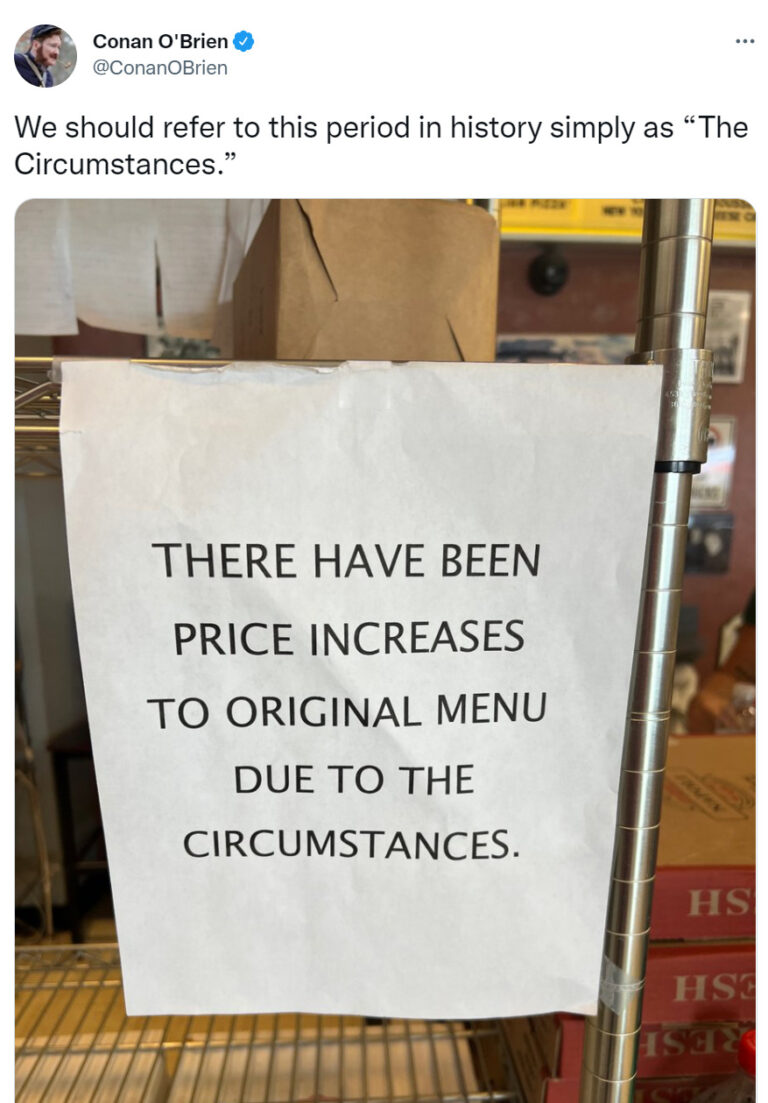

How’s That Third Scoop of Ice Cream?

There’s a fancy economics term for this: “diminishing marginal utility.” Textbooks use far too much paper trying to explain it when really they should just talk about ice cream. The idea is that the first scoop of ice cream tastes great. The second scoop of ice cream tastes a little less great than the first. And the third scoop of ice cream might make your stomach hurt.