Market Commentary Q4 – 2014

When Justin was in high school, he and I rebuilt a 1977 International Harvest Scout II. We bought it for $1400 from Wilkes Community College where the Auto Shop students had been experimenting on it like it was a rolling Frankenstein; we had our work cut out for us. After we repaired a D+ student’s electrical work and removed a C- student’s window tinting, we went to work on the rest of the truck. One of the last things we did was to change the original stock tires for some larger mud tires. What we failed to remember, until a kind policeman informed us, was that our speedometer still “thought” we had small tires. For every rotation of the tire, we were covering about 15% more distance and thus were traveling 15% faster than we realized.

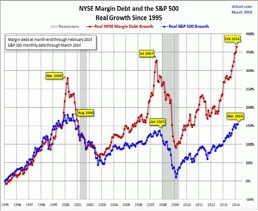

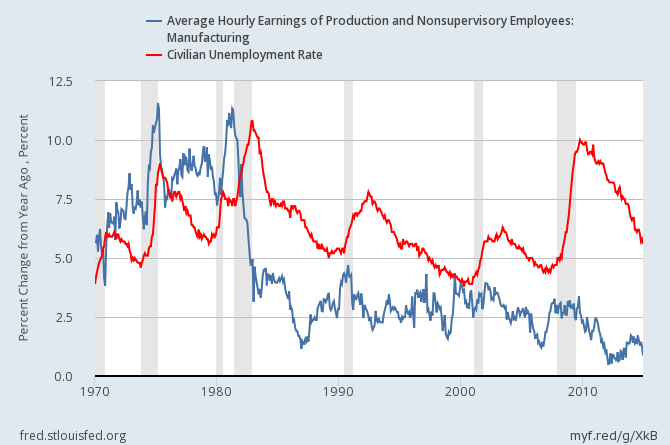

The economy, markets, and investors have experienced much the same: our economy was modified in a very real way that benefitted companies, employees, investors and the government. What the financial memory seems to forget is that the repair work that sped up the economy 1) was never meant to be permanent and 2) has ended. The US Federal Reserve, after buying up $4.5 trillion of Treasuries and Mortgage Backed Securities over a six-year span ending October 29, 2014, brought closure to their unconventional monetary policy. The Fed stayed focused on its Quantitative Easing (QE) until measured results had been achieved, and they got their wish: higher asset prices and lower unemployment. From the inception of QE until now, the S&P 500 is up 137%. Unemployment, after peaking at 10% in October 2009, is 5.6%; lower than the 50-year average. But since late October, the S&P 500 has bounced around plenty, returning close to 0%. In this commentary, we take a look at what themes hold the possibility to keep us moving forward or stall us out now that the QE pump has been shut off.

Theme 1: Interest Rates

Reuters recently reported that Atlanta Federal Reserve President Dennis Lockhart announced on January 12, 2015 that the U.S. economy is “motoring ahead in its recovery, likely putting the Federal Reserve in position to raise interest rates by the middle of the year.” Mr. Lockhart said he expects that reasonably strong growth will continue through 2015, unemployment will fall, and inflation will eventually begin to rise. This is the set of conditions that should allow the central bank to raise rates by the middle of the year. As we’ve written for some time, interest rates, inflation and bond prices will mean revert: rates will go up, inflation will go up and bond prices will go down.

Theme 2: Corporate Profit Margins and PE Ratios

During the six years of QE, corporations were largely unmotivated to reinvest in capital equipment or increase wages. Some cash was reallocated to shareholders, in the form of dividends or stock repurchases and some put toward corporate stock-funded acquisitions, but plenty was stored rather than reinvested. This can be a double-edged sword: companies now have more cushion should they hit a downturn, but it also has the effect of propping up an earnings number which is unlikely to repeat. Years of deferred wage increases and capital expenditures have worked their way into higher corporate profit margins, currently at the high end of normal. In our view, these high margins are unsustainable and have catapulted 2015 S&P500 estimated earnings significantly above their trend. We question whether the market’s pep rally over apparently low forward PE ratios is appropriate.

