spans last only so long. In order to keep them busy when school’s out, research options like summer camp,

help them start a business or encourage them to start one, find free employment with internships (plumbing, electrician, etc), enrichment programs and other activities—and start budgeting for them now. It’s worth having a money week during the summer to teach kids how to use their money. You could review opportunity cost, investing, time value of money. (Need ideas for this OR a teacher? We’re happy to hold a financial literacy week for clients’ children)

help them start a business or encourage them to start one, find free employment with internships (plumbing, electrician, etc), enrichment programs and other activities—and start budgeting for them now. It’s worth having a money week during the summer to teach kids how to use their money. You could review opportunity cost, investing, time value of money. (Need ideas for this OR a teacher? We’re happy to hold a financial literacy week for clients’ children)

April

- Review Your First Quarter: Review the last three months of spending and see if it lines up with your family goals. Do your biggest spending categories line up with what is most important to you? If you’re spending more than you anticipated on things you don’t enjoy consider adjusting your budget accordingly.

- Put Those Taxes to Bed: The deadline for filing your taxes is April 15th. If you’re filing for a six month extension you still need to pay any taxes due by April 15. Also, be certain to make any prior year IRA or Coverdell Education Savings account contributions by then.

- Finalize Summer Travel: If a vacation is in the cards, now is the time to hammer out the details. It’s a good idea to book airfare three to five months in advance—before prices start inching up.

- Review Insurance: Make sure you are adequately covered for your current standard of living, health, disability, property and casualty.

Why?

Why should you stay on track and have a checklist in the first place? The answer is so that you can be prepared. So you aren’t frantic to get things done, so the random one time expenses don’t cripple you, so you can be confident in your financial future and retirement goals. This checklist takes me back to Jocko Willink’s quote “Discipline equals freedom”. If you have the discipline today to save and accomplish what needs to get done, then you will have the freedom later to not worry about the problems most others will.