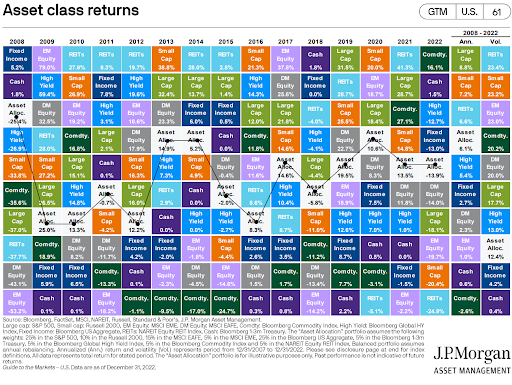

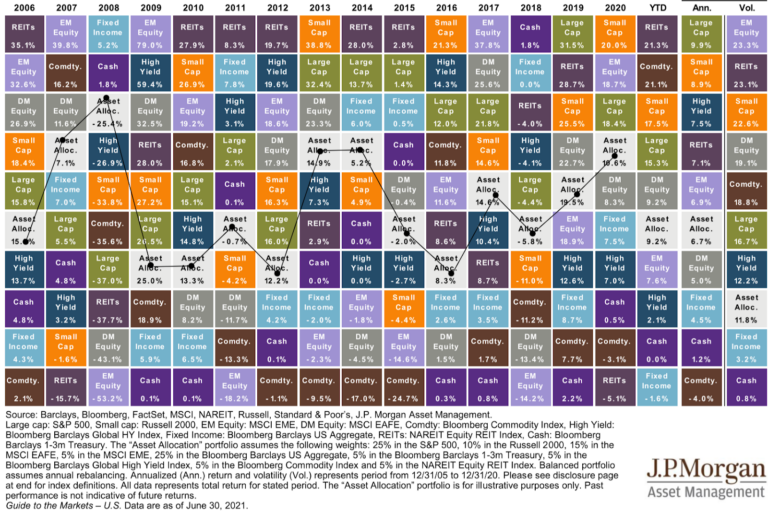

Quarter in Charts – Q4 2022

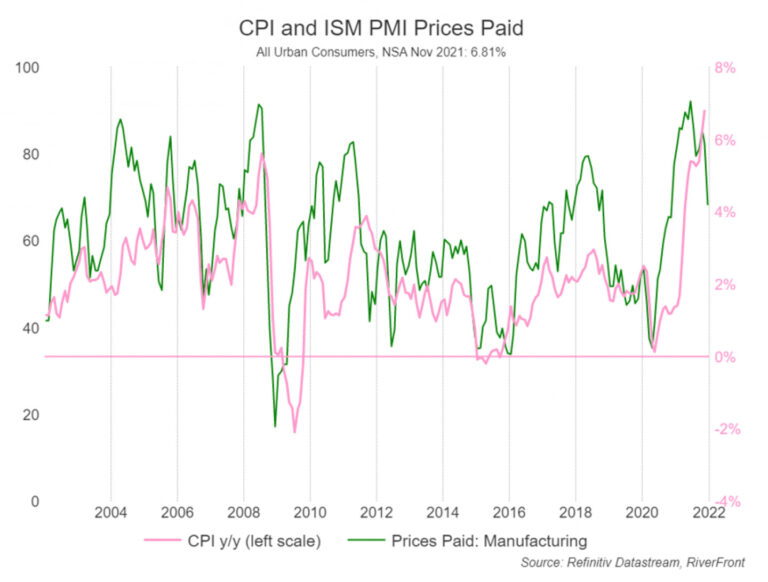

It’s hard to describe how rare and painful 2022 was for investors of all kinds. The phrase “off the charts” is often overused, but in this case, it seems appropriate. And while we’ll look at the causes and details of this year’s returns, we’ll also spend some time exploring how investors should consider viewing the…