Theme 3: Consumers, Overoptimistic Investors and Sidelined Cash

Over the last six year, the wealthiest 10% of wage earners, who hold 95% of investment securities, have been overjoyed. The next 90% of wage earners, holding just 5% of securities and having only 1.7% year-over-year growth in wages, have largely felt left out. Eleven trillion dollars of sidelined cash, having missed an improving market and earning nominal interest rates, will continue to keep pressure on risk assets. Our proprietary Investor Pain Index enters its 4th straight year near 70-year low pessimism levels, and not surprisingly, it has been over 3 ¼ years since the market has experienced a worse than -3.5% down day. While this isn’t close to the hysteria associated with panics or market tops, investors seem complacent and complacent investors are mistake-prone investors.

Theme 4: Oil

By far the “latest and loudest” theme to consider is oil. With prices at $45 per barrel, the effects are widespread and mostly uncharted. We know that a small price decline is always helpful to consumers. It is the equivalent of a raise and helps many individuals who are most likely to redeploy those saved dollars back into the economy. But there are negative impacts after a certain point. Those dramatic employment improvements mentioned above were made largely on the back on a US energy boom; if oil stays cheap long enough, the easiest costs to cut are employees. Cheap oil also disrupts future investment in the energy boom. Not just in fuel exploration and production, but in alternative energy too. Green technology will likely catch on only if there is a financial incentive. And the impact reaches out to the businesses supporting those industries, the banks funding them, and the regions that are supported by them. Possibly the biggest impact is that because fuel is such an integral component of all goods and services, that as the price of oil drops, all prices could drop. That steady inflation that the Fed is expecting could turn south.

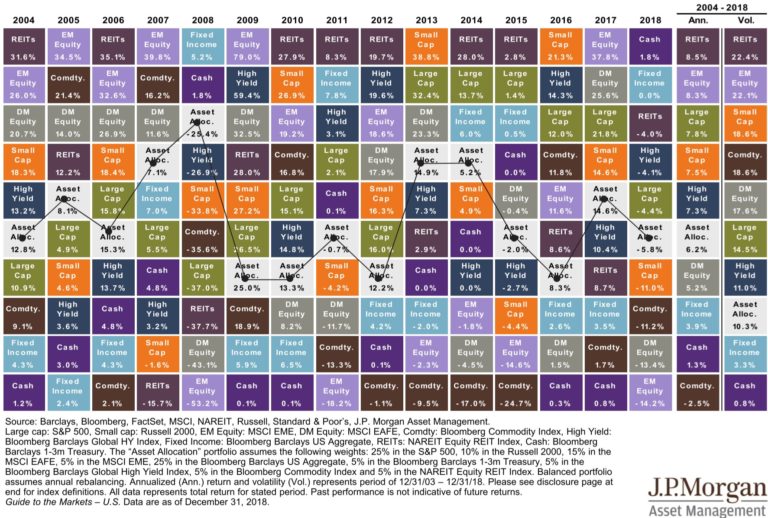

The threat of entering a new recession is low, in our view, making a compelling risk/reward proposition for stocks over bonds or cash, but compared with the lush expected returns opportunity set we faced in 2008/2009, the current opportunity set is quite lean. In our view, for example, the US High Quality Stock asset class hasn’t had 7-year forward real (expected) returns this low in 17 years. Awareness of the landscape of reality has led us to revise expected returns meaningfully lower and made careful planning and investing all the more important. We remain rooted in what history teaches about how sustainable returns are earned. But we also stay flexible and open-minded; tilting asset allocation toward areas offering higher yield and payoff. Finally, recalling that kind policeman who told us we were going faster than we realized, we’re on alert to capitalize on opportunities created by overoptimistic and complacent investors.